Spirits grow market share for 7th straight year

Irish whiskey drives sales for category

In celebration of their good fortune, the milkman Tevye and the butcher Lazar Wolf famously sing “To life, to life, l’chaim” while drinking shots of schnapps to their “good health and happiness” in the musical “Fiddler on the Roof.” The spirits industry also has plenty of reasons to celebrate as the category experienced accelerated growth for the seventh straight year, with supplier sales up 4.5 percent, volume up 2.4 percent and retail sales of nearly $78 billion in 2016, according to the Washington, D.C.-based Distilled Spirits Council.

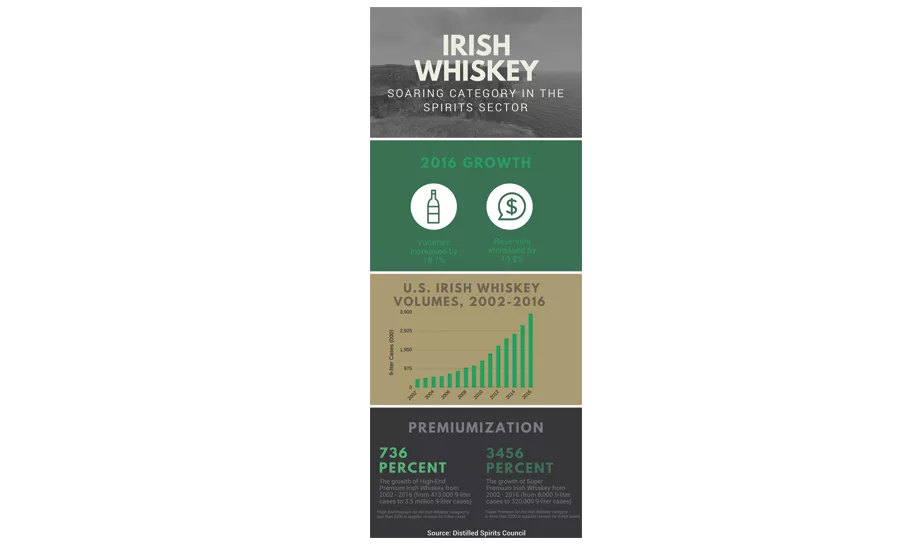

The association reports that volume for American whiskey — bourbon, Tennessee and rye — was up 6.8 percent to 21.8 million cases and revenues increased 7.7 percent to $3.1 billion. Much of this growth is fueled by high-end and super-premium Irish whiskeys, which grew 736 and 3,456 percent, respectively, since 2002, it adds.

“Increased growth of premium Irish whiskey reflects the upward trend of adult consumers’ interest in luxury spirits products,” Distilled Spirits Council Senior Vice President Frank Coleman said in a statement.

Other segments also experienced strong volume growth, including cognac, up 12.9 percent; tequila, up 7.1 percent; and vodka, representing one-third of all spirits volumes, was up 2.4 percent for annual sales of $6 billion last year, the association says.

“The continued growth of the spirits sector clearly demonstrates that adult consumers’ taste for and interest in premium distilled spirits, across all categories, is trending upward,” said Kraig Naasz, Distilled Spirits Council president and chief executive officer, in a statement. “Spirits makers continue to develop new innovations to appeal to a growing audience of adult millennials, and they are responding by purchasing and enjoying our products.”

Premiumization drives growth

Danny Brager, senior vice president for beverage alcohol at New York-based Nielsen, notes that the spirits category is performing well, outpacing wine and beer.

“In the off-premise channels that Nielsen measured in 2016, [spirits] grew 2.6 percent on volume and 4.9 percent on dollars, which is faster than the growth rates of beer and wine,” he says. “And because dollar growth continues to grow faster than volume, the category continues to premiumize, so consumers are continuing to trade up to more expensive choices within the category.

“… The premium segment grew at 7.2 percent, and the ultra-premium [segment grew] at 9 percent,” he continues. “The trend to trade up isn’t impacted by any one demographic. We see it happening in beer, we see it happening in wine, and I suspect it is happening in other categories as well.”

Although case sales are experiencing moderate growth, the premiumization trend is driving double-digit dollar growth for Miami-based Southern Glazer’s Wine & Spirits, according to Shawn Thurman, executive vice president of national accounts.

“Tequila and bourbon grew the most with [the] resurgence of consumer interest in these two categories. We’re seeing dollar growth much higher than equity growth, indicating consumers [are] trading up to premium products,” Thurman says. “Rum and vodka are relatively flat, but revenue continues to increase. This data reinforces the fact that consumers continue to trade up in both categories, which also continue to attract new consumers.”

Whiskey, vodka, rum, cordials and tequila were the Top 5 spirit segments based on dollar sales in U.S. multi-outlets, including supermarkets, drug stores, mass merchandisers, gas and convenience stores, military commissaries, and select club and dollar retail chains, for the 52 weeks ending Jan. 22, according to Information Resources Inc. (IRI), Chicago. Although smaller by comparison to other spirit segments, ready-to-drink, premixed cocktails were up 14.3 percent for more than $285.5 million in sales for the same timeframe, it adds.

“One of the key drivers of premixed cocktails’ success last year was the new hard seltzer items from Boston Beer and Mike’s Hard Lemonade,” says Susan Viamari, IRI’s vice president of Thought Leadership. “The brand that [Anheuser-Busch InBev] (ABI) acquired and has big distribution plans for this year, Spiked Seltzer, is included under premixed cocktails.

“… Premixed cocktails were quite strong for the year, with growth at the value and premium ends of the spectrum, supporting consumers’ desire for easy indulgences that make the tasty cocktail attainable even among those who are challenged to mix a good drink on their own,” she continues. “Jose Cuervo is among the strongest brands in the sector.”

When it comes to sub-segments within the spirits portfolio, blended-malt Scotch whisky grew by 48 percent in 2015, faster than any other spirit, albeit from a smaller base, while cognac had a volume growth of 17 percent in 2015, says Eric Penicka, research analyst for Chicago-based Euromonitor International.

“Blended-malt Scotch whisky … benefits from a unique flavor profile, which makes it a suitable bridge from bourbon to single-malt Scotch,” he says. “With consumer confidence in the U.S. economy improving, cognac’s year-over-year growth has accelerated, allowing the category to assume record sales in 2015 of 44.2 million liters. The softer flavor profile has made it popular amongst consumers [who are] averse to whiskies, and references abundant in pop culture have exposed the spirit to those who may not have been familiar with it before.”

Noting the increased demand for premium products, spirits manufacturers are releasing new varietals. For example, in March Rock N Roll Tequila released its self-named, triple-distilled platinum tequila in three varietals: Platinum, Mango and Cristalino. Hand-crafted and made with 100 percent blue agave grown in the highlands of Jalisco, Mexico, Rock N Roll Tequila is packaged in glass, guitar-shaped bottles with a patented 50-ml bottle top known as a “roadie,” which provides an extra two shots of the tequila, the company says.

In its October 2016 “White Spirits – US” report, Chicago-based Mintel notes that although white spirits lead the overall spirits category, they have been growing at a slightly slower rate than dark spirits.

“Vodka remains the leader of the white spirits category with 59 percent of the total market share by volume, yet [it] achieved a modest gain of 1.8 percent in market share (estimated) in 2016. Tequila continues to boost the category while rum and gin flounder,” the report states. “However, dark spirits are making gains. … Volume sales of dark spirits increased 5 percent in 2016 (estimated), fueled by renewed interest among younger adults in the category.”

Premium and super-premium positioning, along with flavor innovation, have led to “notable growth” for the dark spirits category, with fruit, spice, sweetened, vanilla and dessert flavors among the top choices of millennials, it states.

Consumption of dark spirits strongly correlates with income levels. For instance, households with incomes of $75,000 or greater are more likely to consume bourbon and whiskey, Mintel’s Senior Food and Drink Analyst Billy Roberts notes. Older millennials, between the ages of 30-39, are driving cross consumption between different types of dark spirits, he adds.

“Nearly half of the demographic consumed 15 different types across age and flavor variety,” Roberts explains. “Older millennials are core dark spirits consumers, have broader beverage repertoires in general and enjoy new or culinary experiences, all [of] which positions them as active dark spirits drinkers.”

Jeane Kropp, director of brand strategy at Heibing, Madison, Wis., also points to this trend. “Bourbon, rye, Scotch and flavored whiskey are particularly hot with millennials now. Fireball by Sazerac was one of the first flavored whiskeys to hit it big,” she says. “Now there’s plethora of options out there, including many driven by the big brands like Jack Daniel’s and Jägermeister.

“Flavored whiskeys are appearing to try to steal share from flavored vodkas,” she continues. “Crown Royal Vanilla looks to appeal to younger consumers and women with a taste for something a bit on the sweeter side. Seasonal flavors are allowing promotional emphasis, with things like pumpkin spice whiskey and apple whiskey for the fall and winter seasons.”

Premium tequila is hot and getting hotter, particularly as it moves from being a go-to shot spirit to a savor-and-sip post-dinner alternative, she adds.

Diversifying craft spirits

As global spirits drinkers become more experimental, 39 percent of consumers are actively trying new varieties within each category and moving away from mass-produced brands toward spirits made with craftsmanship and authenticity, according to Emma Wright, consumer analyst for United Kingdom-based GlobalData.

“Out of all the spirits, consumers are most likely to try new or different varieties of whiskey, followed by vodka and liqueurs,” she says.

Bold and sweet flavors and a rise in craft options are further driving the growth of the spirits category, experts say.

“Craft options have seen a surge in interest, as such options communicate a degree of artisanal quality,” Mintel’s Roberts says. “Craft appears to promise an experience of complexity, sophistication and high-quality craftsmanship.

“While not a regulated term, consumers have an opinion of what it means for a spirit to be considered craft, and, generally speaking, consumers regard craft spirits as made in small batches, ideally by independently owned distilleries and utilizing premium ingredients,” he continues.

When it comes to flavors, spirits infused with fruits and vegetables are leading the pack, says Nielsen’s Brager, who notes that the four fastest-growing vodka flavors are apple, grapefruit, mango and cucumber, while cinnamon and honey comprise more than 90 percent of the flavored whiskey segment. Coconut and spiced flavors are commonly used in rums, he adds.

Among the new, bolder flavor offerings are Brandywine Branch Distillery’s DragonDance Gin, a jalapeño distilled spirit, and Kahlúa's new Kahlúa Chili Chocolate, Mintel’s Roberts says.

The natural origin of honey appeals to many mainstream manufacturers and craft distilleries, says Catherine Barry, director of marketing for the National Honey Board, Firestone, Colo.

“The benefits of using honey in a spirit go beyond just adding a sweet flavor note to a finished product,” Barry says. “Honey also adds a depth of flavor to distilled spirits through its combination of simple and complex carbohydrates, minerals and other properties.”

Eric Smith, director of alcohol research for New York-based Beverage Marketing Corporation (BMC), says flavor trends in spirits continue to evolve.

“Portfolios have been pared down, and the dessert and confectionary flavors of a few years ago have returned to stalwart flavors like citrus, raspberry and apple,” he explains. “… We’re seeing a slowing of growth in flavored whiskeys [as] there is a finite number of flavors that work well, making the future for flavored whiskey more precarious than [what] we saw in vodka a few years ago.”

On-premise versus off-premise

Regardless of the type of spirit, the vast majority of consumers are enjoying spirits at home rather than at bars and restaurants, Mintel’s “White Spirits” report notes.

“The lion’s share of distilled spirits are consumed off-premise, accounting for 79.4 percent of the total market share in 2016,” it states. “The difference between on-premise versus off-premise consumption has remained somewhat steady since 2011 with off-premise widening the gap by a modest increase of 2.7 percent from 2011 to 2016.

“The convenience, cost and versatility of at-home consumption offerings will continue to appeal to consumers young and old,” it adds.

Mintel predicts that the sales of white spirits will continue to grow, from 122,670 cases in 2015 to an estimated 123,532 cases in 2016, reaching 136,020 in 2021.

However, the future of the dark spirits category could rest in offerings that leverage craft attributes, chiefly small-batch production and smaller distilleries, Mintel’s November 2016 “Dark Spirits – US” report states.

“Consumers appear to be interested in a host of dark spirits, but there remains significant room to grow for the category,” it states. “The category must maintain its image of sophistication, authenticity and complexity, which have served to set many dark spirits apart from other alcoholic beverages and from other segments of their category.”

Euromonitor’s Penicka expects that classic cocktails, authenticity, premiumization and the spending power of millennials will continue to drive the spirits category, which he predicts will grow at a 2 percent compound annual growth rate.

“The ongoing craft spirits boom taking place in the U.S., reminiscent of where craft beer was a decade or so ago, is rooted in consumer demand for traditional, well-made, richly flavored spirits,” he says. “Similarly, cocktails’ growing prevalence and renaissance, both on-trade and at home, has demanded the use of finer spirits.

“… The continued growth and spending power of the millennial generation is expected to drive the premiumization trends onward,” he continues. “Further, as craft distillers grow in number and strength, they are anticipated to dramatically disrupt the spirits market with higher-priced goods.” BI

Click here to view the Distilled Spirits Council infographic.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!