Even before the COVID-19 pandemic hit, bottled water had widened its gap over carbonated soft drinks as the largest beverage category by volume in the United States. Among the trends contributing to its No. 1 go-to status are its health and wellness attributes, convenience, and more low-calorie sparkling water varieties than ever before.

“Bottled water is continuing on a solid growth trajectory, and has actually experienced accelerated growth in the first half of 2020,” Gary Hemphill, managing director of research for New York-based Beverage Marketing Corporation (BMC), explained in Beverage Industry’s October 2020 eMagazine. “It’s positioning as the ultimate health drink continues to resonate with consumers. Additionally, the category has been boosted in recent years by [the] growing popularity of sparkling water.

“The pandemic has indeed impacted category performance,” he continued. “The first half of 2020 has been a tale of two quarters with the first quarter benefiting from stockpiling and the second quarter seeing soft performance due to first quarter stockpiling and the closure of many on-premise outlets.”

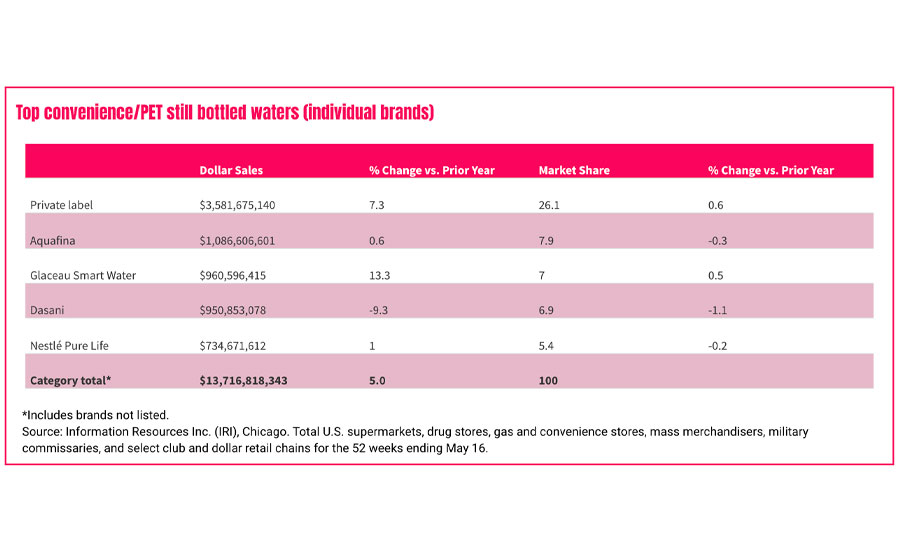

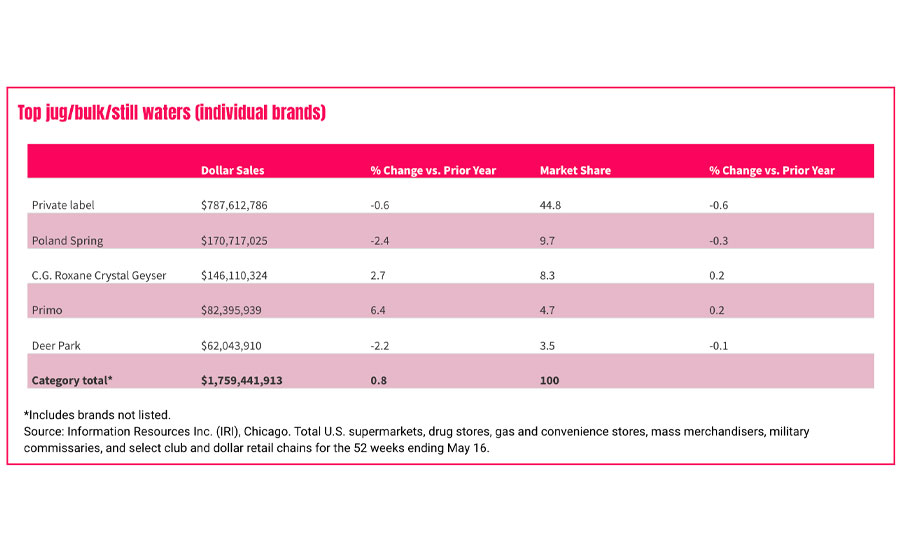

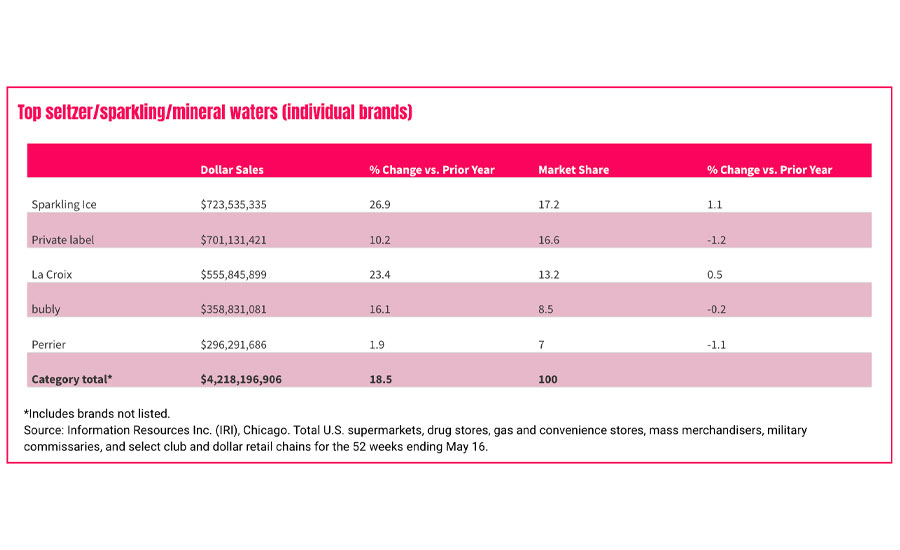

The overall bottled water category generated dollar sales of $19.6 billion, a 7.2% increase in total U.S. multi-outlets and convenience stores for the 52 weeks ending May 16, according to data from Chicago-based Information Resources Inc. (IRI). In the same timeframe, convenience/PET still bottled waters recorded dollar sales of $13.7 billion, a 5% increase. From a smaller base, seltzer/sparkling/mineral bottled waters generated a year-over-year (YOY) increase of 18.2% and sales of $4.2 billion, while jug/bulk still waters saw sales of $1.7 billion, a 0.8% increase, IRI data reports.

At roughly four times the size of the sparkling water market, still water often overshadows sparkling water. Yet, consumer interest in sparkling waters and functional waters are making a splash in the category, noted Caleb Bryant, associate director of food and drink reports at Chicago-based Mintel, in the October 2020 eMagazine.

“Functionality continues to be a major trend within the water market. For example, Nestlé recently launched their new line of Pure Life+ Enhanced Water. Twenty-five percent of all consumers have purchased functional water in the past three months,” Bryant said. “… Sparkling water is one of the fastest growing non-alcoholic beverage categories. The sparkling water market [compound annual growth rate] (CAGR) from 2015-2019 was 15.8% compared to 5.8% for still water.”

When it comes to healthy hydration, bottled water, flavored still and sparkling waters, and enhanced waters are in high demand because of the healthy hydration they provide on the go.

“Beverages have often been given a bad rap as a source of ‘empty calories,’ but there has been lots of innovation recently in exciting additions to water,” said Hannah Polk, associate data product manager and registered dietitian at Chicago-based SPINS, in Beverage Industry’s February eMagazine. “Flavored sparkling water has seen an increase of 29.8% within SPINS’ Natural Enhanced Channel over the past year.”

Shaking up the sparkling water scene are new sparkling water releases from LaCroix, a brand of National Beverage Corp., Fort Lauderdale, Fla. Available in Beach Plum, Black Razzberry and Guava São Paulo, the sparkling waters feature natural essences to deliver the fruit flavors and contain zero calories, zero sweeteners, zero sodium and nothing artificial, the company says.

As reported in the October 2020 eMagazine, SPINS “Functional and Enhanced Beverages” report, noted that many drinking waters in today’s market offer additional benefits for enjoyment such as carbonation and flavor variety as well as functional ingredients for wellness.

“The overall shelf-stable water segment grew 8.2% over the past year to $13.5 billion, and enhanced waters outpaced the segment’s growth at 12.8%, amounting to $2.2 billion and 16.3% share of the category,” the report stated. “Refrigerated coconuts and plant waters generated year-over-year growth of 10.1% and dollar volume of $60.7 million.”

Founded in 2020 by Leon Codner, Liquid Plant-Based Hydration, Tampa Bay, Fla., is formulated with 5% non-GMO watermelon juice, 50 mg of plant-based branch chain amino acids, natural sweeteners, natural flavors and six essential vitamins, the company says.

The ready-to-drink Liquid Hydration contains no added sugar, is vegan and is “an awesome alternative for health-conscious consumers or fitness enthusiast because it offers delicious plant-based hydration to help you stay hydrated throughout the day,” Codner said. Liquid Hydration is available in four flavors: Orange Mango, Black Cherry Pomegranate, Strawberry Banana and Peach.

Another functional water that contains zero sugar, zero juice, zero calories, zero artificial sweeteners and zero GMOs is Flow Alkaline Spring Water. The 100% natural alkaline spring water has an alkaline pH of 8.1 and contains naturally occurring essential minerals and electrolytes for ultimate hydration. The new Flow variety case is available nationwide at Costco in four flavors; Original, Cucumber + Mint, Stawberry + Rose, and Peach + Blueberry.

The future remains bright for the water category, particularly as consumer demand for enhanced waters and sparkling waters are strong, assisted by healthy positioning and lots of innovation.

For the 32 weeks ending Aug. 8, 2020, the total water category saw U.S. dollar sales of $5.5 billion, a 6.3% YOY increase, New York-based Nielsen reported in Beverage Industry’s October 2020 eMagazine. Additionally, drinking water sales captured $3.2 billion, a 6.3% increase; sparkling water netted $1.9 billion and 22.6% growth, while value-added waters notched $1.3 billion and 10.6% growth. Seltzer waters also saw double-digit growth of 14.6% and sales of $337 million, while tonic waters, likely the result of consumers mixing drinks at home, saw a nearly 36% YOY increase and sales of nearly $144 million.

Image courtesy of Flow Alkaline Spring Water

“Both still and sparkling waters are growing, but sparkling has seen greater growth in recent years due to consumers migrating from carbonated soft drinks and some very high-profile product launches,” BMC’s Hemphill said in the October 2020 eMagazine. “We expect continued growth of both bottled water and enhanced waters. In particular, we believe sparkling water will continue its strong growth and we believe innovation will continue to drive growth in enhanced waters.”

Noting that enhanced waters have a relatively long history going back to the introduction of caffeinated waters more than a decade ago, Hemphill suggested that innovation in the sub-segment will expand opportunities in the beverage market. He concluded: “That said, the level of innovation has accelerated over the last five years, which has helped to boost the category. Water makes for a great innovation platform.”