Packaging Materials

Sustainable attributes drive adoption of aluminum cans from beverage-makers

Suppliers innovate to make aluminum cans a solution in more beverage categories

Photo by Breakinpic from Pexels/courtesy of Canva

When a recycled material is used to make a new product, natural resources and energy are conserved. In the words of the coordinator for the first Earth Day (April 22, 1970) environmental advocate Denis Hayes said: “Listen up, you couch potatoes; each recycled beer can saves enough electricity to run a television for three hours.” In the same vein, manufacturing with recycled aluminum cans uses 95% less energy than creating the same amount of aluminum with bauxite, experts note.

Moreover, there is the potential for essentially all of the aluminum in beverage cans to be recycled multiple times, generating significant environmental and economic benefits, note Scott Breen, vice president of sustainability, and Sherrie Rosenblatt, vice president of marketing and communications, at the Can Manufacturers Institute (CMI), Washington D.C.

“It is no surprise that beer, energy, health and soft drink beverage companies are enjoying the many benefits of the aluminum can, which has the highest recycling rate among all beverage packaging,” Breen and Rosenblatt say. “In CMI’s latest can shipment reports, aluminum can production in the United States and Canada increased 3.5%.

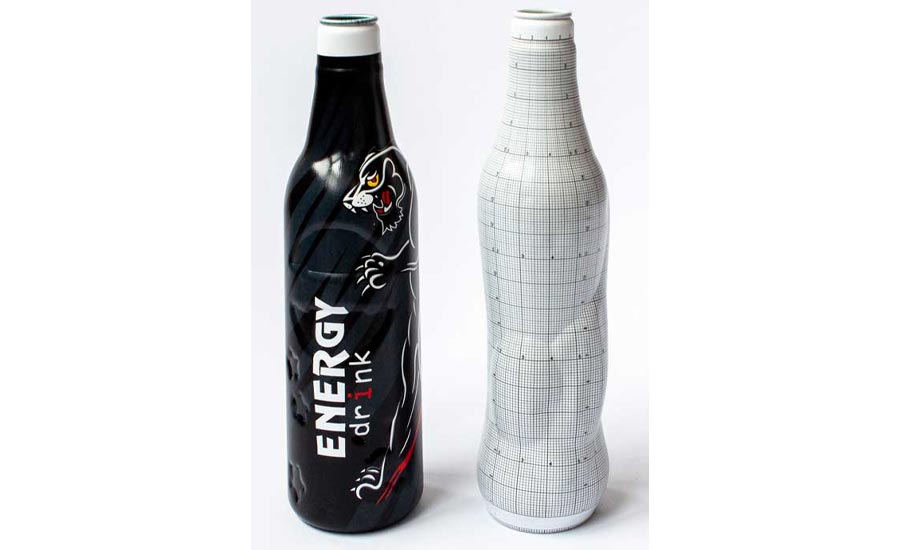

Image courtesy of Kingston Alumishape Technology

“There are many sustainability advantages to packaging beverages in an aluminum can. Compared to plastic PET or glass bottles, aluminum cans lead the way in the key measures of recycling rate, recycled content and value per ton,” they continue. “An industry-leading 45% of aluminum cans are being recycled and an average 93% of recycled cans will end up as new cans, typically in as little as 60 days. As a result, the U.S. beverage can on average is made up of 73% recycled aluminum. This continuous circular journey happens over and over again because metal recycles forever.”

Whereas recycling aluminum beverage cans has a high environmental impact, the industry has seen unprecedented demand for the container by current and new beverage companies, experts note.

“Aluminum packaging is right on trend as it can be recycled time and time again without losing its quality,” says Kathy Mercer, sales manager at Ontario, Canada-based Kingston Alumishape Technology. “Aluminum packaging also falls into the trends and demand of non-breakable beverage bottles.”

Further, aluminum cans are leading the way in attributes that matter to consumers and beverage companies alike, CMI’s Breen and Rosenblatt note.

“Recent trends indicate that more than 70% of new beverage product introductions are in aluminum cans and long-standing customers are moving away from plastic bottles and other packaging substrates to cans due to environmental concerns,” they explain.

Increasing sustainability

As sustainable actions become more prevalent in beverage-makers’ day-to-day operations, experts highlight the environmental benefits that aluminum cans provide.

In the United States, recycled content — 75% — on average for aluminum beverage cans translates into a lower environmental footprint, as recycled aluminum reduces greenhouse gas emissions by more than 80% compared with using primary aluminum, according to Breen and Rosenblatt.

Additionally, increased recycled content would further reduce a can’s carbon footprint because each percentage point increase translates into a 1.43 carbon dioxide equivalent decrease in the can’s global warming potential, they note. Moreover, if recycling rates increase and more aluminum scrap is available as a result, that would enable an increase in the average recycled content.

“Even a slight improvement in the recycling rate of aluminum cans has substantial economic and environmental benefits,” Breen and Rosenblatt explain. “Astoundingly, each percentage increase in the national aluminum beverage can recycling rate in 2020 would produce energy savings that could power more than 46,000 U.S. homes for a year, and generate $17 million in revenue for the U.S. recycling system.

Image courtesy of Ardagh Metal Packaging

“Also consider that if the aluminum beverage can recycling rate had been 70% in 2020, instead of the current 45%, there would have been around 25 billion more cans recycled. These 25 billion cans would have generated more than $400 million in revenue for the U.S. recycling system and resulted in energy savings that could power more than 1 million U.S. homes for an entire year,” they continue.

With new recycling rate targets, CMI is focused on reaching its targets centered on four pillars of action:

- Catalyze the passage and implementation of well-designed deposit systems at the state and federal levels.

- Increase and improve household and away-from-home recycling.

- Ensure that more cans are properly sorted at recycling centers.

- Increase consumer understanding on the importance of aluminum can recycling and the ability to collect and sell used beverage cans for cash.

According to a recent CMI survey, only 38% of U.S. consumers are aware that the aluminum in beverage cans can be infinitely recycled. Helping consumers understand that aluminum can support a circular economy could inspire people to recycle, it says.

Beverage companies also can help spread the message by including the Metal Recycles Forever and Infinitely Recyclable logo on its cans because it makes consumers aware of aluminum cans’ sustainability advantages, it adds.

CMI’s Breen and Rosenblatt note that data from The Recycling Partnership, a national recycling nonprofit, shows that as household access to recycling increases, less aluminum beverage cans are lost to the trash.

“For example, households with drop-off recycling access send 17 pounds of aluminum cans on average per year to the trash while households with curbside recycling access and robust education send only 8 pounds to the trash,” they explain. “Numerous canned beverages are also consumed on the go. However, away-from-home recycling infrastructure is lacking in the United States and with those that do exist, contamination from non-recyclables is a major challenge.”

One way that CMI intends to help improve away-from-home recycling is to set up a pilot partnership between a charity and a venue that primarily or only uses aluminum beverage cans where used beverage cans are collected at the venue and then sold to a metal scrap yard to generate revenue for the charity, Breen and Rosenblatt say.

“That is why CMI members Ardagh Metal Packaging and Crown Holdings funded a Can Capture Grant Program in partnership with The Recycling Partnership to prompt additional can capture equipment at [material recovery facility] MRFs,” they explain. “The equipment installed with the five can capture grants given in 2021 will lead to an additional 71 million aluminum cans recycled every year, which results in more than $1.15 million in revenue for the U.S. recycling system and energy savings that could power more than 28 million U.S. homes for one hour.”

Innovating for the long term

Despite the traditional 12-ounce can still dominating the market, the aluminum can industry is constantly innovating to meet consumer needs, experts note.

“We’ve seen [the industry] breaking norms with new shapes and sizes, and improving functionality with resealability, temperature indicators and widgets to create that perfect, refreshing experience,” CMI’s Breen and Rosenblatt say.

For instance, Kingston Alumishape Technology offers aluminum bottles from 185-ml to 355-ml with crown and ROPP closures, Mercer says.

“The benefits are fully recyclable, non-breakable and offers an impermeable barrier to light, while keeping freshness in,” Mercer says. “We are seeing demands in all varieties of beverage products from water, wine, [ready-to-drink] (RTD) and cannabis beverages.”

Beverage companies know that oxygen and light are a drink’s worst enemy, and the aluminum can creates a barrier from those elements, Breen and Rosenblatt add.

“While the soda and beer industry have long adopted the aluminum can as one of their primary packages, the water, wine and emerging beverage companies are adopting aluminum cans because of its superior attributes of sustainability, branding, convenience, performance and taste,” Breen and Rosenblatt say. “Take canned wine, for example, which has seen 62% sales growth, according to Nielsen. And recent data on new beverage product introduction, nearly 75% were introduced in aluminum cans.”

Moreover, aluminum has the added economic advantage of being lightweight, making the beverage containers big money savers when it comes to shipping and logistics, experts note.

“For aluminum bottles we expect to witness a surge in demand and growth in the next five to 10 years,” Mercer says. “We can’t forget to mention the elegant beauty of a sleek aluminum bottle to differentiate a company’s product on retail shelves.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!