2017 Beer Report: Hard cider declines continues

Dry, hopped options could broaden consumer base

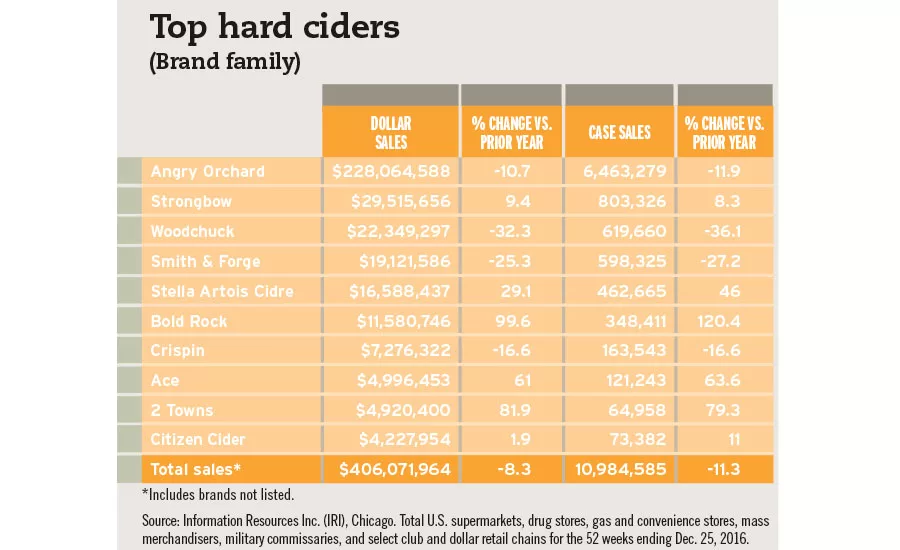

Although premiumization trends have provided growth for domestic beers through super-premium brands as well as import and craft beers, the hard cider segment has not been as fortunate. According to Information Resources Inc. (IRI), Chicago, dollar sales for hard cider were down 8.3 percent in the 52 weeks ending Dec. 25, 2016, in U.S. multi-outlets, including supermarkets, drug stores, gas and convenience stores, mass merchandisers, military commissaries, and select club and dollar retail chains. Case sales also were down 11.3 percent during that same time period.

Brian Sudano, managing partner with New York-based Beverage Marketing Corporation (BMC), notes that the market research firm classifies hard cider among the alternative beverage alcohol space, which includes flavored malt beverages (FMBs) and progressive adult beverages (PABs).

“As with other alternative beverage alcohol segments, the trend is for a rapid rise followed by consolidation and contraction,” he says. “Hard cider has been experiencing a similar dynamic.”

Sudano adds that this is of particular significance to the segment because of the rapid expansion into flavored hard ciders.

Also recognizing hard cider’s 2016 decline, Danelle Kosmal, vice president of beverage alcohol practice for New York-based Nielsen, says that the contraction was driven by a handful of large brands, but notes that other brands still are faring well.

“[T]here are still a few large cider brands that continue to perform well, along with smaller and more local brands,” she says.

Strongbow, a brand of White Plains, N.Y.-based Heineken USA, is among the large hard ciders that performed well in 2016. According to IRI data, the hard cider brand saw dollar sales increase 9.4 percent and case sales grow 8.3 percent for the 52 weeks ending Dec. 25, 2016. Strongbow also recently released its latest flavor: Orange Blossom.

Within the Top 10 hard ciders, Bold Rock and 2 Towns posted the strongest gains in 2016 with case sales growth of 120.4 percent and 79.3 percent, respec-tively, according to IRI data.

In its June 2016 report titled “Cider/Perry in the US,” Chicago-based Euromonitor International details that hard cider sales began to show signs of contraction toward the end of 2015. The market research firm adds that the growth deceleration in 2015 was inevitable as hard cider had gained national recognition in the United States. Hard sodas also had emerged as a competitor with their sweet taste and an alcohol-by-volume content that was in the single-percent range, the report adds.

Another challenge was declining unit prices as the segment was seeing increased competition from large-scale brewers.

“The unit price of cider/perry declined by 2 per-cent in real terms in 2015, as increased competition from mass-produced brands in this typically craft-like category looked to pricing as a point of differentiation,” the report states. “The category entrance of mass-produced brands like Johnny Appleseed, Stella Artois Cidre, and Smith & Forge has led to lower average unit prices resulting from [the] efficiencies of scale these manufacturers are able to employ. Further contributing to a declining average unit price is the steady transition of cider/perry to off-trade consumption, where average unit prices are 31 percent of those found on-trade.”

Despite the challenges that hard cider has faced in the past year, Euromonitor notes that opportunities still are available to grow its consumer base and return the segment to growth. For example, hard cider’s core consumers remain younger legal-drinking-age adults and women who enjoy the sweet taste of the products, it says. However, hard cider has fairly equal consumption rates between both sexes in the United Kingdom, the report states.

“As a result, cider is, in many ways, perceived as a feminine product by American men,” Euromonitor’s report states. “However, cider/perry producers are making efforts to change this perception with new product launches featuring drier apples and/or hops, which assist in making cider more bitter.”

Another positive for the hard cider category could be the on-premise channel. “While the cider [segment] has been struggling overall in the off-premise space, the segment is experiencing positive growth rates in the on-premise channels: plus 1.7 percent in volume and plus 3.8 percent in dollars for 52 weeks ending Dec. 3, 2016,” Nielsen’s Kosmal says. BI

Top hard ciders

(Brand family)

| Angry Orchard | $228,064,588 | -10.7 | 6,463,279 | -11.9 |

| Strongbow | $29,515,656 | 9.4 | 803,326 | 8.3 |

| Woodchuck | $22,349,297 | -32.3 | 619,660 | -36.1 |

| Smith & Forge | $19,121,586 | -25.3 | 598,325 | -27.2 |

| Stella Artois Cidre | $16,588,437 | 29.1 | 462,665 | 46 |

| Bold Rock | $11,580,746 | 99.6 | 348,411 | 120.4 |

| Crispin | $7,276,322 | -16.6 | 163,543 | -16.6 |

| Ace | $4,996,453 | 61 | 121,243 | 63.6 |

| 2 Towns | $4,920,400 | 81.9 | 64,958 | 79.3 |

| Citizen Cider | $4,227,954 | 1.9 | 73,382 | 11 |

| Total sales* | $406,071,964 | -8.3 | 10,984,585 | -11.3 |

*Includes brands not listed.

Source: Information Resources Inc. (IRI), Chicago. Total U.S. supermarkets, drug stores, gas and convenience stores, mass merchandisers, military commissaries, and select club and dollar retail chains for the 52 weeks ending Dec. 25, 2016.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!