Beverage Beat

Study shows fleet market adjusting procurement strategies

Pandemic, supply chain impacting fleet delivery choices

During a recent furniture shopping trip, sales associates constantly warned me about delivery delays because of a fractured supply chain in getting furniture to the Midwest. Although our couch is due for an upgrade, waiting a couple of extra months is not of great concern on this front. However, for members within the food and beverage delivery market, challenges to the fleet supply chain is having a greater impact on their operations.

Fleet Advantage, an innovator in truck fleet business analytics, equipment financing and lifecycle cost management, released its latest fleet industry benchmarking survey showing how trends in fuel economy, maintenance, environmental concerns and procurement strategies have changed this past year.

The following are some key findings from this year’s survey:

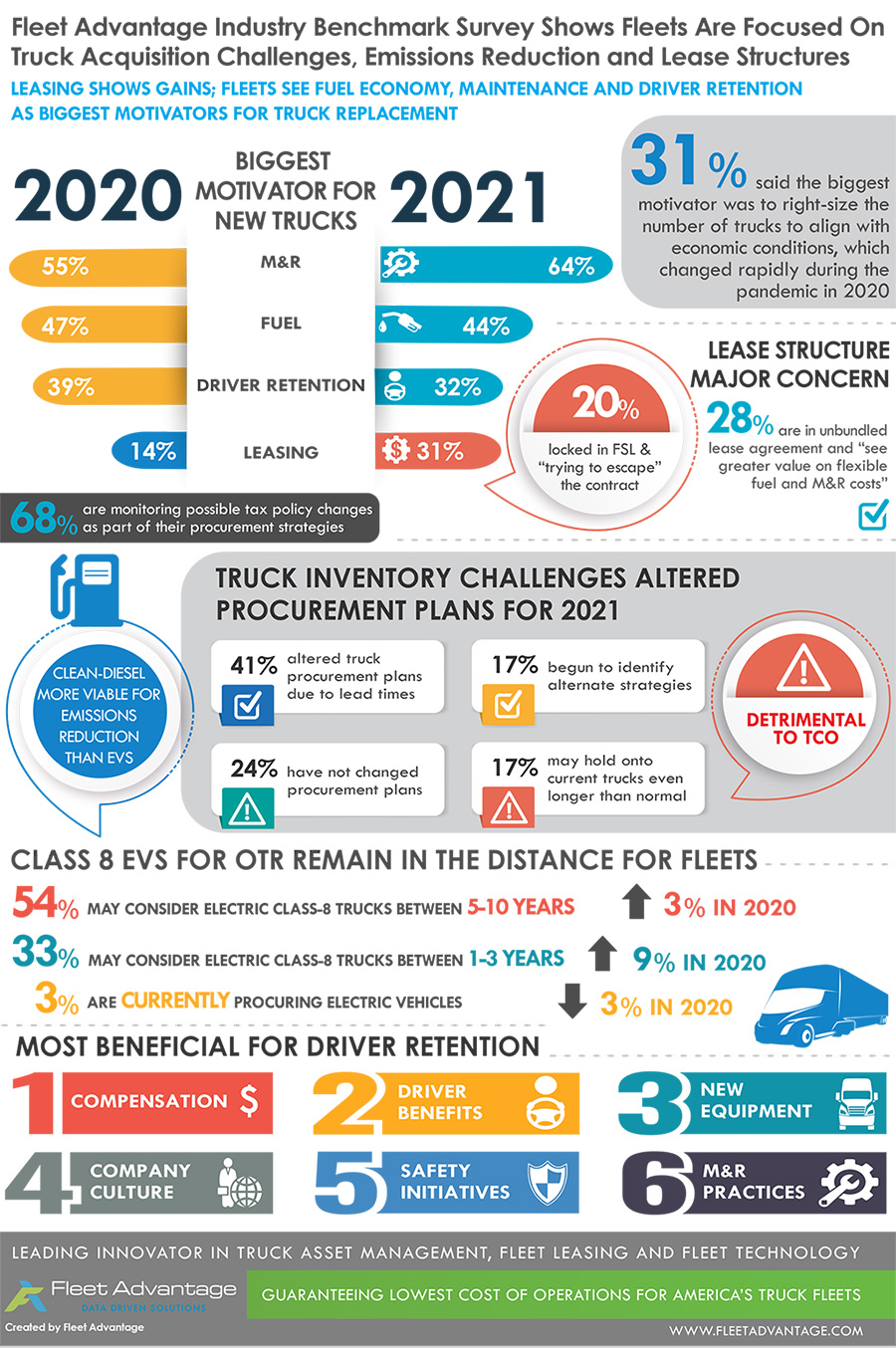

- 41% of fleet executives say the supply of new trucks and inventory challenges have altered their truck procurement plans because of longer lead times.

- 17% have begun to identify alternate procurement strategies in the acquisition of new trucks.

- 17% say that inventory challenges mean they could hold onto current trucks even longer than normal.

- 31% of respondents said they are leasing their trucks, which is up from the 14% of fleet executives who reported leasing in last year’s survey.

- 28% are in an unbundled lease agreement and “see greater value on flexible fuel and maintenance costs,” the survey found.

- 20% reported being locked in a full-service lease with some saying they are “trying to escape the contract because of inflexible costs on fuel and maintenance.”

Although fanfare suggests that electric vehicles are the future of fleet delivery, respondents to the survey are not as convinced. More than half of fleet respondents (54%) said they might consider electric Class 8 trucks for over-the-road between five to 10 years from now; however, only 3% of fleet executives currently are procuring electric trucks, the study found. A year ago, 30% of respondents said they do not see electric trucks widely in service for another 10 years.

The topic of autonomous still shows some skepticism from respondents as 53% indicated that they don’t see autonomous trucks widely in use for another 10 years. This, however, is more enthusiastic from last year in which 62% noted the same sentiment.

“Our annual benchmarking study provides us and the industry with a close look at the issues that are most important to fleet executives today, and the decisions that are helping to shape their business strategies,” said John Flynn, CEO of Fleet Advantage, in a statement. “This year’s study shows that procurement strategies, an emphasis on unbundled leasing, specific replacement motivators and a stronger focus on environmental, social, governance (ESG) are all critical for fleets today.”

As with many markets this past year and a half, delivery fleets are adjusting to the impact the pandemic has had on operations. In the survey, 31% of fleet executives said their biggest motivator for procurement was to right-size the number of trucks in their fleet to align with economic conditions, which changed rapidly during the pandemic in 2020.

It looks as though fleet managers will have many factors to consider as they chart their next course.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!