Packaging Materials

Post-consumer resin key to plastic’s future with beverage-makers

Value, recycling attributes aid packaging material’s status in beverage market

Photo by Emma Pollard for Pexel/ courtesy of Canva

There’s little question about the increasing demand for plastic packaging. According to a report from Mordor Intelligence titled “Plastic Bottles Market – Growth, Trends, Covid-19 Impact and Forecasts (2022-2027),” the global plastic bottles and containers market had a value of $166.78 billion in 2019 and the market research firm expects it to reach a value of $224.97 billion by 2025. Still, as plastic bottles and containers are in high demand, for many brand owners the type of plastic they’re seeking is evolving.

Influencing this evolution has been a growing demand from consumers for sustainable packaging solutions.

“Sustainable packaging is becoming a higher priority. Consumers still want to buy products in sustainable packaging,” says Michael Zuckerman, president of King of Prussia, Pa.-based Zuckerman Honickman, a TricorBraun company. “Younger consumers are a driving force behind this trend. They are willing to spend more for brands that align with their values.”

John Cullen, director of PET resins sales and marketing with Charlotte, N.C.-based DAK Americas LLC, an Alpek Polyester business, highlights that given consumers’ interest in sustainable packaging, more brands and retailers also are taking greater interest.

“Given the importance of packaging to the consumer experience, there is tremendous focus on choosing the right materials that will fulfill the sustainability needs while meeting the practical and economic demands of commerce,” he says. “PET packaging has delivered sustainability, value and consumer appeal for over 40 years and continues to be the material of choice for many brands and retailers. It’s lightweight, clarity, break- and tamper-resistance, and recyclability are all features that improve the consumer experience and help achieve a sustainable cycle.”

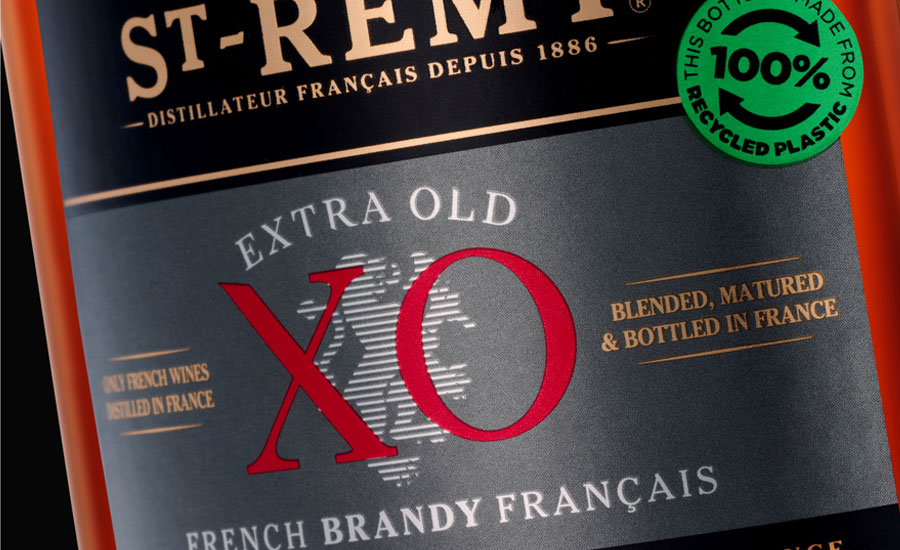

St-Rémy changed its plastic 50-cl St-Rémy XO and VSOP bottles and its 1.75-liter St-Rémy VSOP plastic bottle from PET to recycled PET (rPET) plastic.

With the transfer to rPET in these three formats, St-Rémy will emit 29% less carbon dioxide, and use a third less water and energy than with plastic bottles made with the traditional PET, it says.

One of the ways in which suppliers are aiding plastic packaging’s stance with sustainable measures is through recycled PET (rPET).

“The use of recycled PET (rPET) is a critical part of the brand companies’ commitments to sustainable packaging within a circular economy,” Cullen explains. “One of the unique properties of PET is the polymer’s capacity to be mechanically or chemically recycled back into a state that allows it to be used repeatedly to make packaging.

“The key challenge of rPET remains the collection of PET bottles from the consumer,” he continues. “In the U.S., there are a variety of effective PET recycling programs in various states and municipalities. The future success of rPET will depend on the creative efforts by stakeholders to capitalize on the best practices and increase recycling rates.”

Zuckerman Honickman’s Zuckerman adds that rPET is a straightforward product that consumers can understand.

“Consumers today are drawn to products that offer easy to understand sustainable benefits such as plastic bottles made from recycled plastics. rPET aligns with consumers high interest in recycling,” he says. “rPET created an opportunity for brands to address consumers negative views of plastic packaging. Consumers want plastic packaging for convenience, but they also demand brands use less usage of plastics.”

Furthermore, America’s leading beverage companies ― The Coca-Cola Co., Keurig Dr Pepper (KDP) and PepsiCo ― all are committed to increased usage of rPET packaging for their operations, Zuckerman notes.

“Major brands such as Coke understand that consumers still want plastic bottles because of resealability and lightweight,” he says. “They continue to innovate with new packaging formats designed to improve recyclability — increasing use of post-consumer recycled (PCR) content ― as they approach their own sustainability commitments, e.g., 100% PCR [for] KDP-CORE, 50% PCR [for] Pure Leaf Tea-PepsiCo.”

Image courtesy of Reed’s Inc

Zuckerman also points to the rPET goals for these corporations:

- The Coca-Cola Co.’s goal to make 100% of its packaging recyclable globally by 2025 as well as to use at least 50% recycled material in its packaging by 2030.

- PepsiCo’s plans to design 100% of its packaging to be recyclable, compostable or biodegradable while reducing 35% of virgin plastic across its beverage portfolio.

- KDP also has a goal to convert 100% of its packaging to be recyclable or compostable by 2025, while using 25% post-consumer recycled content across its plastic packaging portfolio by 2025 as well as achieve 20% virgin plastic reduction across its plastic packaging portfolio by 2025.

Moreover, post-consumer resin (PCR) adoption also is being accelerated by state legislations, Zuckerman notes.

“[C]alifornia requires that plastic bottles covered by the bottle deposit program contain at least 15% post-consumer resin (PCR) by 2022, 25% by 2025 and 50% by 2030,” he says. “Another example of the most recent law signed is in Washington, which mimics the California legislation, bottles (with the exception of dairy and wine in 187 ml) will need to include 15% PCR starting in 2023). We can expect increasing number of brands incorporating post-consumer recycled (PCR), enabling circular economy.”

To support these efforts, suppliers are directing their capital expenditures to solutions that will aid the growing rPET demands.

Evergreen announced in early March that it will install artificial intelligence-enabled bottle sorting robotics at its Albany, N.Y., plastics recycling and rPET manufacturing facility. When the installation is completed in mid-2022, Evergreen will have deployed 15 high-speed, highly accurate robotic lines at three of its United States locations, it says.

Supplying the robotics sorting lines to Albany is AMP Robotics Corp., a pioneer in artificial intelligence (AI) robotics and infrastructure for the waste industry.

Evergreen President and CEO Omar Abuaita states replacing previously manual sorting processes with high-tech robotics is part of a strategic vision to transform not just the company, but the overall plastics recycling industry. “With demand for recycled PET (rPET) at the highest levels in history, we simply can’t rely on outdated ways of doing business,” he said in a statement. “Evergreen is playing for keeps. Automating our sorting lines allows us to support ever larger PET recycling streams, provide the millions of pounds of food grade rPET our customers have committed to purchasing, and achieve a safer, more efficient work environments for our team.”

“The key challenge of rPET remains the collection of PET bottles from the consumer. In the U.S., there are a variety of effective PET recycling programs in various states and municipalities. The future success of rPET will depend on the creative efforts by stakeholders to capitalize on the best practices and increase recycling rates.”

- John Cullen, director of PET resins sales and marketing with DAK Americas LLC, an Alpek Polyester business

Valuable solution

As suppliers make strides in accelerating sustainable solutions for plastic packaging, beverage manufacturers continue to turn to the packaging material thanks to its bevy of attributes.

“The number one thing that a plastic like PET offers to the beverage-maker is value,” DAK Americas’ Cullen says. “The weight of the package is minimal compared to the contents reducing the cost. Plastics like PET continue to offer competitive pricing versus material alternatives. And PET is highly recycled and can be part of sustainable identity for beverage brands.”

Zuckerman Honickman’s Zuckerman also touts the packaging recyclability benefits. “PET is the most recycled plastic in the world, with more than 1.5 billion pounds of used PET bottles and containers recovered in the U.S. each year alone,” he says.

Given these attributes, plastic bottles have been embraced across a diverse sect of the beverage community.

“Enhanced waters, fortified juices and beverages with vitamins and minerals are all applications that fit well with the appeal, economics and recyclability of plastic packaging,” DAK Americas’ Cullen says. “Any product that appeals visually to the consumer is best packaged in a material like PET. Years of study have shown that the clarity and gloss of PET can drive consumer preference to a package made with PET.”

Given its benefits, broad appeal and investments by suppliers toward sustainability, experts anticipate that plastic bottles will continue to resonate throughout the beverage market.

“The demand for plastics in beverage packaging will continue to grow,” Cullen says. “The products being packaged will change, but materials like PET offer so much value that they will continue to be the first choice for many beverage-makers. We will see more recycled content in packaging for beverages. All parts of the plastic packaging supply chain are investing in assets to recycle materials into the next generation of bottles. And we will see continued development of sustainable raw materials made from renewable resources like plant waste.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!