Packaging Equipment

Inspection equipment innovation expedites output, reduces error

Advancements in technology, efficiency improve beverage production processes

In the beverage production process, inspection is one of the most vital aspects of a product’s journey to the consumer. As a result, the caliber and capabilities of the equipment that carries out this job is of upmost importance.

Pune, India-based Markets and Markets’ report “Inspection Machine Market by Product - Global Forecast to 2017-2024,” states that the global inspection machines market is projected to reach $774 million by 2024 based on a compound annual growth rate (CAGR) of 5.5 percent. The projected sales growth is due to an increasing number of inspection checkpoints in production lines, increasing product recalls, rising penetration of automated inspection systems and technological evolution in inspection systems driving the market’s growth.

Inspection challenges

With inspection equipment in such high demand, suppliers are working to develop technology that can support the evolving needs of beverage packaging.

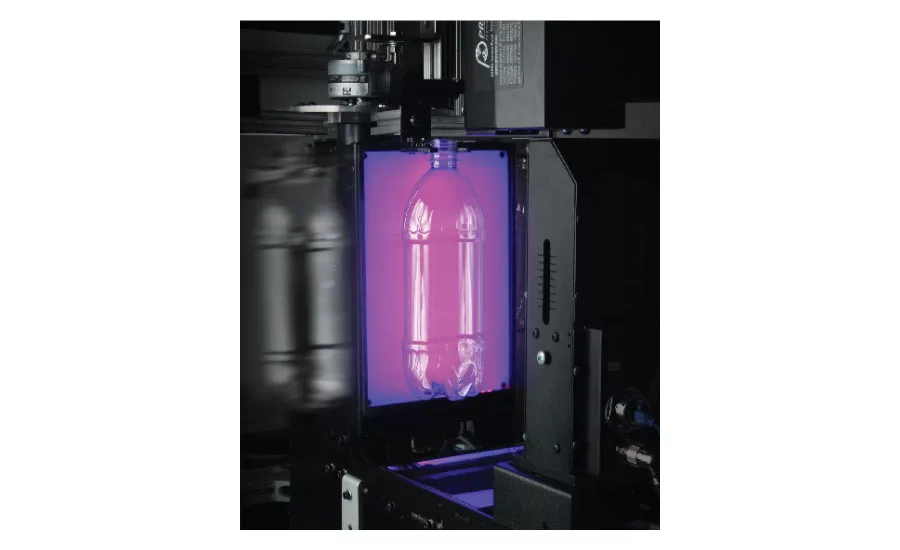

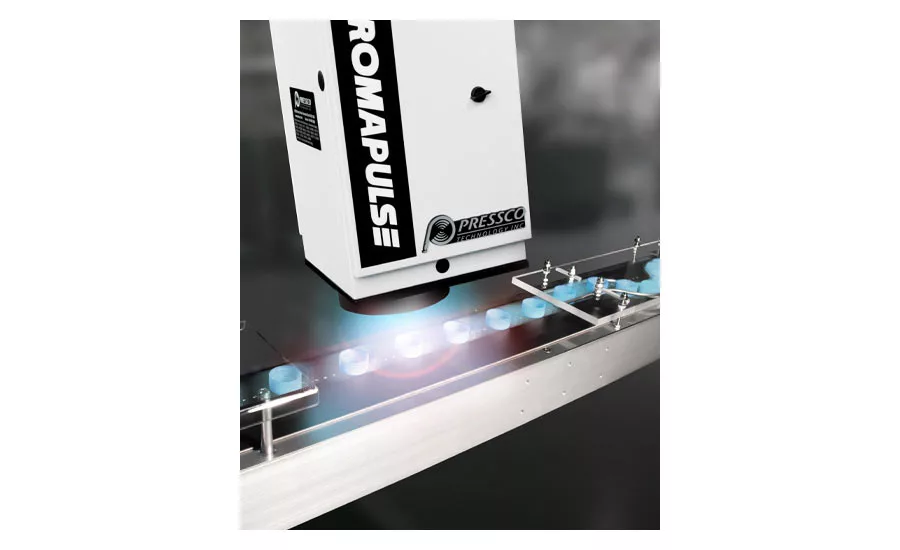

Michael Coy, director of marketing for Pressco Technology Inc., Cleveland, notes that ease-of-use is one of the top priorities for inspection systems. Yet, challenges still remain in beverage production, specifically lightweighting, he says.

“As bottles and closures get thinner and lighter, the manufacturing process is more volatile,” Coy explains. “Not only are defects potentially harder to spot, they are far more likely to result in critical performance failures in the packaging.”

To address this, Coy recommends a distributed approach to defect detection, particularly in today’s vertically integrated blow-fill lines.

“As value is added further along in the process, it becomes more expensive to reject a defective part,” he continues. “Removing a defective preform closure from the process will save having to reject more costly defective filled/capped/labeled bottles downstream.”

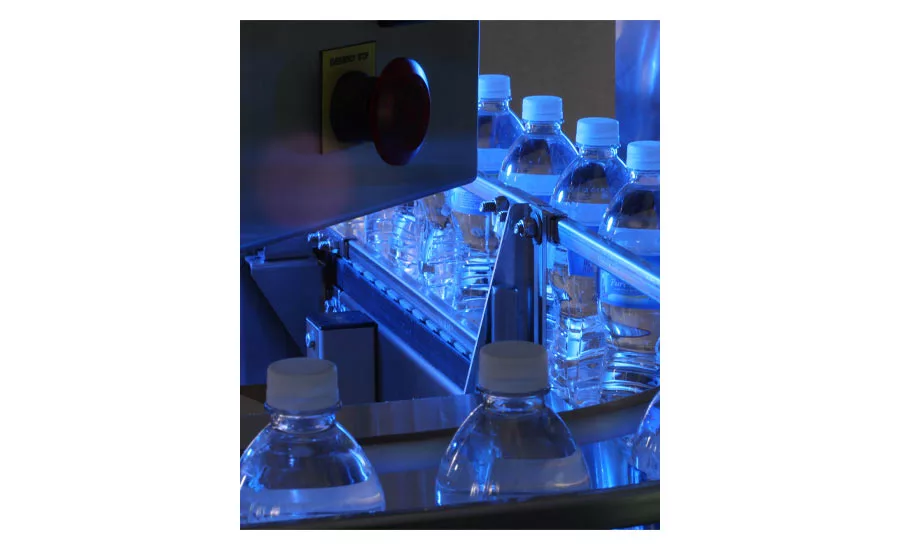

Melissa Rossi, director of marketing and customer service for marine vehicles at Teledyne TapTone, North Falmouth, Mass., notes another challenge: container design changes, which can create significant delays for product changeover that could negatively impact their ability to be tested at all.

“Container size changeovers from small to large and/or slim to fat creates challenges for equipment positioning and sensor location,” she says. “However, [TapTone’s] unique sensor deck design keeps the inspection area centered over the conveyor, resulting in a significant decrease in the amount of time required for changeovers, regardless of the changes in container size from one line run to the next.”

Rossi notes that this shorter changeover and resulting increase in uptime and distribution-ready product helps generate revenue.

Because of the COVID-19 pandemic, a shift toward retail, consumer-sized packaging has proliferated, necessitating an increase in the volume of products requiring inspection, Rossi sates.

“Maintaining production line uptime is essential now, and the high reliability of equipment and limited moving/wear parts with lower maintenance requirements enable companies to stay operational,” she says. “Inspection systems not only detect manufacturing defects before they leave the line, but also monitor and identify potential problems upstream, allowing operators to remove defective products from the lines and catch trending issues before they become problems.”

Designed for success

To ensure inspection operations continue smoothly, Teledyne/TapTon’s Rossi reminds beverage-makers that not all containers can be properly inspected. Because of this, package designers must consider inspection when designing new packaging.

“Container design and how it’s filled can be the difference between an inspectable container and one that can’t be inspected accurately, or at all,” Rossi says. “Another consideration is production line configuration; each product has an optimal location for inspection to occur, which can vary by product and container design. Lines must allow room for inspection systems to be placed in the optimal location for accuracy.”

Pressco’s Coy adds that the faster the manufacturer runs, the lighter their weights, and the increasing use of PCR/rPET all demand a sophisticated inspection platform to ensure quality, maximize line uptime and reduce operating costs.

“Saving a few thousand dollars upfront on lesser inspection technology will cost more over the lifespan of a system in preventable downtime, unnecessary scrap and expensive post-sales support,” he says.

Teledyne’s Rossi adds that as line speeds increase, the needs are extending beyond inspection systems’ capacity, resulting in plants splitting production lines. This reduces product volume and builds redundancy so, in the event of equipment failure, a second system can continue production.

“As plant managers look to increase productivity while decreasing downtime, waste, and expense, the future is data,” Rossi says. “Customers are looking for data on every aspect of the line so they can analyze their lines more effectively, reduce waste and maximize throughput.”

The future of inspection

As data relates to inspection, Pressco’s Coy notes that the Industrial Internet of Things (IIoT) will continue to have a growing impact.

“Manufacturers are driving toward the ‘smart factory,’ where intelligent networks of machinery and systems will further improve operational efficiency and corporate profitability,” he says. “This demands gathering and sharing data on what’s failing where/when/why, real-time connectivity and communication on the plant network, so inspection systems can directly impact process-optimization.”.

As technological advancements continue to revolutionize the efficiency of inspection machines, beverage-makers can anticipate ongoing improvements in the journey of beverages going from conveyor to consumer.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!