Category Focus: Bottled Water

Health appeal drives bottled water sales

Sparkling water leads category growth

Essentia Water launched a 2 Gallon Box in response to consumer demand for multi-serve offerings while supporting a better environment, the company says.

(Image courtesy of Essentia Water)

One look at a shopper’s cart in the beginning of the pandemic last year would almost certainly reveal a multi-pack of bottled water. When shoppers began to stockpile groceries in preparation for stay-at-home mandates, bottled water was one of the items in high demand.

As a result, sales of bottled water grew by 4.7% in 2020, according to Jill Culora, vice president of communications for the International Bottled Water Association (IBWA), Alexandria, Va., citing data from New York-based Beverage Marketing Corporation (BMC).

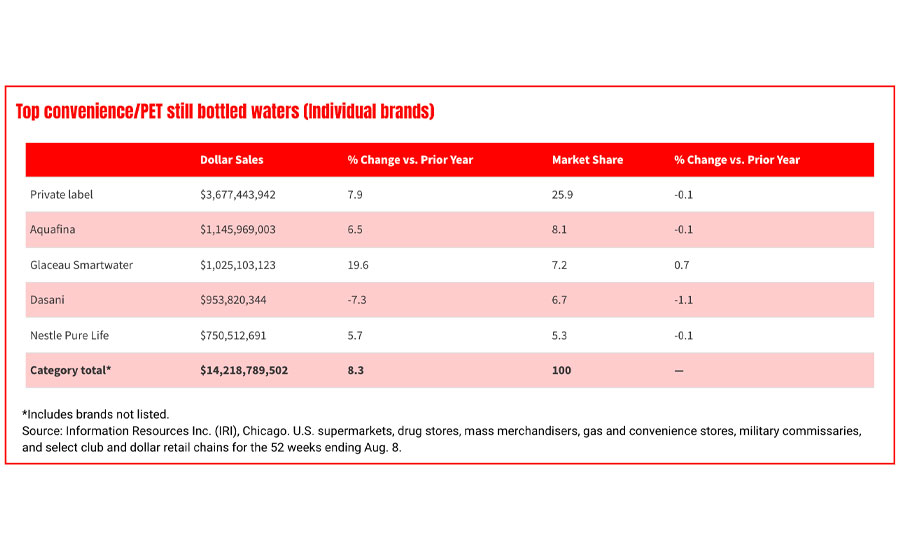

The category has continued strong growth into 2021, according to experts. In the 52 weeks ending Aug. 8, the bottled water category increased 8.8% in dollar sales in U.S. grocery, drug, mass market, convenience, military, and select club and dollar retailers, according to Chicago-based Information Resources Inc. (IRI).

“If any category benefited from the pandemic, it may have been bottled water,” says Michael C. Bellas, Chairman and CEO of BMC. “The pandemic put an extra halo on the bottled water category, emphasizing the importance of its healthfulness.”

In fact, IBWA’s Culora says the bottled water category outsold the carbonated soft drinks (CSDs) category by volume for the fifth consecutive year in 2020, reaffirming its spot as America’s favorite packaged beverage. She adds that, from 2010 to 2020, 44% of bottled water sales growth came from consumers switching from soft drinks and fruit drinks to bottled water.

Nevertheless, Caleb Bryant, associate director of food and drink reports for Chicago-based Mintel, notes that “the pandemic has been a double-edged sword for the category.”

“The pandemic solidified bottled water’s status as a necessity good for emergencies, as consumers cleared retailers’ water aisles during the very beginning of the pandemic,” he explains.

Plus, as consumers spent more time at home, they drank more water, he notes.

“However, the category experienced a notable loss of key consumption occasions stemming from the pandemic,” Bryant adds. “A decline in travel, home gatherings/parties and myriad other social activities (ranging from music festivals to Little League games) depressed the bottled water market in 2020. Pent-up demand for travel, socialization and experiences may result in elevated bottled water sales in 2021, though demand for such experiences falls into question due to rising COVID-19 cases attributed to the delta variant.”

Similarly, the home-and-office delivery (HOD) segment faced ups and downs.

“The residential segment benefited from the pandemic, while the commercial struggled with closures of many businesses,” BMC’s Bellas explains. “More people stayed at home, and more businesses closed their offices. This is starting to change as businesses have begun to open up again; this has improved commercial HOD performance.”

Despite its mixed performance, experts are hopeful the category will drive consistent growth over the next few years.

“Over the coming years, the industry is likely to return to slow and consistent growth as socioeconomic restrictions that were originally implemented to curb the spread of the COVID-19 pandemic are retracted,” says Gavin Ross, team lead and senior analyst for IBISWorld, New York. “As global business restrictions are gradually lifted, sales of bottled and sparkling water from traditional out-of-home channels are expected to benefit.”

Sparkling success

Flavored, sparkling and fortified waters are the fastest-growing segments of the bottled water category thanks to their healthy appeal, IBISWorld’s Ross notes.

In particular, sparkling water is a top competitor for the CSD category, growing 13.7% in dollar sales during the 52 weeks ending Aug. 8, in U.S. grocery, drug, mass market, convenience, military, and select club and dollar retailers, according to IRI data. In 2020, the segment increased 21% in sales, Mintel’s Bryant adds. Even more so, it has increased 118% from 2015 to 2020, he notes.

“Sparkling water has hit the consumer sweet spot for an alternative to carbonated soft drinks,” BMC’s Bellas says. “It’s feeding off the softness of carbonated soft drinks but it’s also benefiting from a significant marketing push of the three category leaders: National Beverage, PepsiCo and Coca-Cola.”

Image courtesy of PepsiCo

Although the segment has become increasingly popular, it has not yet hit its saturation point, Mintel’s Bryant says.

“Opportunities remain to both bring new consumers into the sparkling water market and for existing consumers to increase their sparkling water consumption frequency,” he says.

Consumers are particularly interested in a wide variety of sparkling water flavors, which keep them engaged as they explore different options, Bryant explains.

“Whereas most CSD brands feature only a handful of flavor varieties, sparkling water brands often come in a large variety of flavors, with brands like LaCroix and Sparkling Ice known for their extensive flavor lineups,” he says.

Most recently, Mintel’s Global New Products Database (GNPD) reported watermelon, pink grapefruit and strawberry as some of the most popular new sparkling water flavors. Flavor blends like lemonade pomegranate, ginger strawberry and lime mint also are growing, Bryant notes. He also suggests brands create tropical flavors, such as coconut, pineapple and guava, or mocktail flavors, like mojito, to position sparking water as a refreshing summer beverage or alternative to alcohol.

Even HOD might begin to benefit from sparkling water’s success, according to IBISWorld’s Ross.

“HOD service providers are increasingly looking to expand product offerings to include specialty beverages such as sparkling and fortified waters,” he says.

Private label or premium?

Aside from the sparkling water segment, Mintel’s Bryant adds that the bottled water market is driven by two opposing trends: private-label water and premium, functional waters.

Private label was the top-selling “brand” in the convenience/PET still water segment during the 52 weeks ending Aug. 8, in U.S. grocery, drug, mass market, convenience, military, and select club and dollar retailers, according to IRI. It increased 7.9% in dollar sales with 25% of the dollar share of the segment during the timeframe, it adds.

“A large segment of bottled water consumers simply want the least expensive option available,” Mintel’s Bryant explains.

Image courtesy of Nestlé SA

Yet, in opposition, many consumers are seeking premium, functional waters thanks to their health and wellness benefits, he notes. As a result, many mid-tier brands have gotten stuck in the middle, unable to compete with private-label prices or offer the functional benefits that consumers’ desire, he explains.

In particular, 21% of consumers purchase enhanced functional waters, fortified with ingredients like electrolytes and protein, while 11% purchase alkaline water, Bryant says. He explains that these features enable the products to compete with other categories for various consumption occasions. For instance, a relaxation water could compete with tea or alcohol for the evening occasion, and caffeinated water could compete with CSDs for the afternoon energy occasion, he says.

Sustainable solutions

Despite the bottled water category’s health halo, its plastic packaging has been an area of concern for many consumers. According to Mintel data, 56% of consumers think that bottled water is bad for the environment, and 75% say that companies need to find alternatives to plastic bottles, Bryant notes.

As a result, many beverage-makers have made it a priority to find sustainable solutions. For instance, Atlanta-based The Coca-Cola Co. recently debuted a 100% recycled PET (rPET) bottle as part of its World Without Waste initiative. Similarly, Ice Mountain 100% Natural Spring Water, a brand of BlueTriton brands, launched its water in 100% rPET bottles as part of its Made For A Better Tomorrow initiative. The Stamford, Conn.-based company also promised to donate bottled water to communities in need for every pledge to recycle.

Nevertheless, IBWA’s Culora notes that whether the packaging is plastic, glass or aluminum, it is recyclable.

Image courtesy of Blue Triton Brands

“The bottled water industry has a vested interest in promoting recycling efforts because bottled water companies need post-consumer PET bottles in order to make new bottles using recycled PET (rPET) and recycled HDPE (rHDPE),” she explains. “IBWA supports expansion and improvement of recycling programs through its collaboration with The Recycling Partnership and works to ensure consumers are informed about the value of recycling by working closely with our partner Keep America Beautiful.”

Culora adds that water conservation is another critical component for bottled water companies. Before building a bottling plant, the manufacturer must confirm the water source’s sustainability and the plant’s long-term environmental impact.

Taking it a step further, Purchase, N.Y.-based PepsiCo Inc. recently announced its goal to be “Net Water Positive” by 2030, thereby replenishing more water than the company uses. In collaboration with WaterAid, the initiative also promises to deliver access to safe water for 100 million people in Sub-Saharan Africa by 2030.

By continuing to innovate via packaging, flavors and functional ingredients, the bottled water category is expected to continue slow and steady growth. BMC’s Bellas predicts the category will grow in the low- to mid-single digits during the next five years.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!