Beverage market a bright spot for supermarkets channel

Alcohol drinks, cocktail mixes post strong gains

Comprising 46 percent of the retail share, traditional supermarkets remain the largest channel in the retail food industry; however, Jon Hauptman, senior director of retail at Long Grove, Ill.-based Willard Bishop Co., an Inmar analytics company, notes that dollar sales in the channel have been flat as more consumers shop at supercenters, fresh-format stores, dollar stores and online. Yet, sales of alcohol and non-alcohol beverages have contributed to a more than 6 percent increase in the channel versus a year ago, Hauptman adds.

“In 2015, the supermarket channel grew 1.2 percent, and we can expect growth in 2016 to be even lower, i.e., at best flat due to price deflation,” Hauptman says. “Carbonated beverages are the foundation stone of the beverage business, comprising approximately half of center-store beverages. However, the bottled water and functional beverage categories are quite large and growing rapidly.

“Bottled water growth is being fueled by new product innovation, e.g., new flavored sparkling waters, etc.,” he continues. “Functional beverage growth is being driven by the continued popularity of energy drinks and the expansion of enhanced waters.”

In the grocery channel, the non-alcohol beverage market accounts for 11 percent of dollar sales, alcohol beverages account for 7 percent of sales, while general food, the largest department, accounts for 33 percent of the channel’s sales, notes Susan Viamari, vice president of Thought Leadership at Information Resources Inc. (IRI), Chicago, Ill.

“Key trends include home-based eating/drinking, healthier-for-you functional beverages … and more desirable attributes, such as vitamins/fruits/minerals; satiation (protein-touting, fiber, etc.) on-the-go; quick-and-easy; [and] flavor excitement (ethnic flavors, unexpected flavors),” she says.

Chicago-based Euromonitor International’s Research Analyst Eric Penicka also points to this trend. “Supermarket total sales are expected to have grown by 2.3 percent in 2016, with $371 billion in [U.S.] sales, following growth of 1.2 percent in 2015,” he says. “Alcoholic drinks made strong gains in the supermarket channel with 6.3 percent growth in 2015 and a forecasted 2.7 percent growth in 2016. Soft drinks in supermarkets grew 2.5 percent and 1.9 percent in 2015 and 2016, respectively, while hot drinks in the channel grew 6 percent and 0.3 percent.”

In its September 2016 “Supermarkets & Grocery Stores in the US” report, Los Angeles-based IBISWorld notes that “beverages constitute about 16.1 percent of revenue in 2016, and include both alcoholic and non-alcoholic drinks. Carbonated beverages, followed by beer and wine, were the most popular by unit sales in 2015.

“Due to an increasingly health-conscious customer base, soda sales declined as a share of revenue in the past five years,” the report continues. “Also, the demand for sugary beverages, such as fruit juices and drinks, has waned due to health concerns. For example, refrigerated fruit juices and drinks sales were down 2.3 percent in 2015. To counteract the falling demand for sugary beverages, healthier drinks, such as lightly sweetened iced tea and kombucha, helped maintain this segment’s performance.”

In its May 2016 “The Future of Food Retailing” report, Willard Bishop identifies that there were 26,223 traditional supermarkets that generated $467.8 billion in annual sales and weekly store sales of $343,042 in 2015. However, the overall number of stores decreased 1 percent primarily due to A&P going out of business and Safeway’s divestitures, it adds.

“Traditional supermarket retailers that had relatively high sales increases in 2015 included Bozzuto’s, Brookshire Brothers, Wakefern Food Corporation, Hy-Vee and Walmart Neighborhood Markets,” it states.

Because traditional supermarkets boast an average of 45,000 SKUs and can offer additional services, they offer consumers diversity and the largest number of products from which to choose, according to the report.

Beverage outperforms total store

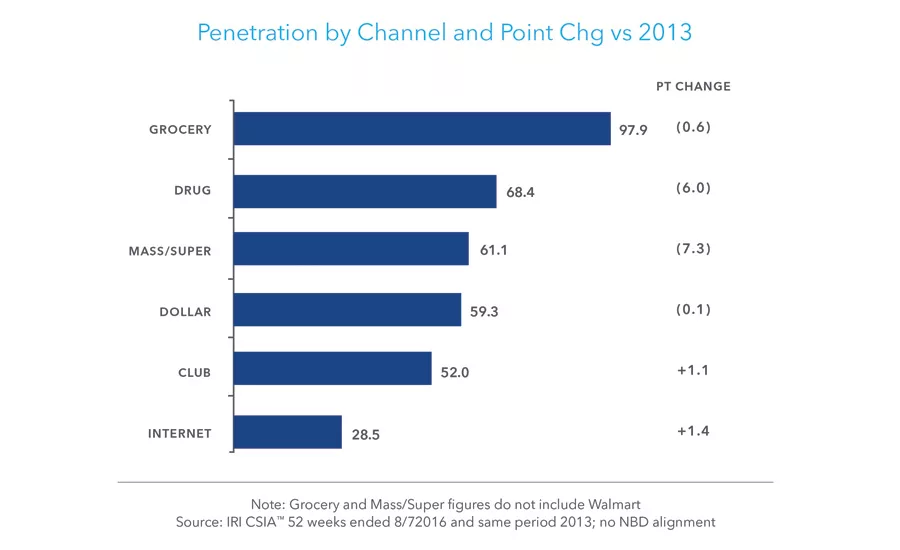

Despite the breadth of products offered, supermarket penetration dipped during the past year, driven by a rise in club and eCommerce penetration as well as consumers’ shift toward stores with a smaller footprint, like drug stores and dollar stores, according to IRI’s Viamari.

“Supermarket unit sales have been flat during the past year, while dollar sales increased 1 percent,” Viamari says. “Increases were driven by an increase in premium products (driving average price up) and some cuts in promotional activity across big categories. As a point of comparison, industry units increased 0.5 percent and dollars increased 1.9 percent.

“… During this time period, the beverage sector outperformed total store,” she continues. “In grocery, beverage units [were] plus 1.1 percent and dollars [were] plus 2.1 percent. The top-performing categories are energy drinks (units plus 9.1 percent; dollars plus 8.6 percent); bottled water (units plus 7 percent; dollars plus 8.5 percent); and ready-to-drink [RTD] coffee/tea (units plus 6.5 percent; dollars plus 8.1 percent). Growth in these categories is being driven by premiumization — new flavors, new benefits, new packaging, etc. — expanding benefits beyond simple thirst quenching … to delivering against sought-after benefits, such as nutritional enhancement, workout recovery and energy enhancement.”

Because of consumers’ interest in in-home entertaining, “cocktail mixes is experiencing good growth (units plus 4.4 percent; dollars plus 4.7 percent) due to consumer interest in new and exciting alcoholic beverage solutions (e.g., Barefoot Refresh premixed cocktails and coolers),” Viamari adds.

Additionally, RTD coffee and tea both have performed well in supermarkets when compared with other beverage categories, partially because of their lucrative nature in all channels, Euromonitor’s Penicka notes. “Specific sub-segments, like cold brew and kombucha, have been growth drivers, allowing early adopters like Whole Foods to benefit,” he explains. “Alcoholic drink sales in supermarkets are already growing faster than supermarkets as a whole. … Soft drinks in supermarkets, however, lag the soft drink category as a whole, despite growing on par with the supermarket channel.”

To boost sales, beverage-makers could adopt a similar approach to the one employed with alcohol drinks in the supermarkets channel — premiumization, Penicka says. “Part of the struggle on the part of supermarkets is the large role carbonates play, [which is] a struggling soft drink segment,” he explains. “Supermarkets would be able improve soft drink sales with the adoption of more niche and premium products.”

Just-in-time shopping

In IRI’s September 2016 “Times and Trends” report titled “The Omnichannel Journey: Translating Big Data into a Prescription for Growth,” the market research firm notes that the grocery industry is in the midst of an omnichannel revolution, with struggling sales driven by the rise of just-in-time shopping, the growth of smaller footprint stores, the growth of eCommerce shopping and shoppers spending money across more channels and store formats.

“Quick trips — those ‘I need it now’ grocery excursions — account for two-thirds of shopping visits and just over one-third of the grocery expenditures,” the report states. “At a macro level, quick-trip share of the country’s estimated 20 million grocery shopping excursions has remained fairly steady. Still, an important shift is occurring under the surface. Shoppers’ approach to fulfilling their grocery needs is quickly evolving and just-in-time shopping has already become the norm. Shoppers are increasingly spreading their dollars across more channels and store formats.”

Understanding the growth trends can be key to determining market dynamics, particularly because eCommerce is having a transformative effect on the grocery industry, experts note.

“Ecommerce is the fastest growing channel in the retail food industry, growing 20 percent per year, albeit off a very small base,” Willard Bishop’s Hauptman says. “This has caused traditional supermarket operators to look for ways to enter the ‘brick-and-click’ business or refresh their current eCommerce processes. The challenge is that eCommerce is not a profitable endeavor for traditional supermarkets, so they’re aggressively looking for ways to enhance efficiencies while doing an even better job of serving and satisfying the shopper.”

A focused approach

To succeed in a changing, complex landscape, retailers must undergo a major cultural shift while tapping into the wealth of knowledge made possible through store loyalty programs and advancements in technology and analytics, IRI’s Viamari says.

“To compete, retailers and beverage manufacturers need to take a really focused approach to assortment and pricing — getting the right products on the shelf to ensure that attributes appeal to the target market and there are options for everyone at a price each consumer is willing to pay,” she says. “This means going beyond ‘standard’ assortment/pricing to ensure that each banner and each location is considering their core customers. Even within the same banner, different store formats require different packages [and] different geographies require different product assortments and pricing.”

Another way to achieve success is to position coolers and shelves near checkout counters rather than in the more traditional soft drink aisle, Euromonitor’s Penicka says.

“Americans are increasingly curious consumers, happy to splurge on an unfamiliar product,” he says. “Such position can have the ability to pique interest in consumers who may not typically dawdle in the presence of unfamiliar products. Basically, all drink trends impact the supermarket channel, either positively or negatively.

“The largest negative is the amount of shelf space designated to carbonates … as health remains a [fast-moving consumer goods] (FMCG) trend,” he continues. “… Consolidation on the part of manufacturers, a notable trend in itself, however, has eased the ability of supermarkets to do business with smaller brands as they fall into the distribution wheelhouse of already familiar companies.”

IRI’s Viamari notes that the supermarket sector will continue to face pressures as competition for share of stomach intensifies and eCommerce disrupts the evolution of the consumer packaged goods industry.

“To grow in this environment, grocers need to stay in lockstep with the evolving needs, wants and behaviors of their customers,” she says. “They need to invest to understand how eCommerce is interacting with the brick-and-mortar world, which is hugely important and not well understood by most grocers at this point. They will need to develop eCommerce strategies that ensure their place in the digital future.” BI

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!