2017 Beer Report: Imported beers outperform other beer segments

Mexican beers outpace import segment

The trades taking place on Wall Street often can come with a sense of urgency and anxiety for brokers and their respective clients. However, consumers also are opting to “trade up” when it comes to their beer selection. With its premium positioning and a price point that typically is less than their craft counterparts, imported beers have seen case and dollar sales increase in the past year, analysts note.

“Imports fall into an interesting price point, where they benefit from the ongoing premiumization trend, but typically are priced slightly lower than a craft beer,” says Danelle Kosmal, vice president of beverage alcohol practice for New York-based Nielsen. “It’s an interesting competitive space for them.”

Among all the beer segments, imported beers performed the best with volume up 6.8 percent and dollar sales up 9.1 percent in Nielsen-measured off-premise channels for the 52 weeks ending Dec. 31, 2016. Mexican imports outpaced the segment by posting growth of 10.9 percent in volume and 13.8 percent in dollar sales during that timeframe.

“Nearly all Mexican import beer brands had strong growth rates in 2016, with some still growing at strong double-digit rates,” Kosmal says.

Brian Sudano, managing partner with New York-based Beverage Marketing Corporation (BMC), attributes the strong performance of Mexican beer brands to several factors. “This has occurred for many reasons that include superior marketing and brand positioning, demographics and more contemporary brand positioning along with marketing focus and support,” he says. “Constellation [Brands] has truly driven this segment through its consistent messaging, execution and singular focus against its Mexican beer portfolio.”

To help support the growth of its Mexican beer business, Victor, N.Y.-based Constellation Brands Inc. entered into an agreement to purchase a brewery operation in Obregon, Mexico, from Grupo Modelo, a subsidiary of Anheuser-Busch InBev, Leuven, Belgium.

The acquisition of the Obregon brewery allows Constellation to obtain functioning brewery capacity to support its fast-growing, high-end Mexican beer portfolio and provides flexibility for future innovation initiatives, it says. Constellation also will phase the buildout of 10 million hectoliters at Mexicali, with the first 5 million hectoliters of production capacity expected to become operational by December 2019, with subsequent capacity increases planned to align with future growth, it adds.

White Plains, N.Y.-based Heineken USA also has been leveraging the assets of its Mexican brands through marketing and advertising campaigns. Last year, it announced that Tecate embarked on a partnership with Golden Boy Promotions to serve as a presenting sponsor. In line with that partnership, Golden Boy and ESPN announced a multi-year agreement for a series of fights to be televised on ESPN@ and ESPN Deportes with Tecate as the presenting sponsor for the series.

Although Mexican imports experienced the strongest growth, Belgian beers also had a strong year as they grew 9.8 percent in case volume and 10.1 percent in dollar sales for the 52 weeks ending Dec. 31, 2016, in Nielsen-measured off-premise channels.

However, imported beers also performed well in the on-premise channel, Kosmal notes. For the 52-week period ending Dec. 3, 2016, imports were the fastest-growing segment in the beer category within on-premise, she says. According to Nielsen data, volume was up 3.7 percent and dollar sales were up 5 percent.

Going forward, analysts expect that the imported beer segment will continue to be a leading growth driver for the overall beer category. “[I]mported beer with the combination of premium, variety of brands/experiences and authenticity will lead the beer market,” BMC’s Sudano says. BI

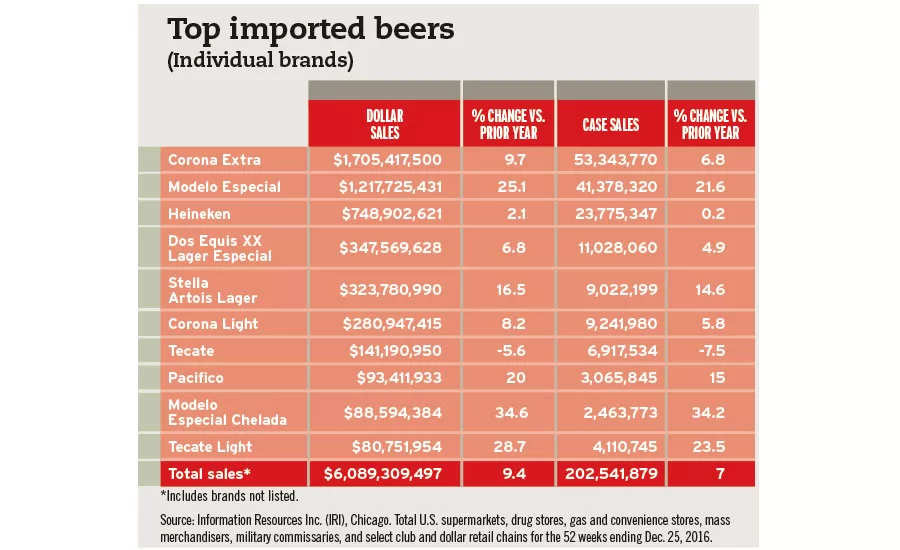

Top imported beers

(Individual brands)

| Corona Extra | $1,705,417,500 | 9.7 | 53,343,770 | 6.8 |

| Modelo Especial | $1,217,725,431 | 25.1 | 41,378,320 | 21.6 |

| Heineken | $748,902,621 | 2.1 | 23,775,347 | 0.2 |

| Dos Equis XX Lager Especial | $347,569,628 | 6.8 | 11,028,060 | 4.9 |

| Stella Artois Lager | $323,780,990 | 16.5 | 9,022,199 | 14.6 |

| Corona Light | $280,947,415 | 8.2 | 9,241,980 | 5.8 |

| Tecate | $141,190,950 | -5.6 | 6,917,534 | -7.5 |

| Pacifico | $93,411,933 | 20 | 3,065,845 | 15 |

| Modelo Especial Chelada | $88,594,384 | 34.6 | 2,463,773 | 34.2 |

| Tecate Light | $80,751,954 | 28.7 | 4,110,745 | 23.5 |

| Total sales* | $6,089,309,497 | 9.4 | 202,541,879 | 7 |

*Includes brands not listed.

Source: Information Resources Inc. (IRI), Chicago. Total U.S. supermarkets, drug stores, gas and convenience stores, mass merchandisers, military commissaries, and select club and dollar retail chains for the 52 weeks ending Dec. 25, 2016.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!