Channel Strategies

Manufacturers, retailers find ways to deliver orders quickly, efficiently

Consumers across varying demographics engage with eCommerce

With the onslaught of the pandemic, younger millennials and Gen Zers started to make more beverage purchases online. Shipt offers same-day delivery of beer and wine from Target in various states, most recently adding Alabama to the mix.

Image courtesy of Shipt

In the 1971 movie, “Willy Wonka and the Chocolate Factory,” Veruca Salt, the fictional spoiled brat who demands everything, sings: “I want the works, I want the whole works … And now, don’t care how, I want it now.” Similarly, due to the COVID-19 pandemic, demand for online delivery orders increased, forcing many businesses to turn to digital marketing and order fulfillment strategies. Convenience and quick turnaround times became more important, and merchants had to find ways to fulfill the online orders or face the potential loss of revenue as consumers “want the whole works” and “don't care how.”

Additionally, manufacturers and retailers supplying perishables or items that were traditionally purchased in-store have been forced to manage online sales and find ways to deliver items efficiently to protect freshness, says David Jackson, eCommerce consultant associate for Chicago-based Information Resources Inc. (IRI).

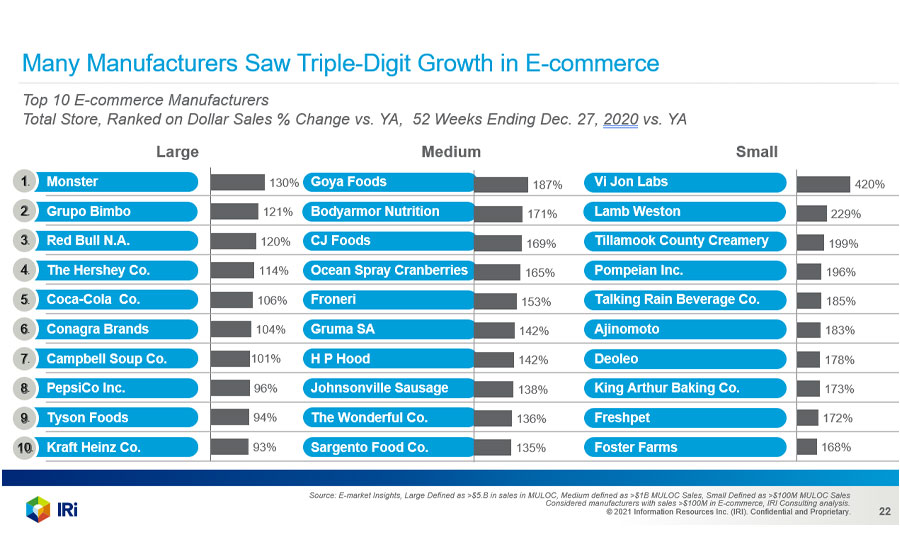

“Despite these hurdles, eCommerce thrived and saw a 58% increase in [consumer packaged goods] (CPG) sales from 2019 to 2020. By the end of 2020, most manufacturers, including some of the top beverage retailers like Monster, Red Bull and Coca-Cola, saw triple digit growth in eCommerce,” Jackson says. “Similar growth continues to date, as consumers become more attracted to the convenience and simplicity of ordering online and having items delivered directly to their front doors.

“Retailers and manufacturers are now having to continue to find ways to meet this new trend to retain and build their consumer base,” he continues.

Image courtesy of IRI

Brigette Thomas, lead analyst at New York-based IBISWorld, adds that as the COVID-19 pandemic significantly increased demand for eCommerce; overall, IBISWorld notes that revenue for the eCommerce and online auction industry increased 18.3% in 2020 alone.

Technological advancements such as the availability of Apple Pay, Google Pay Send (previously Google Wallet) and PayPal have been beneficial to the eCommerce industry as they offer even more convenience to the online shopping experience, Thomas notes.

“Additionally, companies such as Afterpay have capitalized on the increasing popularity of online shopping through offering a ‘buy now, pay later’ platform, which has incentivized many consumers to spend more online,” she says. “Similar platforms are expected to continue to become available.”

Yet, similar to many retail industries, the main challenge facing the eCommerce industry right now is supply chain disruptions.

“The coronavirus caused an unexpected increase in demand for many products, such as home appliances and furniture. At the same time, factories around the world were forced to close down or operate at partial capacity to adhere to social distancing regulations or other coronavirus related restrictions,” Thomas explains. “This combination has been one of the main drivers in supply chain disruptions, which has caused many online retailers to struggle to maintain optimum stock levels.”

Transformations

Although eCommerce is expected to see continued growth due to the convenience it offers consumers, the industry will continue to face external competition from brick-and-mortar stores, which benefit from providing in-person customer service and instant gratification, experts note.

IRI’s Jackson adds that another challenge worth mentioning is how manufacturers will find effective marketing strategies.

“In the past, it was easier to introduce a product to the market at the store level by having optimal planogram locations or being featured on an endcap. These types of marketing strategies allowed manufacturers to promote their products with a high rate of success,” he says. “As eCommerce continues to grow, manufacturers will need to evolve and find ways to distinguish their products amongst a significant number of available options.”

Moreover, despite the many benefits online shopping offers, manufacturers and retailers will face added challenges as distribution is a key component of the beverage industry, Jackson notes.

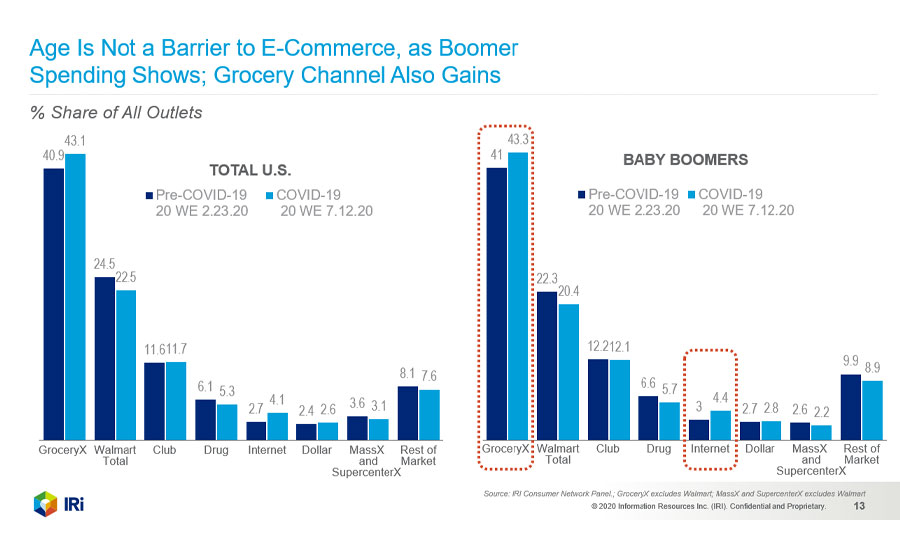

Image courtesy of IRI

“As eCommerce grows, manufacturers and retailers will have to continue to find ways to deliver customer orders quickly and efficiently. In the past, beverage companies had to use a distribution system that required products to funnel through a three-step process: manufacturer to wholesaler, wholesalers to retailer, and retailer to consumer,” he explains. “Manufacturers and retailers [now] will have to find ways to create their own delivery network, or partner with delivery services, such as Instacart, Shipt or Drizly, to fulfill these delivery orders. This also means they will need solid expertise in the supply chain department to ensure there are no distribution issues with inventory or order fulfillment.”

One example of companies finding new ways to expand on its retailer fulfillment network and on-demand delivery capabilities is Ridgefield, Conn.-based ReserveBar’s recent agreement to acquire New York-based Minibar Delivery.

As the two companies plan to link their retailers, customer bases, technology, and delivery modalities to benefit consumers and supplier partners, Minibar Delivery a leading marketplace featuring on-demand delivery of wine, spirits, beer, ready-to-drink cocktails, mixers and more, now will offer an even greater selection of products, including new launches, celebrity-owned spirits, as well as ReserveBar's personalized and engraved bottles and extensive gift offerings, the company says.

“This acquisition is born out of synergies generated by the complementary eCommerce segments we serve. ReserveBar primarily focuses on premium and luxury spirits, utilizing ground shipping fulfillment, while Minibar Delivery has focused on meeting the customer’s everyday needs for wine, spirits, beer, and ready-to-drink cocktails (RTDs), with on-demand delivery. Together, we can provide our clients with the best purchasing experience in the market,” said Lindsay Held, CEO and co-founder of ReserveBar, in a statement. “We also see significant product cross-over synergies in offering Minibar Delivery customers the special limited editions and celebrity, craft and newly launched bottles that are showcased on ReserveBar.”

The merger also creates an expansive retail footprint, expected to bring the combined number of retailer locations to more than 5,000 by the end of next year, serving virtually all legal drinking age consumers in states that permit shipping and delivery of spirits, wine, Champagne, ready-to-drink cocktails, beer and hard seltzers, the company adds.

Age not a barrier

In 2020, as the COVID-19 pandemic became more widely recognized across the United States, there were shifts to consumers purchasing online.

Additionally, as many states passed legislation permitting the online sale and delivery services of alcoholic beverages, leading to increased availability, alcohol through eCommerce platforms is expected to benefit the beverage industry, experts note.

IRI’s Jackson notes that prior to the pandemic, the average eCommerce consumer specific to the beverage industry, were generally baby boomers.

“At the end of 2019, ... the average eCommerce consumer, specifically in the beverages sector, was generally a baby boomer (born between 1946 and 1964) with a postgraduate degree, income level at or above $100,000 per year and single with no children,” he says. “Most of these consumers lived in large cities.

By contrast, with the onslaught of the pandemic, younger millennials (born 1990-1996) and Gen Zers (born 1997 and after) started to make more beverage purchases online, especially premixed cocktails, he notes.

“Male consumers between the ages of 25 and 34 who have completed some college, and female shoppers between the ages of 18 and 24, also began to spend more dollars purchasing beverages online,” Jackson says. “In addition, there was a decrease in non-city-based consumers.”

Nevertheless, consumers younger than age 34 are expected to make up the largest portion of online shoppers with consumers between 35 and 54 following close behind. Consumers in these age groups are generally more comfortable using eCommerce and online payments than older demographics, according to IBISWorld’s Thomas.

“Consumers aged 55 and older are expected to have increased their use of eCommerce during the pandemic due to social distancing regulations and the temporary closures of brick-and-mortar stores,” she explains. “Prior to the pandemic, this age group was generally more resistant to online shopping, however, the pandemic is expected to shift the preferences of consumers in this demographic.”

As time passes, it looks like consumers across numerous demographic backgrounds will be engaging with eCommerce.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!