Key findings from the eighth annual Most Memorable New Product Launch Survey show Americans had more memorable experiences with fast food launches than with technology, toys or personal care products. McDonald’s McCafé specialty coffee drinks landed No. 2 on the list of most remembered products by consumers. The survey, conducted by Schneider Associates, IRI and Sentient Decision Science, reversed a two-year trend where technology has dominated the top ten.

This year, five quick-service restaurant favorites reached the top spots – three of them considered “premium” offerings that fit into the survey’s “Migration Marketing” trend: products encouraging consumers to “trade up” or “down” in a recessionary marketing environment, the researchers said.

While 93 percent of respondents could not name one new product launch from the list of 50, the majority who did, an overwhelming 40 percent, recalled KFC’s Grilled Chicken launch in April of 2009, which involved Oprah Winfrey in a national, free grilled chicken promotion. Other key data shows most Americans (66 percent) watch television and surf the Web simultaneously.

“2009 was the year of comfort food and small indulgences,” said Julie Hall, executive vice president and partner at Schneider Associates, in a statement. “This past year, real estate values plummeted, massive corporations failed, the stock market was in freefall, our government was managing bailouts, and there were continued job losses. The economy is improving now, but looking back, it’s no surprise people donned Snuggies and tried new and premium fast food offerings.”

In the Most Memorable New Product Launch Survey, consumers were given a list of 50 new product launches from the past year, and most surveyed commonly remembered: 1. Kentucky Grilled Chicken (40.1 percent); 2. McDonald’s McCafé (29.6 percent); 3. Beatles: Rock Band (18.3 percent); 4. Snuggie (17.7 percent); 5. Blackberry Storm (13.2 percent); 6. Quizno’s Torpedo (12.9 percent); 7. McDonald’s Angus Deluxe (12.6 percent); 8. Taco Bell Volcano Nachos (10.7 percent); 9. T-Mobile Google G-1 Phone (7.3 percent); and tied at 10. Samsung LED TVs (6.9 percent) and Off Clip-On (6.5 percent).

“Across several key CPG categories, premium tier products are driving growth despite recessionary economic conditions,” said Char Partelow, consumer product goods consultant at IRI, in a statement. “Consumers take solace in home-based dining and entertainment. They’re indulging without breaking the bank.”

According to Aaron Reid, chief behavioral scientist at Sentient Decision Science, "One of the most remarkable findings of the research is the pervasiveness of being actively online while watching television. The data represents a new statistic in the survey that will be a key trend to watch in years to come. Furthermore, 85 percent of people who are online while watching television have searched for something they just saw, a significant shift in the information flow. The resulting social media conversation is substantially influential."

This year, the Most Memorable New Product Launch Survey uncovered important consumer data, which could indicate new trends, including the following 2009 data:

• Income loss is pervasive with nearly one-half of respondents (44 percent) experiencing a reduction. Contrary to traditional thinking, this group was more likely to purchase new technology and food products, and to be early adopters.

• Avoidance of commercials using a TiVo or DVR nearly doubled from 2008 (38 percent vs. 22 percent).

• Women are significantly more likely than men to recommend new products to friends and family, and take recommendations (58.8 percent vs. 45.3 percent, and 59.7 percent vs. 47.3 percent).

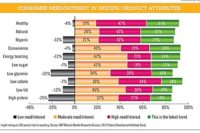

• Younger respondents (18 to 24 years old) are more influenced by “environmentally friendly” attributes than other age groups (68 percent vs. overall rating of 44 percent).

• Free samples (91.5 percent), recommendations from family and friends (81.2 percent), and coupons (71.6 percent) are the most influential sources of information for purchasing decisions, continuing a long running trend.

• Trusted brand names continue to be highly influential in affecting purchase (70 percent).

• Brand names are even more influential for retirement aged respondents (75 percent) and early adopters of technology products (78 percent).

• Most consumers surf the Web and watch television simultaneously (66 percent). Almost half (44 percent) do it very or extremely often. This group is also more likely to search for products seen in commercials (18 percent vs. 11 percent overall).

• Food product purchases are influenced by the absence of trans fats (69 percent) and high fructose corn syrup (41.8 percent), as well as low-salt content (32.4 percent).

• “Made in the USA” labeling was much less influential than in 2008, when foreign product recalls made news headlines (30.3 percent vs. 48 percent).

The online survey, conducted by Schneider Associates, Sentient Decision Science and IRI in October, polled 1,125 consumers age 18 and older, and uncovered data about factors related to awareness of new consumer product launches, including influential trends, media usage, purchasing behavior and the influence of personal finances. For more information on the survey, or to learn more about the results, visit www.mmnpl.com.