U.S. Bottled water market grows 6.4 percent in 2015

New Mintel research finds category drivers

As Americans look for better-for-you alternatives to carbonated soft drinks (CSDs), the U.S. bottled water category is reaching unprecedented heights, according to new research from Chicago-based Mintel, which reveals that sales of bottled water increased 6.4 percent to top $15 billion in 2015. The market research firm expects sales to continue ascending at a rapid pace through 2020, with projected sales growth of 34.7 percent for the category, including 75.1 percent growth for the sparkling/mineral water/seltzer segment, it says.

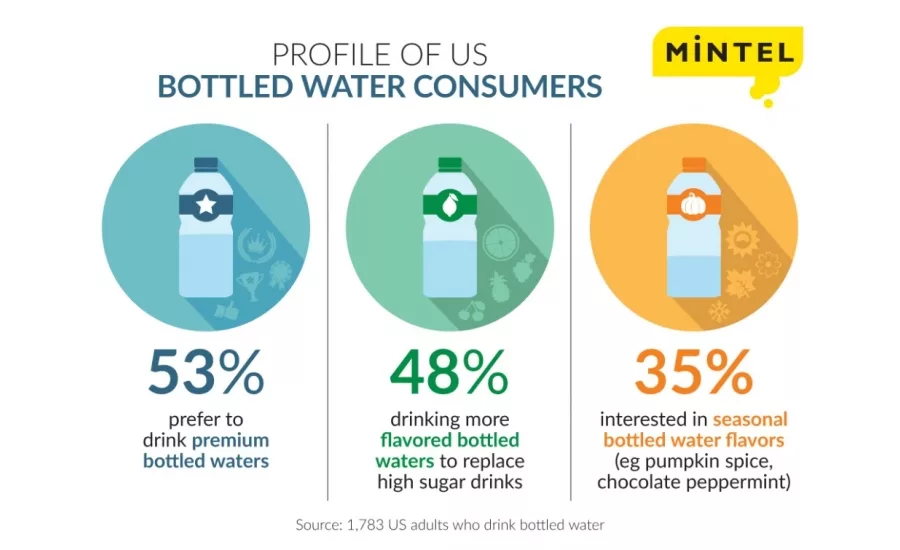

The market research firm notes that innovation in flavor is driving the category’s success, with nearly half, 48 percent, of bottled water drinkers saying they are drinking more flavored waters to replace high-sugar drinks. Consumption of flavored still bottled water is highest among consumers between 18-34 years old (66 vs. 48 percent of consumers overall), who also are the most likely age demographic to consume any still bottled water (93 vs. 85 percent of consumers overall), Mintel adds.

A wide range of interest also has emerged in functional attributes for bottled water, according to Mintel. More than two in five (43 percent) consumers are interested in bottled water enhanced with vitamins; another three in 10 agree that the ideal bottled water should contain minerals (29 percent) and energy (29 percent). When it comes to calorie counting, consumers show a clear preference for zero-calorie bottled water (31 percent) as opposed to less than 100 calorie offerings (13 percent), it adds.

The market research firm adds that two in five (43 percent) consumers say that the ideal bottled water would have no artificial sweeteners, artificial flavors (43 percent) or artificial colors (40 percent), and one-quarter of consumers report that their ideal bottled water would be GMO-free or organic (24 percent). The trend of increasing demand for organic food and drink options continues as Mintel research indicates 37 percent of consumers feel better about themselves when they buy organic foods and beverages, it adds.

“Bottled water brands benefit from the overarching consumer trend toward more healthful, better-for-you alternatives to unnatural and high-sugar drinks. This has spurred sales growth of bottled water with even greater projected growth over the next five years,” said Elizabeth Sisel, beverage analyst at Mintel, in a statement. “In the coming years, consumers will likely put even greater value on no artificial ingredients in bottled water. To capitalize on this trend, brands should emphasize free-from claims on packaging as they release new flavors and functions in order to engage the market’s most active consumers.”

Although consumers indicate that the overall top purchasing factor is price (62 percent), the majority of consumers are interested in premium offerings with more than half (53 percent) of bottled water drinkers preferring to drink premium bottled waters, the company says. Additionally, 39 percent of consumers agree bottled water is worth the added cost. However, there still remains some educating to be done as more than half (51 percent) of consumers are unfamiliar with premium water, it adds.

“While price is a major purchasing factor for many consumers, the majority gravitate toward premium water offerings despite its typically higher cost. To attract the more price-conscious consumer, brands should look to incorporate product messaging that justifies a higher price point, as well as communicate the health benefits and sophistication of premium products in order to alleviate any confusion,” Sisel added.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!