With its ability to deliver consumers the taste of exotic brewing styles, imported beers have served as reliable segment in the U.S. beer market that helps deliver dollar sales due to its premium price point. However, imported beer also has become a key contributor in terms of volume performance.

“Imported beer and craft beer are the only segments projected to avoid volume losses in 2020, and even see gains through 2023,” states Chicago-based Mintel in its November 2020 report “Beer: Incl Impact of COVID-19 – US.”

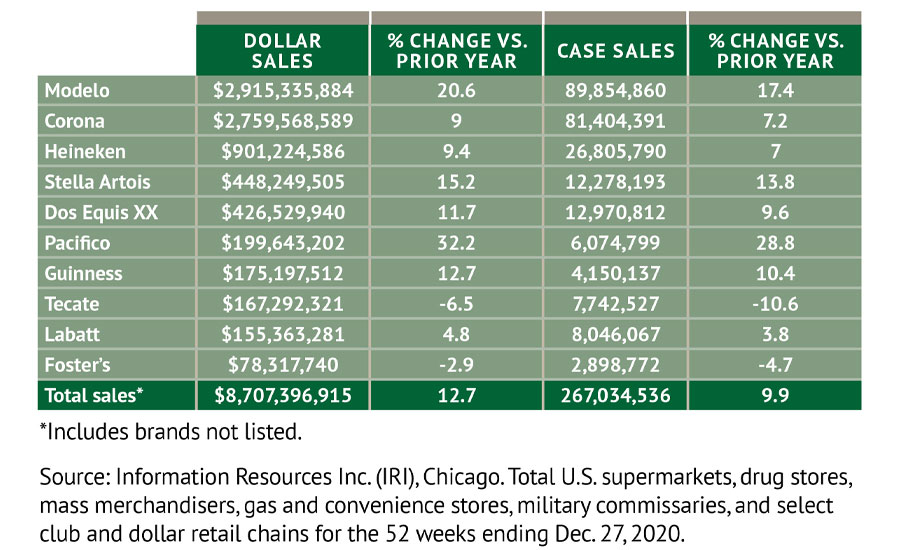

According to Chicago-based Information Resources Inc. (IRI), import beer sales totaled $8.7 billion in total U.S. multi-outlets, a 12.7 percent increase, for the 52 weeks ending Dec. 27, 2020. Case sales also were up 9.9 percent during that timeframe.

Danelle Kosmal, vice president of beverage alcohol practice for Chicago-based NielsenIQ, notes that prior to the pandemic, Mexican import beers had been a growth driver for the U.S. beer market. However, that shifted as the pandemic’s impact on imports progressed.

“[D]ue to inventory and out-of-stock challenges, the segment’s growth slowed during the pandemic months of 2020, losing 0.4 share points compared to those same months in 2019,” she says.

Nathan Greene, consulting analyst for New York-based Beverage Marketing Corporation (BMC), also notes the mixed results that the import beer segment experienced in 2020.

“Total U.S. Import Beer shipments saw near flat performance in 2020, with total volume growth of 0.3 percent, a slowdown from 1.8 percent growth in 2019,” he says. “Mexican import performance suffered dramatically in the middle quarters of the year, yet came back strong to achieve full year 2020 volume growth of 2.6 percent, compared with plus-2.9 percent.

“Imports from the Netherlands (driven by Heineken) outperformed, growing 10.8 percent compared with a decline of 5.3 percent in 2019,” Greene continues. “However, beyond the top two sources of imports, the vast majority of other countries saw declines and underperformance to 2019.”

BMC’s Managing Partner Brian Sudano adds that the unpredictability of the pandemic had consumers turning to familiar brands, which helped major players in the import beer segment.

“Bigger brands like Heineken have returned to growth as consumers seek reliable brands to consume at home,” he says. “With craft beer struggling due to on-premise restrictions, imported beer has benefited as consumers continue to seek high-end products. Modelo Especial continues to be the best-selling imported beer and is now a Top 5 U.S. beer brand.”

To adjust to consumers’ increased at-home beer consumption as well as affection for reliable brands, imported beer brands innovated around packaging.

For instance, Dos Equis Lager, a brand of White Plains, N.Y.-based HEINEKEN USA, now is available in a 5-liter draft keg format. By expanding the draft experience outside of bars and restaurants, consumers can enjoy the experience of an ice-cold Dos Equis Lager in the safety and comfort of home, or anywhere beer drinkers gather, the company says. The new format is available in Texas and is expected to roll out to additional markets this year.

“On average, a Dos Equis consumer spends four to six times more per serving on a draft beer versus a can or bottle purchased off-premise,” said Adam Jaskol, senior brand manager for Dos Equis, in a statement. “The new 5-liter keg offers consumers the same draft they love at a fraction of the price and brings highly incremental shoppers into retail.”

Like other beer segments, import beer brands also are taking steps to align with consumers health-and-wellness goals.

In January, Corona Premier, a brand of Victor, N.Y.-based Constellation Brands, expanded its partnership with connected fitness leader Echelon Fitness to support consumers of every fitness level on their personal fitness and wellness journey and motivate them to “Earn Their Crown.” Corona Premier joined forces with Echelon to amplify its wellness offerings to their consumers, helping them stay motivated at the start of the new year, the companies say.

Corona Premier and Echelon hosted a six-week wellness content series, providing consumers with the tools and community they need to reinvigorate their fitness journeys. The series includes custom workout videos, weekly giveaways, and weekly virtual happy hours to celebrate milestones and keep consumers motivated, the companies say.

“This partnership with Echelon is a natural fit for the Corona Premier brand,” said Ann Legan, vice president of brand marketing for Corona, in a statement. “The ‘Earn Your Crown’ content series provides our audience with a variety of accessible fitness and wellness content and celebrating their successes with a Corona Premier ― the perfect cerveza to enjoy ‘La Vida Más Fina.’”