2021 Beer Report: Hard seltzers continue to drive FMB market

Flavored malt beverage sales up 68%

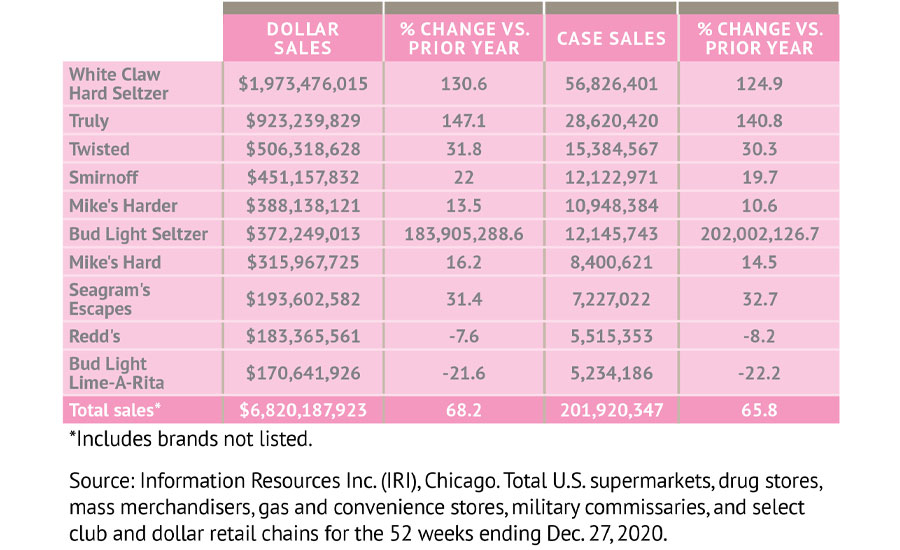

Although off-premise performance for the U.S. beer market show that nearly all segments posted dollar sale gains in 2020, no one had a better financial performance than flavored malt beverages (FMBs). In total U.S. multi-outlets for the 52 weeks ending Dec. 27, 2020, the segment recorded $6.8 billion in sales, a 68.2 percent increase, according to data from Chicago-based Information Resources Inc. (IRI).

Comprised of varying sub-segments, analysts note that hard seltzer have been the driving force for FMBs booming performance.

“The beer/FMB/cider category grew to $6.3 billion in off-premise channels in 2020 compared to 2019,” says Danelle Kosmal, vice president of beverage alcohol practice for Chicago-based NielsenIQ. “Hard seltzers represented a large percentage of the total category growth, accounting for 40 percent of the category’s growth dollars in off-premise for 2020.”

Kosmal notes that hard seltzer’s performance is tied to a bigger trend that emerged for the beer market during the pandemic: trading up.

“Premiumization in beer (consumer trading up to more expensive or high-end beer) accelerated during COVID, gaining 4.2 share points compared to pre-pandemic time periods,” she says. “Hard seltzers contributed to most of the premiumization growth within the category. In 2020, hard seltzers had just over $4 billion in off-premise sales, and gained nearly 5 share points compared to 2019.”

In line with premiumization, beverage manufacturers are taking steps to elevate the hard seltzer market even more. Michelob ULTRA, a brand of St. Louis-based Anheuser-Busch, launched a hard seltzer for people who prioritize natural flavors and enjoy an active lifestyle. Available in three flavors ― Cucumber Lime, Spicy Pineapple and Peach Pear ― Michelob ULTRA Organic Seltzer caters to the more mature hard seltzer consumer, ages 35-54 years old, who is driving half of growth in the hard seltzer segment, the company says.

"We believe that Michelob ULTRA is uniquely positioned to win in the hard seltzer segment, not only because it's one of the hottest brands in the country, but also because it has unmatched equity as a high-quality brand,” said Ricardo Marques, global vice president of Michelob ULTRA, in a statement.

Brian Sudano, managing partner for New York-based Beverage Marketing Corporation (BMC), highlights that much of the innovation taking place in FMBs stems from the concept of healthy beverage choices.

“The vast majority of the innovation in FMBs is taking place in hard seltzer,” he says. “Focus is on lower calories and lower carbs, a better-for-you alternative.”

Although much of the growth in FMBs is centered on hard seltzers, Sudano notes that brands outside the sub-segment have performed well. “[S]everal leading brands grew double digits while hard seltzers dominated the press,” he says. “This includes Mike’s Hard and Twisted Tea.”

Nielsen’s Kosmal also pinpoints the other performance winners from the FMB market.

“Similar to hard seltzers, other ready-to-drink segments that were growing prior to the pandemic continued growth throughout 2020,” she says. “Hard teas were up 16 percent in pre-COVID time periods, and grew 37 percent during COVID months of 2020. Similarly, hard kombucha was up 130 percent in pre-COVID, and up 129 percent in COVID months of 2020. While these segments are still very small, they represent the emerging ready-to-drink products that will continue to contribute to growth in 2021.”

These ready-to-drink segments have seen an infusion of new products to support its growth. For instance, Truly Hard Seltzer, a brand of Boston-based The Boston Beer Co., released Truly Iced Tea Hard Seltzer, an amalgamation of hard seltzer, real brewed tea and fruit flavor, in four varieties: Lemon, Raspberry, Peach and Strawberry.

Meanwhile Bud Light Seltzer, a brand of St. Louis-based Anheuser-Busch, released Bud Light Seltzer Lemonade. Available in four flavors ― Original Lemonade, Black Cherry Lemonade, Strawberry Lemonade and Peach Lemonade ― the new hard lemonades are brewed with loads of lemonade flavor, cane sugar and natural fruit flavors, the company says.

“Our Seltzer Lemonade marries the bold flavors of lemonade with the refreshing bubbliness of seltzer; this new offering is perfect for both established seltzer fans and those who are looking to give seltzer a try,” said Andy Goeler, vice president of marketing for Bud Light, in a statement.

Given the booming performance of FMBs, beverage-makers looking to capitalize on this market performance should keep a keen eye on other major market trends, experts note.

“Historically, the FMB market has evolved with new segments popping up and driving growth for a few years,” BMC’s Sudano says. “This rotation has occurred since ‘malternatives,’ such as Smirnoff Ice, hit the scene in 2002. Lemonade, Tea, Ritas and hard soft drinks are more recent trends. Today it’s hard seltzer. Nearly all the trends had one or two things in common, they played off a large sub-segment and/or a major trend in another segment. Seltzer market has both characteristics playing off of non-alcoholic seltzers large scale and rapid growth.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!