Supermarkets exercise innovation to achieve freshness and quality

Grocery channels strategize to achieve optimal freshnessthrough HPP

With consumers’ growing demand for fresh foods and beverages, manufacturers and supermarkets face rising challenges when it comes to maintaining product freshness in-transit and on-shelf to ensure quality and integrity. With fresh foods and beverages sourced from all around the United States and beyond, brands and retailers are implementing innovative solutions for achieving optimal quality.

According to New York-based Nielsen, two-thirds of Americans say their eating habits have changed during the past five years, and three in 10 are making healthier food choices than they were a year ago. Millennials, specifically, are two to three times more likely than older generations to change their eating habits to manage mental health, finances and time. As a result, the demand for healthy, fresh, organic food and beverages is growing quickly. Nielsen reports more than $4.6 billion in sales from fresh foods, $925 million from organics and $982 million from foods supporting plant-based diets.

As a result, consumers are seeking food and beverages that work harder for their health, so they don’t have to.

“Americans are drinking, not just eating, their snacks,” states Nielsen’s December 2019 “How America Will Eat” report. “Beverages can help bridge the gap to time-savings with healthier eating. In fact, beverages are among the top trending consumable categories today.”

Because healthier food and beverage options are the goal, consumers are tasked with choosing the best source — in-store or online — for purchasing groceries while taking freshness into account.

Omnichannel shopping

According to London-based Future Marketing Insights (FMI), almost 70 percent of consumers in the United States shop for groceries online and at brick-and-mortar locations. Online shopping is valuable to consumers because it enables them to research inventory availability ahead of time, along with the convenience of placing online orders for pickup, FMI states. However, shopping on-premise enables consumers to gauge product freshness, it adds.

“Of these omnichannel shoppers, roughly 81 percent rely on digital research when they are discovering, shopping for, and purchasing products,” says Nandini Roy Choudhury, FMI’s senior research consultant. “Even if their ultimate purchase is transacted in brick-and-mortar retail, on average, 35 percent — and even more in certain categories — are likely to validate their choice on their mobile devices, even when they are poised to purchase the product in a supermarket.”

Experts note that the growth of omnichannel and online shopping means retailers must stay ahead of trending consumer demands and maintain excellence in product and ease of shopping via both channels.

Brick-and-mortar top choice

Although eCommerce is thriving and online grocery shopping is no longer a novelty, the majority of consumers still prefer to buy from brick-and-mortar supermarket locations.

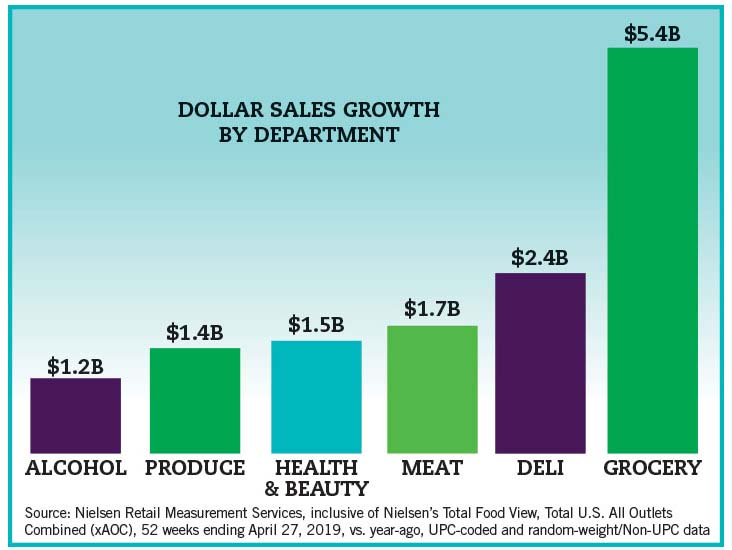

In addition, Nielsen reports that dollar sales by department indicate that the largest amount of money is spent in the $5.4 billion grocery segment. Among the items most frequently purchased, deli is No. 2 followed by meats, health and beauty products, and produce. Clocking in at No. 6, beverage alcohol purchases had sales of more than $1 billion, according to Nielsen data.

The grocery market as a whole, consisting of food and beverages sold at retailers such as grocery stores, mass merchandisers, drug stores, convenience stores and foodservice facilities, surpassed $5.8 trillion in 2018. The average U.S. consumer made about 1.6 trips to supermarkets on average each week in 2018 and spent the most on groceries, averaging about $89 for each shopping trip, Nielsen data reports.

Nielsen reports that dollar sales by department indicate the largest amount of money is spent in the $5.4 billion grocery segment.

Along with the grocery channel as a whole, the beverage category is performing particularly well.

FMI’s Choudhury says the beverage market is a “bright spot” for supermarkets. Beverages with alcohol by volume of less than 5 percent, such as zero-proof beverages, are posting strong triple-digit growth in supermarket channels.

With healthy, fresh food and beverage options demanded by consumers, clean-label products without artificial ingredients, preservatives or other stabilizers are resonating. As a result, manufacturers are creating healthier foods and beverages featuring fresh fruits, vegetables, herbs and botanicals. Yet, they still have to ensure the products’ quality and efficacy throughout its shelf life.

Likewise, retailers carrying these products face the challenge of storing and stocking these products using practices that ensure quality remains optimal.

Keeping it fresh

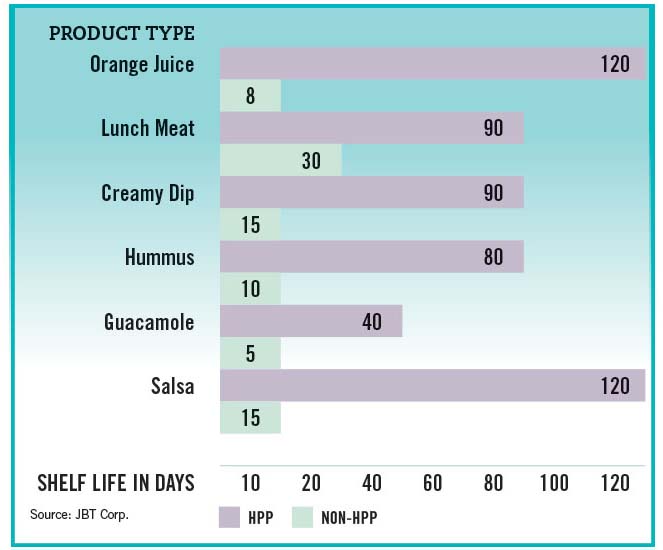

One way manufacturers can accomplish these tasks head-on is by increasing the shelf life of fresh beverages such as by utilizing manufacturing processes that prevent quality degradation without the use of preservatives. One such strategy is high-pressure processing (HPP). According to JBT/Avure Technologies, HPP is cold pasteurization in water where food or beverages are subjected 87,000 pounds of pressure per square inch. At this high pressure, bacteria such as Listeria, E. coli, and Salmonella are destroyed, keeping packaged food pathogen-free and fresh longer.

“Regulatory bodies, including the U.S. Food and Drug Administration (FDA), are becoming increasingly concerned about the proliferation and safety of raw and unpasteurized juice and calling on many brands to begin using HPP, or an alternative form of processing, in order to deliver a safer product to consumers,” FMI’s Choudhury says. “As cold-pressed juices, smoothies and soups prepared over HPP technology are sold in supermarket chains, specialty or gourmet stores, and food services providing fruit preparations and dressings, these products have been taking up considerable shelf space. As a result, they significantly impact and contribute to gain and amplified revenue in [the] supermarkets/grocery business.”

FMI reports that the demand for food with active ingredients will fuel the HPP market in 2020, forecasting it will grow at a compound annual growth rate (CAGR) of 13 percent. As a result, manufacturers are hoping to reduce the costs of HPP.

“HPP aligns so well with consumer trends that all markets will help grow the category,” says JBT Avure’s Chief Marketing Director Lisa Wessels. She cites several key trends that indicate how HPP use will continue to expand:

- Consumers are interested in the process that goes into making a beverage, and HPP is an all-natural process that allows for a clean-label product.

- Consumers are looking for plant-based ingredients, for example, matcha, turmeric and ginger, in their beverages for health reasons and for enhanced taste, ingredients protected by HPP.

JBT/Avure demonstrates that HPP delivers an extended shelf life and pathogen elimination in products containing fresh ingredients. (Image courtesy of JBT/Avure)

Protecting product quality

Although processing innovations can play a key role in maintaining product quality, the less time a product spends in-transit or on-shelf, the better the chances for optimal freshness, experts note.

One means of reducing the time spent from brand to buyer is through an emerging trend: micro-fulfillment centers (MFC). Located on-premise at grocery retailers or supermarkets, MFCs combine the proximity of brick-and-mortar stores with the automation capabilities of a large warehouse. MFCs can hold approximately 15,000 to 18,000 products that are bought most frequently in the local market, according to a release by Albertsons Companies and Takeoff Technologies.

Boise, Idaho-based Albertsons Companies has already implemented this strategy, teaming up with Takeoff Technologies, Waltham, Mass., to not only drive micro-fulfillment capabilities, but also to drive the future of eCommerce order fulfillment. The companies first MFC launched in San Francisco in October 2019.

“The micro-fulfillment center is like a giant vending machine. Instead of you going to the shelf to collect an item, the shelf comes to you,” Jose V. Aguerrevere, co-founder and chief executive officer of Takeoff, said in a statement. “With this machine, you can assemble orders 10 times faster than hand-picking groceries. It fits inside the back of a supermarket, meaning you can bring the efficiency of automation to your local grocery store.”

Max Pedro, co-founder and president of Takeoff, added that MFCs have a chilled section for temperature-sensitive and perishable items, which can be picked by robots 10 times more quickly than being filled manually.

“MFCs that are placed at store-level have the added advantage of being hyperlocal, as existing grocery stores are already very close to shoppers,” Pedro said. “This reduces travel time dramatically, cutting down on risks of damage and expiration in-transit.”

By using micro-fulfillment centers, supermarkets and specialized grocery stores have the option of reducing on-site running costs by becoming smaller, while dedicating a larger proportion of their shelves to displaying fresh produce.

Product positioning and marketing is another way retailers can encourage the purchase of the healthy or fresh products they carry, according to FMI’s Choudhury. “To increase more healthful food purchases, some supermarkets have begun making their own store-level changes, such as adding healthy checkout lanes devoid of less-healthy food products; enhancing the appeal of more healthy foods through colorful packaging, signage and lighting; offering more healthy food samples; and providing additional nutritional information,” he notes.

Moving into 2020 and beyond, the supermarket sector will continue to see emerging and disruptive changes that will impact the overall shopping experience for consumers. Leveraging eCommerce capabilities along with new manufacturing and storage technologies features the potential to strengthen product offerings in the supermarket channel, experts note.

Takeoff’s Aguerrevere anticipates ongoing empowerment of retailers to attain profitable online growth by leveraging automation at a hyperlocal scale. “We are living in historic times. The grocery industry is transforming its way into the future, and the winners will be the ones getting it right first,” he said in a press release. BI

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!