Food, beverage manufacturers show growing concern for US economy

Clear Seas data highlights steps employers are taking to protect workers

The coronavirus outbreak is a human tragedy with very real business and economic consequences. Business leaders globally are in uncharted waters as together we face the challenges surrounding the recent pandemic and resulting economic impact. Insight into how others are reacting, overcoming current challenges, and planning for tomorrow can provide us with not only comfort, but a shared community of learning and preparation.

The bringing together of industry professionals to share their experiences with the coronavirus/COVID-19 as related to business activities including planning, staffing, investing, and marketing in an online survey, provides a collective industry perspective. This is a perspective that will continue to change over time; a perspective that can help inform the business decisions we make today as well as our future plans. This is a perspective that can unite the industry and encourage collaboration; a perspective that will be monitored and reported as events continue to evolve.

Clear Seas Research, a BNP Media Company, is uniquely positioned to engage with industry professionals in niche market sectors, which are all impacted in different ways by this pandemic. The unrivaled industry access available to Clear Seas Research through myCLEARopinionPanel and BNP Media subscriber databases provides extensive reach to business thought leaders, decision makers, decision influencers, skilled trade professionals, and general employees of companies of all sizes.

Clear Seas Research, a BNP Media Company, polled publication subscribers across its food and beverage manufacturing titles the week of April 2-6, which addresses the industry perspective of the challenges of today.

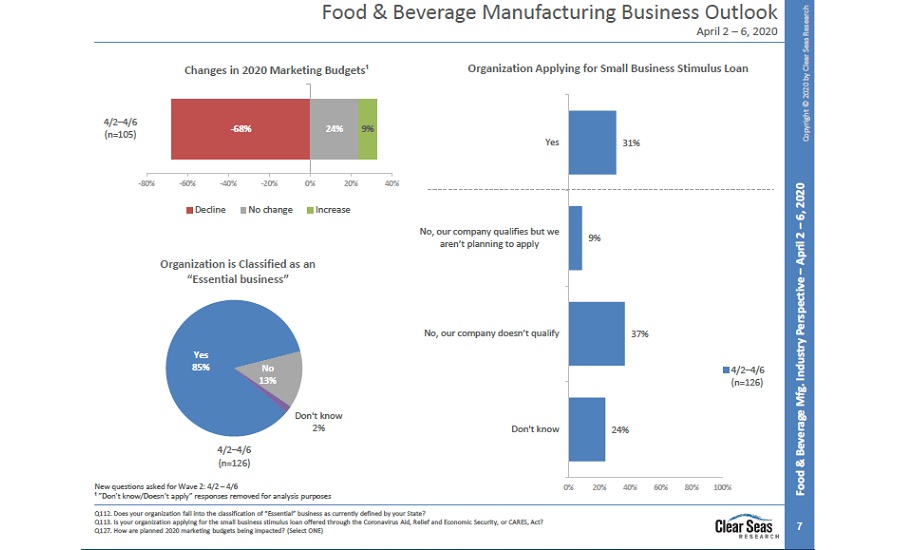

According to respondents, 85 percent of those surveyed indicated that their organization has been classified as an “essential business” by their respective states.

Business Outlook

As the effects of the pandemic continue to proliferate, manufacturers across the food and beverage markets continue to express concern when it comes to achieving their business goals.

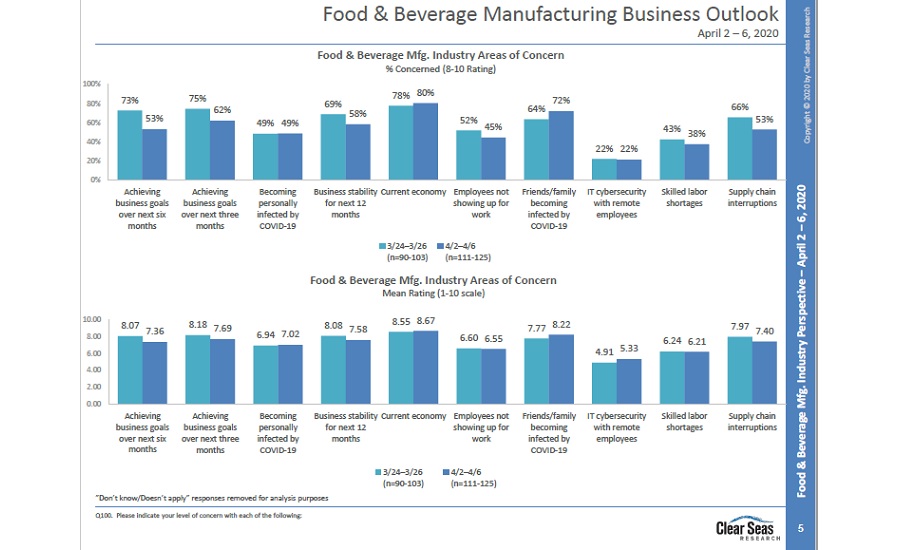

The following is a comparison of respondents’ industry areas of concern for the April 8 published report versus the March 27 published report:

Current economy: 78 percent from the March 27 report listed this among areas of concern, but by the next polling this had advanced to 80 percent.

Achieving business goals over the next six months: 73 percent had listed this concern, but only 53 percent noted it in April 8 report.

Achieving business goals over the next three months: 75 percent listed this concern in the previous report. It decreased to 62 percent in the most recent research.

Friends/family becoming infected by COVID-19: This area of concern saw an uptick. For the March 17 report, 64 percent listed this; however it increased to 72 percent in the April 8 report.

With the passage of the CARES Act on March 27, small businesses and workers can apply for the small business stimulus loan that was included in the package. Respondents showed a mixed bag of results for whether their company will take part in the program.

- 31 percent will apply

- 9 percent said company qualified but aren’t planning to apply

- 37 percent stated the organization does not qualify

- 24 percent don’t know whether their company will apply

Employee impact

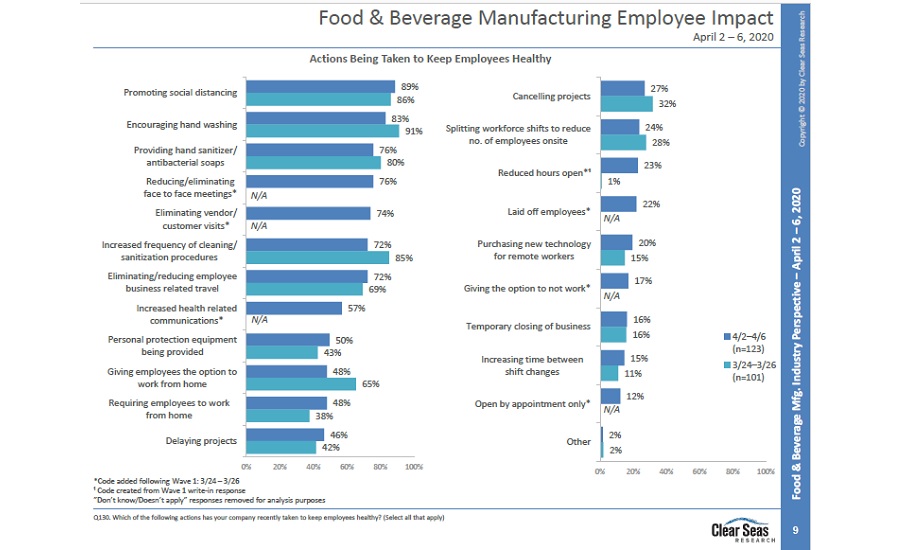

With a strong majority of respondents noting their businesses as being classified as essential, these employers are taking extra steps to protect their employees during this time.

The following are the Top 5 actions being taken to keep employees healthy:

- Promoting social distancing (89 percent)

- Encouraging hand washing (83 percent)

- Providing hand sanitizer/antibacterial soaps (76 percent)

- Reducing/eliminating face to face meetings (76 percent)

- Eliminating vendor/customer visits (74 percent)

Given the shifts to traditional workload, respondents were asked to indicate their anticipated workforce changes in the next three months. The results showed a diverse set of plans:

- 22 percent expect hire new employees

- 18 percent plan to layoff some employees

- 17 percent anticipate they will temporarily suspend employees without pay

- 14 percent plan to rehire previously suspended/laid off employees

- 8 percent expect to temporarily suspend employees with pay

- 3 percent anticipate laying off all employees

- 29 percent indicated now workforce changes

- 11 percent stated they don’t know

Customer engagement

Food and beverage manufacturers still are connecting with their customers; however, those interactions have changed as a result of the pandemic.

Email communications is the top form that manufacturers are utilizing as 79 percent of respondents stated, according to the April 8 report.

Other top communication solutions were as follows:

- Phone calls (71 percent)

- Text messaging (47 percent)

- Social media (42 percent)

- Video chat/online software (39 percent)

- Emailing marketing (31 percent)

Click here to download your copy today.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!