Contract manufacturing, packaging work with new beverage formats

Function has added a new dynamic to the beverage landscape, which has allowed beverage-makers to explore new ingredients, package sizes and innovative products. Globally, functional claims remained a relatively small group for food and beverage launches from January to May 2012, according to Chicago-based Mintel’s Global New Products Database webinar titled “Functional Foods.” However, the market research firm also reports that, despite a dip in 2010, the North America region currently has the highest percent of product introductions with functional claims.

|

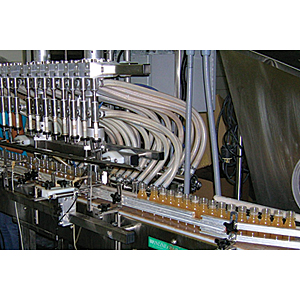

| Tampa Bay CoPack offers line speeds between 75 and 150 bottles a minute. |

With these new product introductions, contract manufacturers are tasked with helping beverage-makers fill that market need.

“I think we’re starting to see a lot more functional products that [have] to be addressed; there’s a lot more people who want to make products that incorporate different proteins and different sources of protein,” says Bob Occhifinto, president of NVE Pharmaceuticals, Andover, N.J.

Offering high-speed capability for functional shots, NVE can produce approximately 30 million shots a month, Occhifinto notes.

Advancements in technology have helped aid contract manufacturers in being able to accommodate these functional supplement formats, says Brian Dworkin, president of Castle Co-Packers, New Kensington, Pa.

These advancements have allowed consumers access to different types of vitamins and nutritional ingredients via dietary supplements that typically were obtained from a multi-vitamin, he explains.

Regulations for dietary supplements also add an element of complexity to manufacturing, says Bill Foley, chief executive officer with Tampa Bay CoPack, Dade City, Fla. He notes that it also is important to have the proper certification for those formats as a contract manufacturer, and this is something he is looking to add to Tampa Bay Co-Pack’s business.

“[W]e want to be a company that has the five-star certification, if you will, on a certified [good manufacturing practices] (GMP) basis working under [U.S. Food and Drug Administration] (FDA) guidelines to be able to manufacture as a co-packer and turnkey specialist [for] liquid dietary supplements,” he says.

Featuring liquid dietary supplements manufacturing capabilities, NVE’s equipment includes high-tech apparatuses for its filling equipment that conform to FDA regulations, Occhifinto says.

“There’s a lot of testing going on these days for raw materials and purity and to make sure the quantity of the raw materials are in the final products, whereas before none of that was really in any demands for testing by the FDA,” he says. “But nowadays that’s all being handed down with new regulations that have come into effect for supplement manufacturers, and we are supplement manufacturers, so we have to have a higher guideline, a higher caliber, a lot stricter than it would be for just an ordinary beverage manufacturer.”

However, beverage-makers are not the only ones adding to the functional beverage market. Retailers also are developing their own functional products, tasking contract packagers to meet this demand.

“[W]e’re starting to see a trend where a lot of consumers are looking for better-for-you products, so as consumers look for better-for-you products and less sugary products, the industry is starting to shift to be able to manufacture those type of products,” says Jon Biller, vice president of marketing for Cott Beverages, Tampa, Fla. “What we’re finding is that we as a company are becoming more nimble in terms of being able to provide packages that are going to be able to meet the consumer trends that we’re seeing in the marketplace like … the alternative beverages.”

Although a majority of Cott’s business is within carbonated soft drinks, juice and juice drinks, Biller notes that more and more of Cott’s partners are requesting teas, sports drinks, energy drinks and energy shots.

Also impacting the functional beverage formats are the ingredients, which can add another complexity for contract manufacturers and packagers to accommodate.

“As products are becoming more complex, it results in a number of complications for manufacturers,” says Andy Dratt, executive vice president of Imbibe Inc., Wilmette, Ill. “Beverage-makers have formulations that have new ingredients that manufacturers would not otherwise purchase. More complex formulations require additional processing steps or procedures that need to be addressed.”

An example he cites are aloe-based beverages. “You’re working with an ingredient whose attributes change depending on how much sheer is applied to … the breakup of the aloe, whereas if you are running a traditional soda, you would not worry about that,” Dratt says.

Because of complexities similar to this, Dratt adds that the manner in which ingredients are handled can be very important to the outcome of the finished beverage.

Choice offerings

Functional formats are not the only segments that have experienced SKU proliferation. The overall beverage landscape has seen a number of introductions. According to Mintel’s Global New Products Database, 4,528 new beverage products were released between September 2011 and September 2012.

“[W]e’ve seen an awful lot of new product introductions by startup companies in the last 14 or 15 months,” Tampa Bay CoPack’s Foley says. “We’ve actually done work for 22 different companies, and an overwhelming majority of those companies have been in startups coming to the market with brand-new products.”

Some contract manufacturers think health and wellness trends about lowering sugar intake could be having an effect on new product introductions. “We are finding more customers looking for seltzer, and our existing customers having strong growth on it,” says Eric Miller, president of Brooklyn Bottling Co., Milton, N.Y.

Castle Co-Packer’s Dworkin also has seen an influx of partners who are entering new category markets.

“A big push has been going in hot fills; [that’s] been huge for a while now. People have been getting out of CSDs, [but] now people are getting into CSDs but on a healthier scale,” he says.

However, consumers’ beverage choices aren’t limited to new product offerings; they also include numerous packaging options.

Darold Sauber, director of business development for Kansas City, Mo.-based Dairy Farmers of America, notes that there is a strong demand for variety packaging, whether that is for quantity, flavor or both. “This has been driven by the club stores, but we’re also seeing more demand for these custom variety packs from the big box and grocery retailers as well, and we are working to deliver on the production flexibility these relationships require,” he says.

Another trend Sauber is seeing is more opportunities for aseptic plastic packaging. “[An] area that is significantly impacting our business is the new technology that allows aseptic plastic packaging, which has strong appeal for convenient, shelf-stable products,” he says. “Aseptic packaging wasn’t previously an option for dairy beverages, so this has been an especially exciting innovation for Dairy Farmers of America as we look for opportunities to expand our dairy beverage and other low-acid businesses.”

NVE also has recognized the new opportunities for packaging in the beverage marketplace and is making investments to keep up with these demands.

“Right now we’re putting in pouching equipment that has resealable closures on it; we also have stick-pack machines and other kinds of pouch machines for dry powders, for liquids and also for gels,” Occhifinto says.

These equipment capabilities allow NVE’s business to continuously evolve as well as stay on top of the most current trends, he adds.

And like so many businesses, contract manufacturers recognize the importance sustainability has had on their businesses.

“Protecting the environment is an increasingly important consideration in our industry,” Sauber says. “Historically, packaging was far more complex with complicated primary and secondary packaging. Today’s focus on sustainability means less is better, and we are continually challenged to achieve the same function of more complex packaging using fewer, more environmentally friendly materials.”

Cott Beverages also notes the multiple points of reference that sustainability has on business operations.

“One of the things that we at Cott are committed to doing as a manufacturer is to assist our customers around innovation possibilities through sustainability. This can occur through several avenues that may include unique container and packaging designs and configurations while taking advantage of reducing overall materials that help provide favorable margins for all parties as well as doing the right thing for the environment,” says Greg Whitaker, senior vice president of operations and supply chain with Cott Beverages. “These are significant points of difference that we can offer with our vertical integration process and our overall footprint throughout North America.”

Staying current

As contract manufacturers and packagers seek to accommodate the changing beverage landscape, these companies are adding new capabilities to their company portfolios.

After investing the last few years in its factory, machinery, building and trucking, Brooklyn Bottling Co. is about to implement an upgraded IT system.

“We’ll be able to have portals with our customers so they can check their inventory of their products,” Brooklyn Bottling’s Miller says. “We’ll be able to take orders online through a website that connects right to our company. We will have all of our products scanned from raw material receipts to sending out finished goods, so everything from cases of finished products to raw materials of caps will all be monitored.”

Miller adds that this will facilitate easier comm-unication between the company and its partners to help support the quality and service it has developed throughout the years.

Castle Co-Packers also has made some significant capital expenditures. The company recently bought the former Le-Nature facility in Latrobe, Pa., Dworkin says. In 2013, Castle Co-Packers will move into the 236,000-square-foot facility, he adds. The company also now features four loading trucks and a van for its affiliated Full Circle Distributing business, which distributes into Pittsburgh and as far north as the Erie region and Ohio. In addition to all of these investments, Dworkin adds that the company is looking into Tetra Pak packaging and adding a can line.

Tampa Bay CoPack also is looking into adding to its capabilities. Currently, the company offers line speeds between 75 and 150 bottles a minute in either a flash-pasteurization, cold-fill process or a hot-fill process, but Foley notes that in the last 12 months the company was approached by six companies to manufacture carbonated products but had to turn them down because it currently doesn’t have the equipment.

“What’s on our horizon for 2013 is to be able to manufacture carbonated product,” he says. “We feel, based on what’s been happening over the past 12 months or so, [there’s] a real need in the marketplace for carbonation co-packers.”

Highlighting the importance of offering a full range of services to its partners, Imbibe is constructing a new, state-of-the-art beverage development center and pilot plant, Dratt notes.

Whether it’s software, facility upgrades or equipment improvement, co-packers continue to make a commitment to serve the changing marketplace. BI

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!