In college football, one of the most recognized rally chants can be heard from fans of the University of Alabama Crimson Tide as they cheer “Roll Tide.” Coming off an upset loss on the road to the Texas A&M Aggies during week four, Alabama rebounded with a dominate 49-9 win against the Mississippi State Bulldogs. Despite uncertainty in the market, there’s an all-time high of 8,764 craft breweries, suggesting that, like the Crimson Tide, the craft brewing industry is poised to rebound from last year’s devastating global pandemic that saw beer volume, retail dollars and jobs drop precipitously.

“2020 was obviously a challenging year for many small brewers, but also one that proved their resilient and entrepreneurial nature,” said Bart Watson, chief economist of the Brewers Association (BA), in a statement. “In a year where U.S. draught sales were down more than 40%, small brewers found new ways to connect with their customers and keep their businesses running.”

When the COVID-19 pandemic hit in March 2020, the beer industry, like the hospitality industry, restaurants, bars and taprooms, suffered dramatic declines in sales and jobs, particularly on-premise. In fact, the industry suffered one of its worst declines in the modern craft area, according to the Denver-based Brewers Association 2020 Annual Production Report.

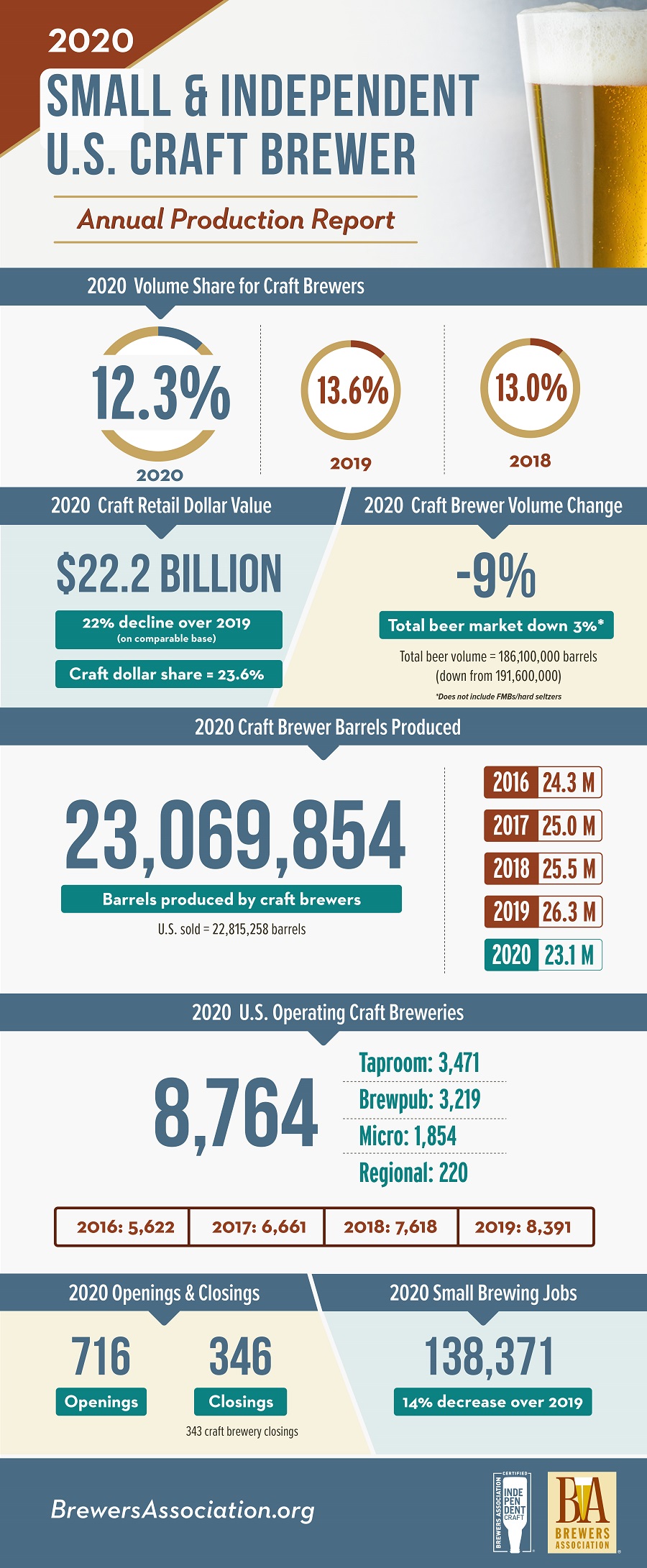

Numbers reveal that in 2020, small and independent brewers collectively produced 23.1 million barrels of beer, a 9% decline that also impacted craft’s overall beer market share, which was 12.3% by volume, down from 13.6% in 2019.

Excluding flavored malt beverages (FMBs), the overall beer market dropped 3% by volume in 2020. Retail dollar value was estimated at $22.2 billion, representing 23.6% market share and a 22% decline compared with 2019. Additionally, craft brewers provided more than 138,000 direct jobs, yet that was a 14% decrease from 2019.

Brian Sudano, managing partner at Beverage Marketing Corporation (BMC), New York, concurs that the craft beer industry was disproportionately impacted by the pandemic because of the near shutdown of its entire on-premise business including taprooms.

“As the market has slowly opened up, craft beer has returned to growth but has not recovered totally to where it would be if the pandemic did not take place. However, it is slowly returning to pre-pandemic growth levels,” Sudano says. “In 2020, craft beer declined approximately 6%, total beer was flat and FMBs including hard seltzer grew 67%. For 2021, craft accelerated to high single digit growth, FMBs including hard seltzer in mid-teens, and total beer to decline low single digits.”

For the 52 weeks ending Sept. 5, beer sales in multi-outlets were $43.8 billion, a 3% year-over-year (YoY) increase, according to data from Information Resources Inc. (IRI), Chicago. Craft beer generated dollar sales were slightly north of $5 billion, a 1.4% increase, IRI data shows.

During the same timeframe, beer and craft beer cases sales numbers were slightly down at 1.4% and 0.8%, respectively, with sales in excess of 1.6 billion for beer overall and 128.8 million for craft beer, according to IRI data.

Craft beer volume creeping up

More than a year and a half later, the BA’s Watson is cautiously optimistic about the state of the craft beer industry.

“The rough version is that craft brewers appear to have made up about half of their volume lost in 2020 (versus 2019) in the first half of 2021,” he explains. “The second quarter was stronger than the first, and while it’s probably unlikely craft will fully get back to 2019 volume levels, it’s probably going to get close, barring further economic and consumer confidence setbacks due to the delta variant.”

Even before the pandemic hit, overall beer sales had decelerated and craft brewers were exploring the beyond beer market with products like hard seltzers, hard coffees, ready-to-drink (RTD) canned cocktails, hard sodas, kombuchas and low- or no-alcohol products to drive sales.

In fact, at the Distilled Spirits Council’s 2021 DISCUS conference, Oct. 6-8, New York-based NielsenIQ’s Senior Vice President of Account Development Kim Cox noted that low- and non-alcohol beverages generated sales of $3.1 billion, a 10.4% YoY increase versus the past 52 weeks. Up 33.2%, non-alcohol sales were $331 million, while low-alcohol sales were $2.77 billion, an 8.1% increase.

The BA’s latest annual survey found that around a third of craft brewers are brewing up something in beverage alcohol that isn’t traditional beer. Products also are running the gamut of taste and style.

“Craft brewers have long been innovative, and it’s tougher than ever to summarize what they are doing,” Watson explains. “Within beer, we are seeing continued growth in IPAs, but also in lower ABV beers (including lagers and other low ABV ales), and fuller flavored but non-hoppy styles such as sours or fruit beers. We are also seeing more small brewers pursue beverage alcohol markets outside of core beer. This includes seltzer, which is still growing faster than the overall beer category, though that growth rate has begun to slow, and seltzer’s share gains have decelerated.”

In its September “Breweries in the US” report, Los Angeles-based IBISWorld notes that the $7.3 billion craft beer industry has medium revenue volatility, with annual growth down 1.8%, and a profit margin of $305.7 million for the five-year period through 2021.

When it comes to craft beer production, India pale ales (IPAs) are No. 1 at 30.2%. Rounding out the list are Belgian witbiers, 23.3%; seasonal, 10.5%; lagers, 9.1%; pale ales, 7.7%; and amber ales, 5.5%.

Similarly, IRI’s Client Insights Consultant Cara Piotrowski says the top-selling craft beers are IPAs, wheat ales, seasonals, pilsners/pale lagers, amber/dark lagers and bocks. “IPAs continue to drive most growth with wild/sour ales and Belgian ales also contributing to growth from a style perspective,” she adds.

IRI data of the Top 20 craft beer brand families reveals that the vast majority of craft beers are experiencing single-digit YoY declines or tiny pockets of growth. Yet, one craft brand family — New Belgium Brewing Co. with locations in Fort Collins, Colo., and Asheville, N.C. — posted double-digit growth of 21.9% and dollar sales of $334 million for the 52 weeks ending Sept. 5.

When comparing year to date (YTD) case sales pre-pandemic versus 2019 YTD for the week ending Sept. 26, craft beer volume grew 7.1%, signaling a recovery; however, its growth still lags others segments like seltzers, imports, domestic super premiums and FMBs, IRI’s Piotrowski says.

“From a pre-pandemic perspective, beer YTD is up 6.5% in case volume; craft, is up 7.1% and FMBs are up 13.6%,” she says. “The trends are better if we look at the latest 52-week period versus two years ago: beer, up 7.3%; craft, up 8.5%; and FMBs, up 14%.”

Craft beer essentially is flat at 0.2%, according to Newark, N.J.-based National Retail Solutions’ (NRS) data reports. Beer is up 5% led by imports at 11.7% growth; domestic super premium (up 9.8%); and FMBs (up 19.1%).

Beyond beer market driving growth

To drive sales and innovation, large beer companies and craft beer brands quickly are moving into other categories, particularly as consumers are thirsting for hard seltzers, RTD canned cocktails and low/non-alcohol products, experts point out.

Noting that craft beer remains “highly fragmented” with small local brewers driving growth as a group as opposed to any particular brand, BMC’s Sudano notes that a few companies are faring well in the beyond beer space. For example, CANarchy and its Wild Basin Boozy Sparkling Water is nearing 3 million cases, and Sweetwater, which was purchased by Aphria, is beginning to focus on hemp beverages.

NRS data reports that sub-segments such as hard seltzers (up 28.3%) and malt beverages (up 13.9%) are accounting for 37% of beer/FMB/ciders YTD growth. Brandon Thurber, NRS’ director of media measurement and scan data insights, notes that many should keep an eye on RTD cocktails as these products, which are less than a third of the size of hard seltzers and comprise roughly 2% of beer/FMB/cider sales, are seeing 55% growth YTD versus a year ago.

According to Chicago-based Mintel’s Global New Product Database (GNPD), several beyond beer companies are thriving.

“Athletic Brewing Co. is a pioneer in non-alcoholic craft beer. As the first brewery and taproom fully devoted to the production of NA craft beer in the U.S., Athletic Brewing Co. was ahead of the low/no trend that we see gaining speed today,” it states. “Their portfolio features four award-winning, low-calorie, non-alcoholic brews that are rooted in the enjoyment of great beer, without the sacrifice of health or active lifestyles.

“Full Circle Brewing is leaning into the dessert-inspired IPAs movement — launching several ‘milkshake’ IPAs containing lactose this year — Illa Vanilla, Strawberry Illa and Blueberry Illa,” the report continues.

Various craft beer brands are expanding into seltzers, FMBs and canned cocktails, including Karbach, Dogfish Head, Flying Embers, New Belgium and Sweetwater, IRI’s Piotrowski says.

“There are also examples of craft brewers moving into these alternative spaces under different brand names, such as Founders Mas Agave Hard Seltzer and Peak Organic’s Highball Hard Seltzer,” she explains. “Bold Rock is an example of a craft cider house that offers products across the spectrum of alternative alcoholic beverages (ciders, seltzers, cocktails, hard tea/lemonade) except traditional craft beer.”

When it comes to the craft industry as a whole, “the craft industry is still not fully back, because the overall on-premise is not fully back,” explains Jim Watson, executive director in beverages research for New York-based Rabobank.

“It is certainly still true that beer companies of all sizes are branching out into new segments to find new growth and attract new consumers,” Watson says. “Seltzers are by far the most popular way to do this. For the vast majority of craft brewers a seltzer could be a nice supplement to the beer business, but little more. We think it’s unlikely that a craft seltzer will break through nationally, though some early movers in craft seltzer could have better share of seltzer than beer on a regional basis.

“We also see some moves in the RTD cocktail space, which we think could be very incremental to any craft brewer that has the operational/production capacity to pull it off,” Watson continues. “I don’t think hard coffees/sodas or kombuchas offer much long-term growth for craft brewers.”

Although there’s been an interest from craft beer drinkers who also are purchasing low/no alcohol beer because of broader trends for health and wellness, these products are part of the consideration set for many alcohol consumers, not just craft.

“Craft brewers should consider how to expand into this space, and perhaps even compliment their existing flagship brands,” IRI’s Piotrowski says. “On the flipside, we’re also seeing craft brewers lean into higher alcohol and more flavorful offerings as a counterpoint to all the low-alcohol/light seltzers that have flooded the market.

(Individual Brands)

| DOLLAR SALES | % CHANGE VS. PRIOR YEAR | CASE SALES | % CHANGE VS. PRIOR YEAR | |

| Blue Moon | $377,270,273 | -0.6% | 11,063,907 | -2.1% |

| New Belgium | $377,344,789 | 21.9% | 8,598,115 | 18.2% |

| Sierra Nevada | $319,041,036 | 1.8% | 8,406,262 | -2.1% |

| Samuel Adams | $225,851,802 | -5.2% | 6,424,417 | -6.6% |

| Lagunitas | $186,913,482 | -8.5% | 4,825,136 | -9.5% |

| Shiner | $142,477,090 | -0.1% | 4,168,544 | -2.2% |

| Founders | $123,612,100 | -0.8% | 3,831,354 | -2.4% |

| Elysian | $120,448,661 | 8.5% | 2,598,352 | 7.9% |

| Firestone | $117,612,068 | 6.2% | 3,316,381 | 3.4% |

| Leinenkugel Specialty | $108,792,660 | -8.8% | 3,312,731 | -11.1% |

| Category total* | $5,042,666,220 | 1.4 | 128,801,759 | -0.8% |

*Includes brands not listed.

Source: Information Resources Inc. (IRI), Chicago. Total U.S. supermarkets, drug stores, mass merchandisers, gas and convenience stores, military commissaries, and select club and dollar retail chains for the 52 weeks ending Sept. 5.

Eternal hoptimist

Experts note that more taste profiles such as fruited beers and sours as well as trending coffee, dessert and breakfast flavors has expanded craft beers reach. For example, the 1903 Brewers Caramel Macchiato Stout features layers of caramelized sugar, rich caramel and vanilla flavored roasted coffee, while Full Circle Brewing crafted Pie of the Tiger Lemon Meringue Pie Sour, and Ellicottville Brewing offers a Blueberry Maple Pancake Rich Wheat Ale.

Craft brewers also are joining forces with companies to create “out of the box” options and expanded drinking occasions for consumers.

The BA’s Watson notes: “We’ve seen partnerships outside of beer companies for years with craft brewers, many driven by two local brands that see a lot of themselves in each other. Local coffee beers partnering with a local coffee roaster, or a fruit or pumpkin beer made with a particular farm or producer that is well known locally. Barrel aged products (either beer aged in wine or spirits barrels or vice versa) are another example totally within beverage alcohol. Outside of the beer, we’ve seen innovative partnerships on branding and design with local artists and innovative fundraising campaigns with charities breweries are passionate about.”

Given the competition in the industry and the fact that on-premise still is recovering due to the delta variant, Rabobank’s Watson expects the craft brewing industry will experience more consolidation in the months ahead.

“I expect further consolidation among the larger craft brewers, and for almost every one of the top craft brewers to be part of some version of a craft beer roll-up within the medium term,” he explains. “There are a number of different players looking to build out a craft platform, and the challenges of COVID (both in terms of sales and supply chains) may bring more sellers to the table.”

IRI’s Piotrowski suggests that craft brewers should consider variety packs to drive sampling, promote local influences and leverage their regional appeal to promote the communities they do business in.

“This can be integrated into their go-to-market strategies, supported through events, and promoted on package,” she explains. “Sierra Nevada’s Big Little Thing is a larger scale version of this, where the brand is partnering with musicians across the U.S. to highlight their stories and how they help their communities.”

IBISWorld’s report suggests that craft brewers will continue to benefit from flavor innovations and consumers wanting to visit their local craft breweries and taprooms at home and as a go-to destination. Over the five years to 2021, craft beer revenue is expected to rise 2.5% to $7.3 billion while profits plateau and revenue grows at a slightly slower rate as the industry seeks to normalize and fully reopen.

Yet, small pockets of growth are expected. “Over the five years to 2026, the industry is anticipated to fully rebound from the setbacks incurred amid the COVID-19 pandemic and experience sustained growth,” the report states. “Continual rises in expenditures on alcoholic beverages and decreases in excise taxes on beer will likely further entice prospective operators to try their hand in the industry. Ultimately, industry revenue is forecast to rise an annualized 2.4% to $8.2 billion over the five years to 2026.”