The Last Mile: Evaluating route to market

Differing approaches bring own advantages, disadvantages

There are three primary avenues for getting your brand to consumers. These systems include direct-to-consumer (DTC), warehouse direct sales to retailers (WD) and direct-store-distribution (DSD).

Several brands have found success, while many others have failed entering the market through one of these approaches. Each comes with its own set of advantages and disadvantages.

For DTC, the advantages include direct relationship with consumers, lower support cost and greater margins. Disadvantages are more limited consumer reach and slower marker build.

With WD, the advantages are focus on retailers, more control over price points, and greater gross margins and lower support costs. The disadvantages include lower account service levels, limited account access and merchandising logistics.

And finally, DSD, the advantages include broad account reach, small format access (e.g., convenience stores) and merchandising support. The disadvantages are lower product margins, the requirement of greater support staff and distribution partner focus challenges.

In many cases, brands begin with online sales, then move onto large-format retail shelves (such as grocery and club stores) before expanding into DSD to reach small-format outlets (convenience and independent stores) and non-traditional accounts.

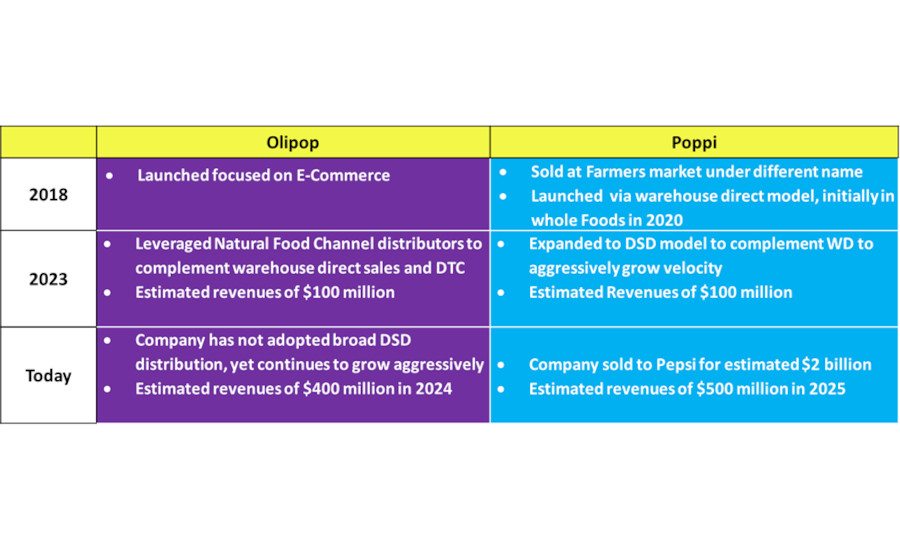

A clear example of this evolution can be seen in the prebiotic soda category dominated by poppi and OLIPOP. Both brands launched in 2018 but pursued different initial strategies: OLIPOP emphasized DTC, while poppi relied on a warehouse direct model. While OLIPOP has transitioned into an omnichannel approach to market, poppi has chosen to evolve into a DSD model. It is interesting to follow the trajectory of both companies.

Although some successful companies started with direct-to-consumer, the vast majority of the companies that began using this approach fail as building awareness in a crowded space can be difficult. That said, for some this channel is less costly than retail and offers an opportunity to connect with consumers and develop a following before approaching retailers.

In order to get noticed, a well-defined and differentiated strategy is required to succeed. Some companies that have succeeded by initially going DTC such as OLIPOP, Hint and G-Fuel as highlighted below:

• Olipop built brand awareness between 2018 and 2020 through health-focused influencers on TikTok and Instagram, as well as features in health journals. Although the business was small, it leveraged its eCommerce results and subscription-based model with retailers to gain distribution in 2020.

• Hint started as a local retail business serviced directly by its founder. As an early adopter of eCommerce, the brand used a variety of online tools to drive consumers to its website and Amazon, resulting in accelerated eCommerce growth in 2010. This early embrace of digital channels set the stage for other brands to follow. This consumer engagement and trial was instrumental in gaining broad retailer acceptance.

• G-Fuel launched through eCommerce by targeting the gaming community. The rise of gamer culture created opportunities to gain sponsorship with the leading personalities and tap into their large followings. By leveraging these sponsorships to drive traffic to its website to purchase product (initially tubs of powdered energy drinks), G-Fuel quickly had broad reach and generated revenues between $50-70 million. This success made the brand extremely desirable to large retailers such as Walmart that were looking to attract gamers to their stores.

Although these brands are some of the most successful, it is more common for new brands to seek a warehouse direct model to gain availability into large format retailers. There are several companies that utilize this as their primarily route-to-market while others have evolved from WD to DSD. In deciding which model is best, it is important to understand what is required to succeed in either WD or DSD.

In WD, an internal sales organization which is complemented by brokers is the most common sales support utilized to service the channel. Although the cost to service is lower than DSD, the supplier must create consumer demand or risk being delisted by retailers. The most successful brands that leverage this approach to market include Sparkling Ice, OLIPOP and Spindrift.

• Sparkling Ice was a little-known brand when it approached Costco in the mid-1990s. Capitalizing on the Perrier recall, Sparkling Ice gained availability in the store and expanded to other large format retailers. The brand grew to achieve nearly $200 million in revenue by 2010. By 2015, the business took the next step and pursued DSD distribution so expand beyond large format retailers. The company revenues are approximately $1 billion today with business split skewed toward DSD although WD still plays a role.

• OLIPOP leveraged the perfect storm of online awareness and health consciousness that emerged during Covid in 2020. Utilizing WD, the brand was able to drive distribution to major retailers such as Target and Walmart as consumers were searching for health-oriented products. Through the WD model, the company was able to go to market with a lean staff driving profitability. In 2024, the company was able to achieve an estimated $400 million in revenue and a valuation of nearly $2 billion based on a recent fund raise. OLIPOP has yet to develop a mainline DSD network to expand its retail coverage.

• Spindrift was launched through foodservice and WD in 2010. The company focused on clean label with targeted accounts. Its RTM continues to focus on WD model in which the increased margins are reinvested back in the brand through innovation and strong social media platform. The brand has grown to approach $400 million in revenue today.

The most comprehensive and expensive route to market is direct-store-delivery (DSD). In beverages, DSD services between 700,000 and 1 million accounts. If including vending, this would take the number upwards of 1.5 to 2 million; while WD services approximately 120,000 to 150,000 stores. The vast majority of the DSD accounts are small-format stores such as convenience and foodservice (restaurants, bars, etc.). Aside from reach, full-service providers also will manage the shelfs in accounts, build displays and manage logistics. This system is geared for brands that are well known or categories that are single-serve-oriented businesses such as energy drinks, which skew to small format.

The large systems are dominated by the three large soft drink companies: The Coca-Cola Co., PepsiCo and Keurig Dr Pepper (KDP). Although beverage alcohol distributors are now entering the beverage distribution business to leverage the infrastructure they have in place. Beverage alcohol by law is required to sell through distributors in all states with limited carve outs.

In summary, the best reach-to-market (RTM) approach is dependent upon where a product is, its development and what category it competes.

If we go back to our original example regarding poppi and OLIPOP, one can see the benefits of both approaches. Poppi was able to kick start its growth by servicing the small-format accounts through DSD. At the same time, this came with a cost to included additional manpower needed to service accounts and manage distributors and margin paid to distributors to provide the service.

Although OLIPOP did not need to incur this cost. From a margin perspective, OLIPOP is more profitable on a per unit basis than poppi. Until a certain scale is achieved to leverage the increased velocity, profitability will be moderated. This is evident in poppi having 25% greater sales revenue but valued at roughly the same level as OLIPOP. In the end, both were able to manage expanding growth and profitability indicating that both RTMs work.

A few key questions will determine which approach one should follow:

• How well capitalized is the business?

• What channel does my brand’s competitive set sell best?

• How best to enhance brand image, e.g. health channel or mainstream channels?

• Can I effectively use eCommerce to elevate awareness?

• Is my product different enough to generate interest from retailers?

• Do I have access to brokers to help access retailers?

• Can distributors open up channels and which type of distributor is best?

In the end, understanding your brand, where you want to compete, your short and intermediate objectives and the current stage of you brand development will determine which RTM is best for you.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!