2017 State of the Beverage Industry: Almond driving dairy alternatives

Soy milk down in volume, sales

Although the dairy and dairy alternatives market is expected to see decelerated growth, innovation with a variety of plant-based alternatives is expected to continue to drive the category going forward, experts say. New York-based Beverage Marketing Corporation notes that the dairy milk market has experienced continuous declines throughout the past several years in its December 2016 report titled “U.S. Milk and Dairy Beverages through 2020.”

“Beverage Marketing projects continued but moderated losses through 2020,” the report states.

But, when it comes to dairy alternatives, the market research firm has more positive projections. “From 2015 to 2020, Beverage Marketing anticipates a [compound annual growth rate] (CAGR) of 2.8 percent for dairy-alternative beverages,” BMC states in its July 2016 report titled “U.S. Dairy Alternative Beverages through 2020.” “… As a result of such growth, dairy alternative beverage volume would approach 385 million gallons in 2020.”

As the dairy alternatives market has grown, it has evolved and seen new leaders come to the forefront. Currently, almond milk is driving the dairy alternatives segment, said Gary Hemphill, managing director of research at BMC, in Beverage Industry’s November 2016 issue.

Almond milk makes up approximately 68 percent of the total plant-based/alternative beverage segment in volume, noted John Crawford, vice president of client insights for dairy at Information Resources Inc. (IRI), Chicago in the November 2016 issue of Beverage Industry.

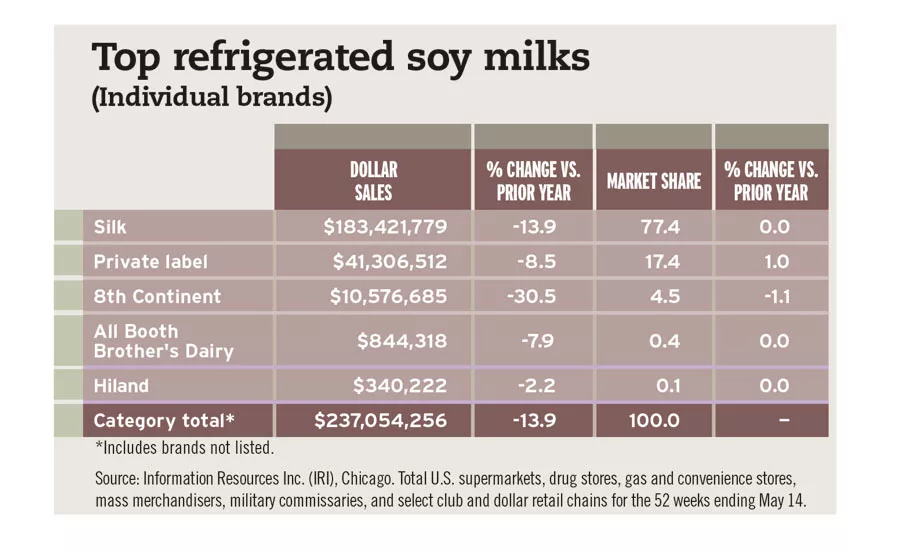

Yet, with the growth of various alternatives, the previous mainstays of the category are losing share, BMC’s Hemphill noted. “Within the market, the dynamics have shifted,” he said in Beverage Industry’s November 2016 issue. “At one time, soy defined virtually the entire dairy alternative category. Today, there are many other dairy alternatives — almond, rice, hemp and others. With this, soy has slipped in popularity.”

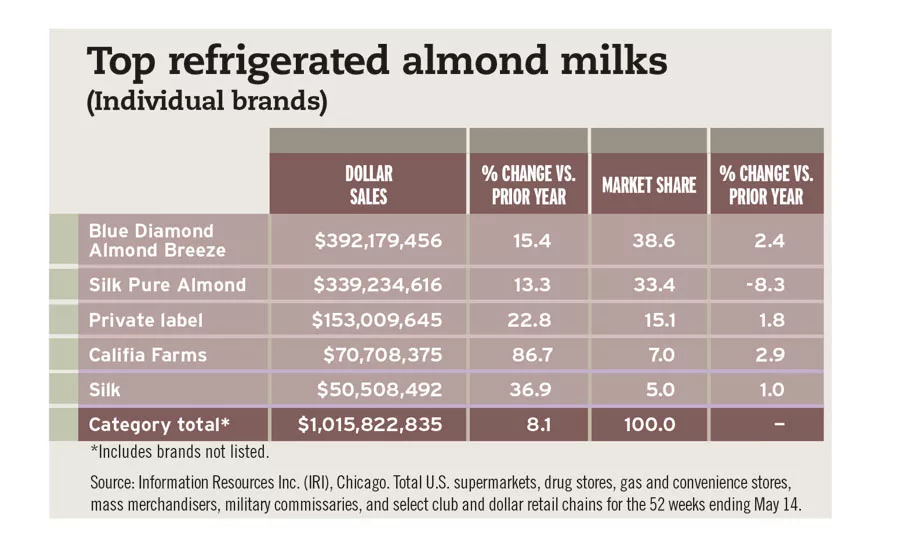

Highlighting this shift, data from IRI indicates that sales of refrigerated almond milk increased 8.1 percent in total U.S. multi-outlets and convenience stores for the 52 weeks ending May 14, while sales of refrigerated soy milk were down 13.8 percent for the same timeframe.

Chicago-based Mintel also notes this trend in its April 2016 “Non-Dairy Milk – US” report. According to the report, soy milk made up approximately 19.3 percent of the market in 2015, and lost sales in this segment have hindered overall category growth. “Soy milk is forecast to be surpassed by the ‘other’ non-dairy milk segment by 2017 and coconut milk by 2018, as consumers look to other plant-based milks to meet their drinking occasions,” the report states.

However, almond milk isn’t the only dairy alternative making waves in the segment. Sales of coconut and cashew milks also are increasing, albeit from a smaller base, according to IRI's Crawford.

“Plant-based/alternative beverages continue to grow with new varieties coming along all the time,” Crawford said in Beverage Industry’s November 2016 issue. “Cashew milk is hot, and banana milk is a new variety that we will see in the coming years.”

Experts say that the market will be driven by further innovation with these other plant-based alternatives that are garnering consumer attention. “Non-dairy milks have great opportunity for growth as consumer interest in the beverage stays strong, but the category will need to continue to evolve to meet drinkers' preferences and needs, and better compete with dairy milk’s current penetration,” the Mintel report states.

“The high percentage of non-dairy milk drinkers that also drink dairy milk demonstrates the need for companies and brands to stand out and strengthen their application to be more than just a preference,” it continues. “Positive health perceptions benefit non-dairy milk, but continued innovation with flavor, functions and usage occasions will help it stay relevant.” BI

Top refrigerated almond milks

(Individual brands)

| Blue Diamond Almond Breeze | $392,179,456 | 15.4 | 38.6 | 2.4 |

| Silk Pure Almond | $339,234,616 | 13.3 | 33.4 | -8.3 |

| Private label | $153,009,645 | 22.8 | 15.1 | 1.8 |

| Califia Farms | $70,708,375 | 86.7 | 7.0 | 2.9 |

| Silk | $50,508,492 | 36.9 | 5.0 | 1.0 |

| Category Total* | $1,015,822,835 | 8.1 | 100.0 | - |

*Includes brands not listed.

Source: Information Resources Inc. (IRI), Chicago. Total U.S. supermarkets, drug stores, gas and convenience stores, mass merchandisers, military commissaries, and select club and dollar retail chains for the 52 weeks ending May 14.

Top refrigerated soy milks

(Individual brands)

| Silk | $183,421,779 | -13.9 | 77.4 | 0.0 |

| Private label | $41,306,512 | -8.5 | 17.4 | 1.0 |

| 8th Continent | $10,576,685 | -30.5 | 4.5 | -1.1 |

| All Booth Brother's Dairy | $844,318 | -7.9 | 0.4 | 0.0 |

| Hiland | $340,222 | -2.2 | 0.1 | 0.0 |

| Category Total* | $237,054,256 | -13.9 | 100.0 | - |

*Includes brands not listed.

Source: Information Resources Inc. (IRI), Chicago. Total U.S. supermarkets, drug stores, gas and convenience stores, mass merchandisers, military commissaries, and select club and dollar retail chains for the 52 weeks ending May 14.

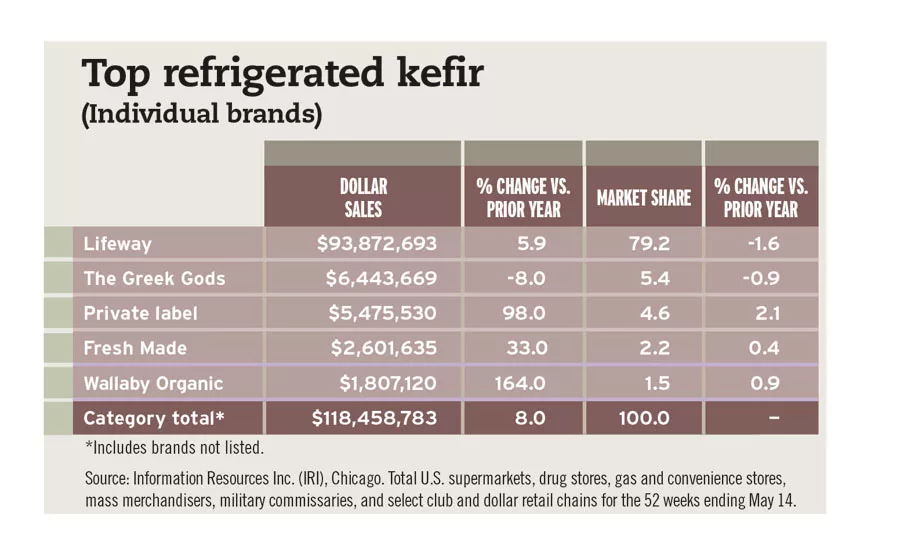

Top refrigerated kefir

(Individual brands)

| Lifeway-RFG Kefir | $93,872,693 | 5.9 | 79.2 | -1.6 |

| The Greek Gods- RFG Kefir | $6,443,669 | -8.0 | 5.4 | -0.9 |

| Private Label- RFG Kefir | $5,475,530 | 98.0 | 4.6 | 2.1 |

| Fresh Made- RFG Kefir | $2,601,635 | 33.0 | 2.2 | 0.4 |

| Wallaby Organic- RFG Kefir | $1,807,120 | 164.0 | 1.5 | 0.9 |

| Category Total* | $118,458,783 | 8.0 | 100.0 | - |

*Includes brands not listed.

Source: Information Resources Inc. (IRI), Chicago. Total U.S. supermarkets, drug stores, gas and convenience stores, mass merchandisers, military commissaries, and select club and dollar retail chains for the 52 weeks ending May 14.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!