2021 State of the Beverage Industry: Beer market sees pockets of growth

Beer seltzer centric segment outperforms other beer counterparts

The U.S. beer market seems to be in a state of transformation thanks to a host of factors.

“The current U.S. beer market is in a state of flux,” said Chris Lombardo, team lead and senior analyst for New York-based IBISWorld, in Beverage Industry’s March eMagazine. “Though the craft beer boom has normalized, relatively, breweries now contend with consumers that increasingly demand a diverse array of alcoholic beverages and not just the traditional culprits like wine or spirits — think spiked seltzers, spiked teas, [ready-to-drink] (RTD) mixed drinks, cider, etc. Beer is still the largest alcoholic beverage segment in the United States, but its years of complete domination seem to be dwindling.

“Younger demographics entering the legal age to consume alcoholic beverages are the greatest drivers of this change, in addition to increased attention on health and dietary concerns,” he continued. “As a result, over the past five years, the industry’s largest players, such as AB InBev and Molson Coors, have increasingly diversified their product catalogue, introducing many products that diverge from their traditional beers.”

Brian Sudano, managing partner for New York-based Beverage Marketing Corporation (BMC), also highlighted the transitions permeating throughout the beer market as well as the implications from those changes.

“The U.S. beer market is going through a transformation,” he explained in the March eMagazine. “After decades of consolidation, the emergence of craft beers began to create fragmentation. Major brewers tried to play via acquisition but the segment continued to fragment. Now the rapid growth of [flavored malt beverages (FMBs), particularly hard seltzer, has further supported fragmentation although the leaders in FMBs are fairly concentrated. Via this fragmentation, we are beginning to see fragmentation of the leading beer brands.”

Overall the beer has performed well in the past year. Based on sales of total U.S. outlets for the 52 weeks ending May 16, beer dollar sales were up 9.5%, totaling nearly $44.3 billion, according to Chicago-based Information Resources Inc. (IRI). Case sales also reflected respectable growth of 4.6%.

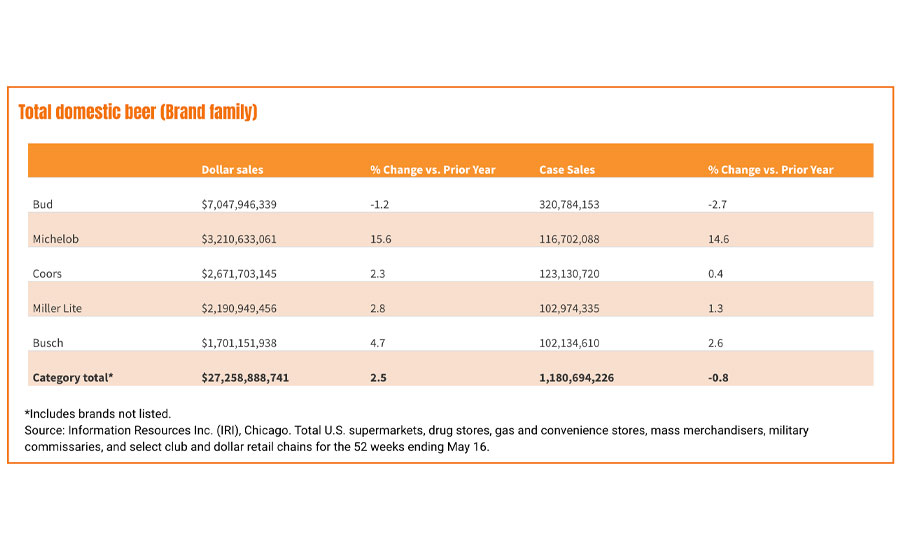

For that same timeframe, total domestic beer posted modest growth with dollar sales up 2.5% while case sales were down 0.8%. Domestic super-premium and craft were the segments that lifted total domestic beer the most with dollar sales up 13.2% and 9.5%, respectively.

Comprised of varying sub-segments, analysts note that hard seltzer have been the driving force for beer market performance.

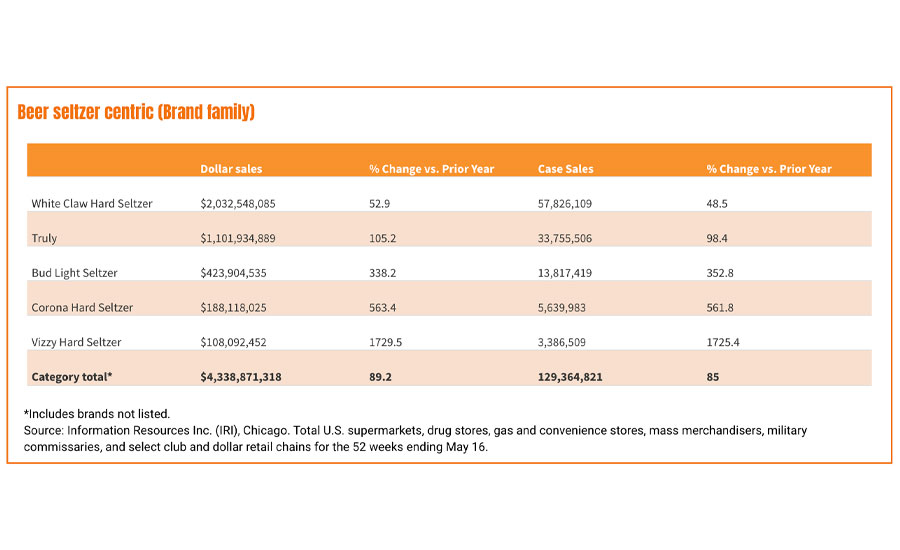

“The beer/FMB/cider category grew to $6.3 billion in off-premise channels in 2020 compared to 2019,” said Danelle Kosmal, vice president of beverage alcohol practice for Chicago-based NielsenIQ, in the March eMagazine. “Hard seltzers represented a large percentage of the total category growth, accounting for 40% of the category’s growth dollars in off-premise for 2020.”

Kosmal noted that hard seltzer’s performance is tied to a bigger trend that emerged for the beer market during the pandemic: trading up.

“Premiumization in beer (consumer trading up to more expensive or high-end beer) accelerated during COVID, gaining 4.2 share points compared to pre-pandemic time periods,” she said. “Hard seltzers contributed to most of the premiumization growth within the category. In 2020, hard seltzers had just over $4 billion in off-premise sales, and gained nearly 5 share points compared to 2019.”

According to IRI data, the beer seltzer centric segment amassed sales of $4.3 billion for the 52 weeks ending May 16, representing an 89.2% increase.

BMC’s Sudano highlighted that much of the innovation taking place in FMBs stems from the concept of healthy beverage choices.

“The vast majority of the innovation in FMBs is taking place in hard seltzer,” he said. “Focus is on lower calories and lower carbs, a better-for-you alternative.”

Premiumization also benefited the import and craft segments within the U.S. beer market.

“Imported beer and craft beer are the only segments projected to avoid volume losses in 2020, and even see gains through 2023,” stated Chicago-based Mintel in its November 2020 report “Beer: Incl Impact of COVID-19 – US.”

Import beer has continued that performance, posting a 9.7% increase in dollar sales, totaling $8.9 billion, based on IRI data.

NielsenIQ’s Kosmal noted that prior to the pandemic, Mexican import beers were a growth driver for the U.S. beer market. However, that shifted as the pandemic’s impact on imports progressed.

BMC’s Sudano added that the unpredictability of the pandemic had consumers turning to familiar brands, which helped major players in the import beer segment.

“Bigger brands like Heineken have returned to growth as consumers seek reliable brands to consume at home,” he said. “With craft beer struggling due to on-premise restrictions, imported beer has benefited as consumers continue to seek high-end products. Modelo Especial continues to be the best-selling imported beer and is now a Top 5 U.S. beer brand.”

For the craft beer market, however, the shutdown of on-premise locations resulted in a hard hit for purveyors.

Image courtesy of HEINEKEN USA

“Craft brewers experienced significant challenges amid the pandemic, as many, particularly nascent craft brewers, are reliant on on-premise sales, either at in-house bars or local food service establishments,” IBISWorld’s Lombardo said in the March eMagazine. “With these channels restricted, craft brewers have been forced to adapt quickly, with many offering on-site pick-up options or attempting to establish local off-premise channels. Many have been successful with such tactics, especially as consumers seek out different alcoholic beverages or reallocate money they would have spent at bars and restaurants on more expensive beverages.”

Even prior to the pandemic, the craft beer market was reaching a maturation point likely because of overcrowding, which contributed to its deceleration of growth, Lombardo noted.

Despite this factor, experts anticipate that craft beer will be able to regain footing as on-premise outlets open up.

“[T]he macro trend of consuming local craft remains intact and it is likely that taproom strength will return post COVID,” BMC’s Sudano said.

The U.S. beer market also saw the acceleration of the non-alcohol beer segment. For the 52 weeks ending May 16, non-alcohol beer posted sales of $207 million, a 33.2% increase, based on IRI data.

“Consumer trends around health and wellness, as well as drinkers seeking more mindful drinking occasions, are fueling the increasing popularity of non-alcoholic beer,” NielsenIQ’s Kosmal said.

BMC’s Sudano echoes similar sentiments: “Consumer desire to drink lower and non-alcoholic adult beverages has increased over the past several years,” he said in the March eMagazine. “Non-alcoholic beer plays into this healthier lifestyle. The restrictions in place against the on-premise have hurt the overall adoption and growth of the segment. With the major [brewers] including Heineken and ABI introducing non-alcoholic versions of their flagship brands, availability and trial is likely to continue to build.”

Although the non-alcohol beer market is not as mature as other beer segments, it still can further its potential by appealing to younger adults.

“Younger consumers have broadly reduced their consumption of alcohol with more abstaining versus prior younger demographics,” Sudano said. “This overall presents a tailwind. However, adoption of non-alcoholic beer in the U.S. has been declining in recent decades. This creates more of a headwind going forward.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!