Survey shows how food, beverage manufacturers are adjusting to coronavirus

Third wave of research show current state of economy remains top concern

The COVID-19 outbreak has forced business leaders globally into uncharted territory as together we face the challenges surrounding the pandemic.

In new research, Clear Seas Research, a BNP Media company, examines the following aspects:

- The impact of the pandemic on the industry

- Measures being taken to keep employees, customers and other healthy/safe

- How industry professionals are managing current business activities and planning for the future

In Clear Seas’ third wave of research for the report “Food & Beverage Manufacturing Industry: Industry Perspective on the Challenges of Today,” the study details some controversy exists surrounding the gradual reopening of the economy, with great consideration being given to both the health of people and the economic health of the country. Although Wave 3 survey respondents indicate just under half of their current and/or planned business has been delayed or canceled, the small business stimulus offered through the CARES Act appears to be having a positive effect for some.

Industry professionals surveyed have changed the way they are communicating with employees and customers, and report they are using this down time to position themselves and their businesses for success when things return to “normal.” What the new “normal” will be remains to be seen, however, industry professionals are hopeful that their business activities will be back on track in the next seven months or so. As with prior waves, the information contained within this report represents moments in time. It provides the collective voice of industry decision makers, influencers and contributors, and offers a unique understanding of where businesses are today.

Conducted between April 16-20, below are some of the key findings from the report.

Business Outlook

Remaining consistent with the Wave 2 study, 87 percent of respondents indicated that their organization is classified as an “essential business.” The previous study that number was 85 percent.

Respondents also indicated that the following were their top areas of concern:

- Current economy (74 percent)

- Friends/family becoming infected by COVID-19 (67 percent)

- Achieving business goals over the next three months (66 percent)

- Business stability for the next 12 months (63 percent)

- Supply chain interruptions (62 percent)

Marketing budgets also continue to take a hit during this time as 64 percent of survey-takers reported a decline in 2020 marketing budgets. This is slightly lower than the Wave 2 study, which showed 68 percent stated as much.

Information Sources

As communication practices have shifted, 60 percent of respondents indicate that a combination of online and offline formats is the preferred format used for business decision making.

When citing their top online formats when making business decisions, the following were listed by survey-takers:

- Email communications: 54 percent

- Government sources: 43 percent

- General media: 21 percent

- Social media: 18 percent

- Webinars/virtual events: 18 percent

For offline formats, the following also were listed as solutions for business decision making:

- Word of mouth (colleagues/peers): 24 percent

- Government sources (offline): 16 percent

- General media: 9 percent

Employee impact

With a strong majority of respondents noting their businesses as being classified as essential, these employers are taking extra steps to protect their employees during this time.

The following are the Top 5 actions being taken to keep employees healthy:

- Promoting social distancing (83 percent)

- Providing hand sanitizer/antibacterial soaps (82 percent)

- Encouraging hand washing (80 percent)

- Reducing/eliminating face to face meetings (786 percent)

- Eliminating/reducing employee business related travel (77 percent)

Although operations have shifted, communication remains important to keep businesses moving along. As such, food and beverage manufacturers are utilizing a diverse set of mass communication tools to reach their employees.

- Email: 87 percent

- Phone calls: 69 percent

- Text messaging/instant messaging: 54 percent

- Video chat/conferencing (Facetime, Skype, GoToMeeting, Zoom, WebX): 49 percent

- Company website/Intranet: 31 percent

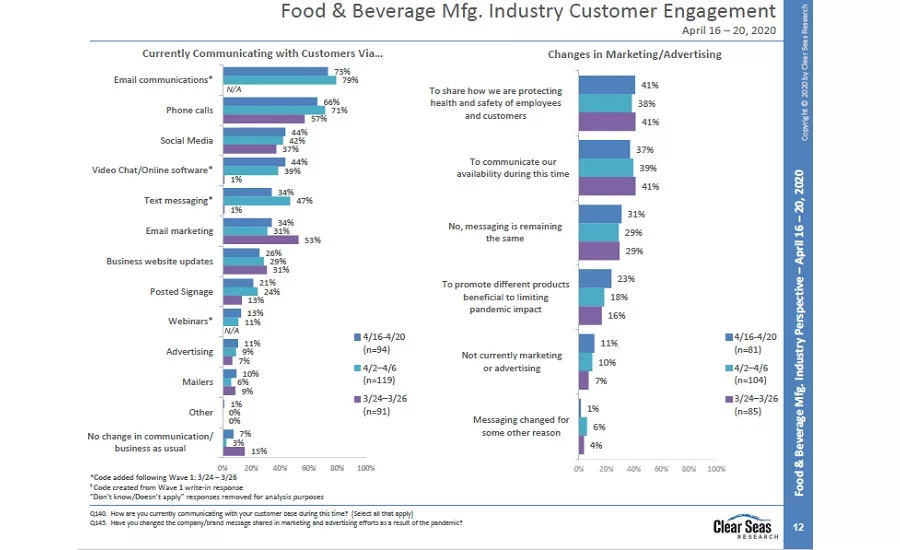

Customer engagement

Despite the changes to traditional work environments, food and beverage manufacturers still are connecting with their customers to support them during this time. Respondent answers suggest that the forms of communication with customers also is gravitating to a digital format.

- Email communications: 73 percent

- Phone calls: 66 percent

- Social media: 44 percent

- Video chat/online software: 44 percent

- Text messaging: 34 percent

To read more from the report, click here for your free copy.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!