The 2018 State of the Beverage Fleet Industry

Beverage trends see uptick in refrigerated vehicle usage

The results of Beverage Industry’s annual Fleet Study are in and they reflect the increasing diversification of fleet equipment, fuel and the best day-to-day practices in modern delivery operations.

The lighter side

The survey results underline the notion that beverage fleets aren’t just about medium-duty vehicles and above. Vans and passenger vehicles continue to play a critical role in day-to-day operations, whether it’s sales calls, troubleshooting or small deliveries.

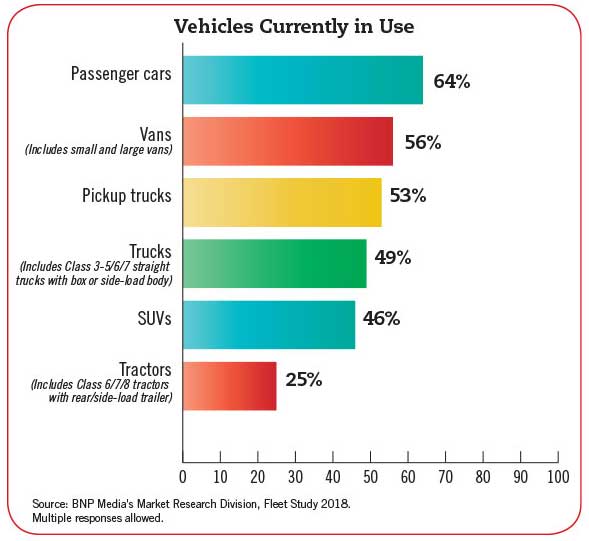

In fact, passenger cars are the most common vehicles in use, with 64 percent of respondents saying they deploy them for some functions. Those fleets operate an average of three passenger cars each, out of an average of 17 total vehicles. More than half of respondents use vans and pickup trucks, with an average of four and two, respectively, in each fleet. Sport utility vehicles also are filling a significant role in many fleets, with nearly half of respondents reporting that they operate an average of two SUVs.

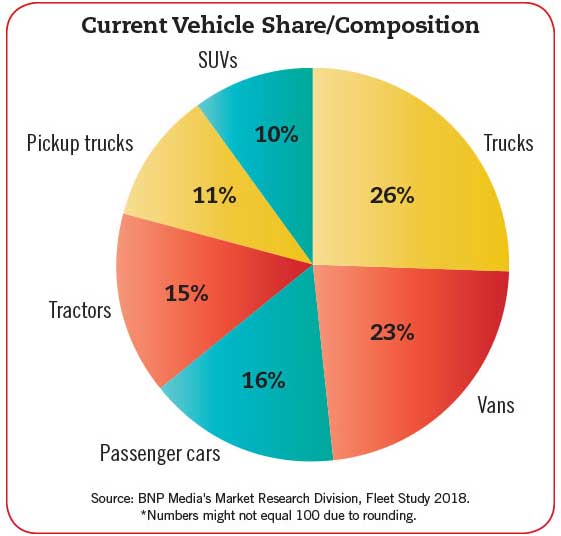

When you break down the average fleet, Class 3 to 7 straight trucks with box or side-load bodies represent the greatest share of the fleet’s overall composition at 26 percent, while vans are not far behind at 23 percent.

Down the road

When it comes to the vehicle types that beverage fleets are most likely to purchase in the next two years, vans are the most popular.

More than two-thirds of all respondents indicated that they plan to make a vehicle purchase of some sort during that period and, of those, 60 percent noted that they expect to buy at least one van, compared with 50 percent who say they’ll be buying Class 3 to 7 straight trucks with box or side-load bodies.

When it comes to light-duty and small, consumer-friendly vehicles, vans appear to be the future of beverage fleets. Only 34 percent plan to buy SUVs and 28 percent expect to purchase pickup trucks in the next 24 months. And most purchase decisions (58 percent) are driven by the need to replace existing vehicles versus a desire to add vehicles to that fleet (42 percent).

Keep it cool

The continued surge in the number of new craft beer brands on the market, as well as certain functional non-alcohol beverages, has made refrigerated vehicles increasingly more popular. Some beer styles, especially a number of bottle-conditioned brews with live yeast in them, as well as non-alcohol drinks with active cultures or other components that are sensitive to spoilage, make refrigerated trucks an ideal addition to any fleet.

Forty-two percent of survey respondents have at least one refrigerated vehicle in their fleet. For nearly half of the respondents (44 percent), refrigerated vehicles make up between 21 percent and 50 percent of each of their fleets.

Fueling the future

Petroleum prices are once again creeping up after a multi-year reprieve. So now’s as good a time as any for fleet managers to start thinking about alternative fuels.

One-third of respondents say they currently employ an alternative fuel strategy of some sort. A little more than one-tenth of those surveyed say they plan to in the next 12 months.

However, there’s still a sizable number of beverage fleets (43 percent) that have not adopted alternative fuels nor plan to in the near future. Among the different types of alternative fuels, ethanol is the most popular and, surprisingly, natural gas is the least popular. A few years ago, fuel seemed to be trending in the natural gas direction.

It will be interesting to see the results next year once fleets have had the chance to digest this year’s higher fuel prices. BI

Beverage Industry’s Fleet Survey was conducted by BNP Media’s Market Research Division. The online survey was conducted between July 16 and 30 and included a systematic random sample of the domestic circulation of Beverage Industry.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!