Sparkling wines, red wine blends fastest-growing segments

Millennials drive category growth

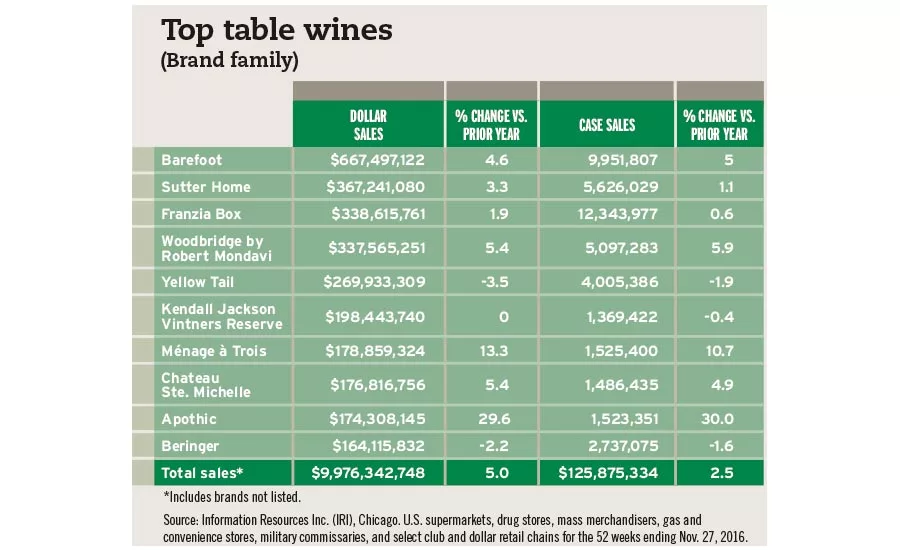

Capping several years of steady, modest growth for both domestic and import wines, the wine market in the United States continues to grow, experts note. Fueled by consumers’ interest in fine wine and increased product launches, the market has grown “at mid-single-digit rates on dollars [and] smaller single-digit rates on volume as consumers continue to trade up to more expensive wines,” says Danny Brager, senior vice president of beverage alcohol for New York-based Nielsen. “Sparkling wines in particular continue to grow dynamically at double-digit rates.”

Susan Viamari, vice president of Thought Leadership for Chicago-based Information Resources Inc. (IRI), also points to this trend. “The wine market is on a positive growth trajectory during the past several years. Imported wines outpaced domestic through 2015 and the first half of 2016,” Viamari says. “Dollar sales in 2016 increased 5.9 percent [for] domestic and 4.4 percent [for] imported. In 2015, domestic grew 8 percent and imported grew 6.2 percent.

“Consumers are trading up to higher-end wines, with higher-end table wines ($11 plus) performing well,” she continues. “Table wines priced at $20 plus have seen growth pick up versus year-ago trends. Sparkling wine is also showing strong growth trends (plus 11.2 percent). Performance is outpacing still wine (plus 4.2 percent), but both have seen growth decelerate versus [the] prior year.”

The wine industry experienced a compound annual growth rate (CAGR) of 1.9 percent from 2011 to 2016, according to Los Angeles-based IBISWorld’s April 2016 “Wineries in the US” report. However, the market research firm predicts that the wine industry will grow at a slower pace throughout the next five years.

“Revenue will increase at an annualized 0.1 percent to $18.4 billion, including projected growth of 0.3 percent in 2017,” the report states. “Exports are expected to grow an average [of] 4.0 percent per year to $2.2 billion, while imports are expected to grow an average of 4.4 percent per year to $9.2 billion.”

Experts note that 70 percent of wine is domestically produced in California, Washington state and Oregon, while Italy and France are the top wine importers by volume. However, importers are facing increased competition from other regions as well, according to Chicago-based Euromonitor International’s June 2016 “Wine in the US” report.

“These key wine-producing countries continue to feel competition from countries in the Southern hemisphere, such as Chile, Argentina and Australia, whose imports primarily comprise value wines; however, wines imported from New Zealand and South Africa are highly regarded,” it states.

Among U.S. produced wines, California and Florida account for the largest domestic table wine market share based on total dollar sales and were up 1.8 percent and 6.6 percent, respectively, says IRI’s Viamari, citing the company’s 2016 Wine Mid-Year Review. “Despite the size of these markets, other areas of the country are showing solid momentum,” she adds. “For example, Michigan, much smaller by sales, experienced significantly higher growth at 10 percent.”

Steve Slater, executive vice president and general manager of the wine division at Miami-based Southern Glazer’s Wine & Spirits, notes the “exceptional and abundant” production of wine in California, Washington and Oregon from the past five vintages.

“A five-year run of stellar vintages is unprecedented in recent history,” Slater says. “It has provided a rich buying market for consumers to choose from. Imported wines have also been made more widely available in the U.S. market as a result of shrinking consumption in their home markets.”

In the past five years, the Miami-based distributor says its mix of wines produced in the United States has been hovering around 65 percent.

Regardless of the country of origin, wine is being consumed by both men and women for its perceived health benefits, experts note. Virtually every consumer demographic, including millennials, baby boomers and seniors, is partaking of wine, they add.

Yet, millennials, who have shown a preference for higher-quality goods, are driving the premiumization of the category, according to Euromonitor’s report.

“The growing millennial generation group has joined and influenced the alcoholic drinks market with new, eager consumers, who are fast becoming trendsetters and main drivers of growth in the wine category,” it states. “They are gradually increasing their wine consumption and tend to consume with increased frequency, trading up to more premium wines.”

Rise of the red blends

Eric Schmidt, director of alcohol research at New York-based Beverage Marketing Corporation (BMC), notes that the wine market’s consistent growth can be attributed to a bevy of different factors, including consumer trial of wines from different locales and varietals.

“Cabernet Sauvignon, red blends [and] Pinot Grigio have led the way,” he says. “Domestic wine accounts for approximately 75 percent of all wine consumed, [and] California accounts for a large portion but there has been an increase in consumption from Oregon and Washington state.

“Yellow Tail remains the largest imported wine by volume, although its volumes have slowed over the past couple of years,” Schmidt continues. “There have been pockets of growth from wines from Italy, New Zealand and South Africa. Consumers continue to want to discover new wines from different, unique locales.”

Consumers also have an increasingly wide array of varietals from which to choose. At 26.4 percent, Chardonnay is the No. 1-selling wine; followed by Zinfandel, Riesling and other blends at 19.8 percent; Cabernet Sauvignon at 19.4 percent; Merlot at 10.8 percent; Pinot Grigio at 10.3 percent; Pinot Noir at 7.6 percent; and Sauvignon Blanc at 5.7 percent, IBISWorld's report states.

In terms of popularity and market share, Nielsen’s Brager notes the top wine varietals are Chardonnay, Cabernet Sauvignon, Pinot Grigio/Gris, Pinot Noir, Merlot, Sauvignon Blanc and Moscato. White Zinfandel, Malbec, Riesling, Zinfandel and Shyrah/Shiraz have captured between 1 and 2.5 percent of market share. However, red blends have become a major factor in the marketplace, accounting for 12.3 percent of market share, he adds.

“This is likely impacting the growth of some individual red varietals,” he explains. “In terms of growth, leading the way are these red blends as well as Sauvignon Blanc (both in double-digit growth territory) in the last year, followed by Pinot Noir and Cabernet Sauvignon.”

Experts note that sangrias, wine blends and flavorful sweet wines continue to show growth. The industry also is seeing more soft red blends, powerful Cabernets and a growing interest in the many styles and offerings of Pinot Noir from around the world, they add.

A demand for bubbles

Although red blends and other varietals have benefited from recent growth, sparkling wines remained the fastest-growing wine segment in 2015, notes Chicago-based Euromonitor International’s Research Analyst Eric Penicka.

“Growth in sparkling wines continues to stem from non-Champagne wines, most identifiably Prosecco. The lower unit price of other sparkling wines has allowed them to become an everyday luxury in a way [that] has been cost-prohibitive for many consumers to do with Champagne,” Penicka says. “Sparkling wine will maintain its position as the fastest-growing wine segment, experiencing a forecast period CAGR of 5 percent, as consumer interest in bubbles persists.

“Whilst Italian Prosecco has attracted the most attention over the past several years, consumer interest in other sparkling wines is expected to expand to sparkling wines from other regions, particularly so for California,” he continues. “Champagne is also expected to perform quite well in the years to come, as consumers return to the traditionally luxury product alongside rising consumer sentiment.”

BMC’s Schmidt also points to this trend. “A category that continues to outperform the market is sparkling wine, both U.S. sparklers and ones from abroad, including Champagne, Cavas and Proseccos.”

In addition to consumers flocking to sparkling wine, the category also has been influenced by other trends. "Slow but steady channel shifts from the on-premise to the off-premise has been ongoing,” Southern Glazer's Slater says. “The trends are leaning more toward more approachable wines with a New World style. Packaging continues to be important as shelves fill with wines from all over the planet. … [I]t has to be identifiable on a shelf.”

Boosting accessibility

In order for wine to maintain its growth, experts note the importance of approachability. According to Chicago-based Mintel’s November 2016 report “Wine,” making wine more approachable could further boost sales.

More than half of wine buyers consider themselves beginners and are intimidated by the wide range of offerings, according to a Lightspeed/Mintel survey of 1,167 Internet users aged 22 and older who have purchased wine in the six months prior to the survey.

“While wine consumers fall into a broad spectrum of age ranges, half consider themselves to be beginners,” it states. “… Only one in five wine buyers says industry terms give them a clear idea of what the wine will taste like, and a higher 36 percent of buyers prefer when basic words are used to describe the taste (e.g., sweet, spicy, grapefruit).

“This suggests the category could use some simplification to boost accessibility [particularly with] women and baby boomers,” the report continues.

Both Euromonitor’s Penicka and Nielsen’s Brager note that packaging also can further influence wine-buying decisions.

“Wine packaging has moved dramatically over the past decade, both in label design and pack-type used,” Penicka says. “As is visible with craft beer, wine brands are seeking differentiation through eye-catching, modern label designs, which are completely at odds with traditional, low-key labels. Consumer demand for single-serve and on-the-go packaging has allowed unconventional packaging, like Tetra Paks, to flourish.”

Brager adds: “[S]ince wine doesn’t spend as much on advertising/media as compared to beer and spirits, wine brands need to differentiate themselves in other ways.” Label designs and innovative packaging formats for that category such as cartons and cans are among the ways that brands are accomplishing this,” he says. Beyond packaging, wine brands will employ tasting events or promotional campaigns in store and online as well as various pricing strategies, Brager notes.

“We’d expect the market to continue to grow … and encourage consumers entering legal drinking age to drink wine in the face of heightened competition from beer and spirits,” he says. “At the same time, history has shown that as consumers age, they often turn to wine, and given the growth of the senior population in the U.S., that should benefit wine more than the other adult beverage categories.”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!