2016 State of the Industry: Bottled water market has potential to surpass CSDs

Sparkling and enhanced waters drive category growth

Today, consumers are choosing bottled water more often for its natural and healthy attributes. The International Bottled Water Association (IBWA), Alexandria, Va., and Beverage Marketing Corporation (BMC), New York, recently released 2015 bottled water statistics showing that Americans’ consumption of bottled water increased by 7.9 percent and bottled water sales were up 8.9 percent from the previous year. BMC indicates that the category will overtake carbonated soft drinks (CSDs) as the largest beverage category by volume by 2017, if not by the end of 2016, it says.

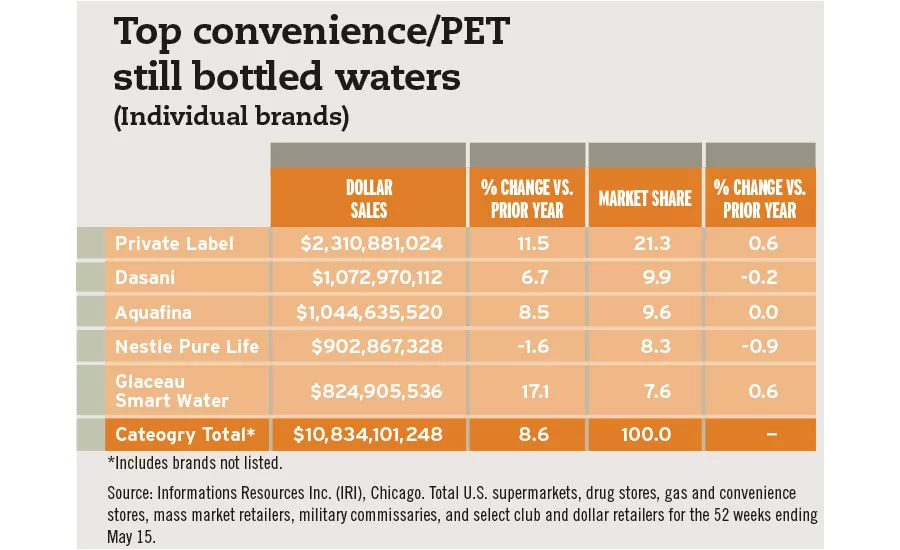

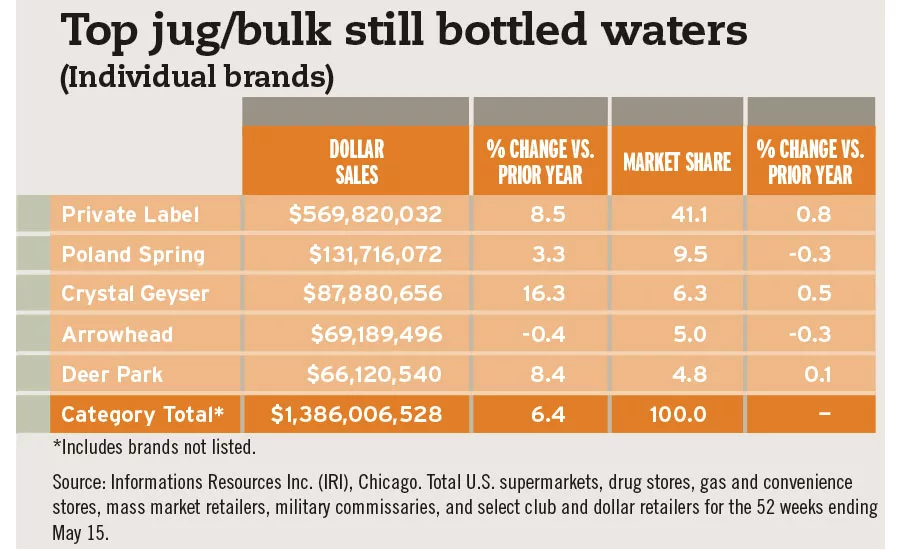

This is in line with Chicago-based Information Resources Inc.’s (IRI) data, which indicates that the bottled water category as a whole is up 9.3 percent year-to-date, for $14.2 billion in the 52 weeks ending May 15 in U.S. supermarkets, drug stores, gas and convenience stores, mass market retailers, military commissaries, and select club and dollar retailers.

Experts say health-and-wellness trends are one factor driving many consumers toward bottled water, specifically flavored bottled water, as an alternative to CSDs. “Continued consumer concern over the high sugar content of regular carbonates has consumers seeking healthier alternatives, oft presented by the bottled water categories. In the case of low-calorie carbonates, where artificial sweeteners are present, consumers are drawn to unsweetened or very lightly, naturally sweetened waters,” explained Eric Penicka, research analyst for Chicago-based Euromonitor International, in the October 2015 issue of Beverage Industry.

He added that this also is driving consumption of sparkling waters. “The aforementioned aversion to high sugar content and artificial sweeteners in soft drinks of all types is benefiting all waters nicely; however, carbonated waters continued to fare particularly well, as consumers find sparkling water a compelling value-added trait over bottled water,” Penicka said.

IRI data notes that the sparkling/mineral bottled water segment has experienced a 15.5 percent increase in sales year-to-date for the 52 weeks ending May 15, bringing sales to nearly $2 billion for the segment.

In line with this, Mintel’s March 2016 “Bottled Water – US” report notes that while hydration and overall health are the main drivers of bottled water consumption, nearly one-third of bottled water consumers drink it as an alternative to less healthy beverages. “Sparkling water in particular, offers a carbonated mouthfeel similar to soda, which may attract those looking for the familiar fizzy sensation without the calories,” the report states.

It also notes that unflavored, enhanced still bottled waters accounted for approx-imately 30 percent of bottled water pur-chases, according to the company’s survey of 2,000 internet users ages 18 and older.

IRI data indicates that it is the largest segment of the category, raking in $10.8 billion for the 52 weeks ending May 15, an 8.6 percent increase from the previous year.

The category does face a few changes though, including sustainability concerns related to bottled water's packaging, experts report.

But the category is innovating past this obstacle in several ways, including a move toward aluminum cans. According to Mintel’s July 2015 Product Innovation report titled “Cans can take added value bottled water to the next level,” aluminum cans are growing as a packaging alternative for water.

According to the IBWA, the bottled water industry is utilizing a variety of measures to continue reducing its environmental impact. All bottled water containers are 100 percent recyclable, and many bottled water companies already are using recycled plastic in their bottles, it says.

Regardless of these concerns, Mintel notes in its “Bottled Water” report that this concern is not impacting sales. BI

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!