In response to consumers who want more “pep in their step,” the energy drinks and mixes category is maintaining steady growth. In fact, the energy drinks’ category saw dollar sales just north of $12.8 billion in U.S. multi-outlets and convenience stores for the 52 weeks ending May 17, a 9.3 percent increase over the prior-year period, according to data from Chicago-based Information Resources Inc. (IRI). Up 13.5 percent, energy drink mixes also are flourishing, racking up sales of $124.5 million, IRI data states.

Energy shots, on the other hand, remain on a downward slide. Energy shots experienced a 7.9 percent contraction and sales of $977 million for the same time period, IRI data reports.

In the August 2019 Beverage Industry, Roger Dilworth, senior editor at New York-based Beverage Marketing Corporation (BMC), suggested that energy shot growth perhaps had flattened out due to a lack of competition. For instance, 5-Hour Energy shots, made by Farmington Hills, Mich.-based Living Essentials LLC, maintains the lion’s share of the market at 89 percent and notched sales of more than $867 million in multi-outlets for the 52 weeks ending May 17, IRI data suggests.

Three of the Top 5 energy shots brands are seeing sales decline: 5 Hour Energy is down 9.3 percent with sales of $867 million, Tweaker is down 0.3 percent with sales of $20.7 million, and Stacker 2 Extra had sales of $14.3 million, a 8.7 percent decrease over a year ago.

However, literally energizing the energy shot category with a 438.6 percent growth trajectory and $10.7 million in sales is VBX Bang, which failed to crack the Top 10 last year and now sits in the fifth spot. In April, this up-and-coming brand of Vital Pharmaceuticals Inc. (VPX), Weston, Fla., inked a distribution deal with Purchase, N.Y.-based PepsiCo to expand its presence on store shelves.

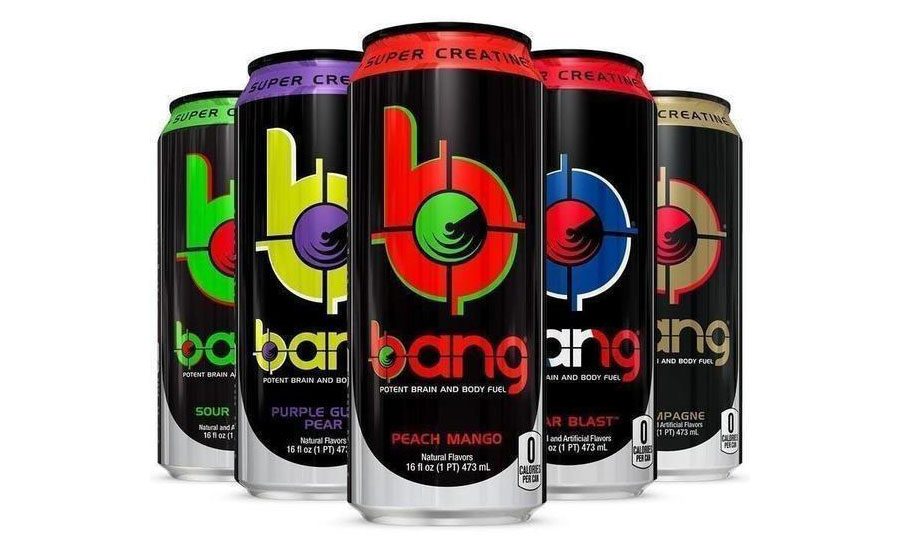

On the energy drinks side, VPX Bang also is finding favor — and flavor — with consumers. It had a year-over-year growth of 80.8 percent and sales of $780 million, IRI data reports. The company’s tag line, “Fuel Your Destiny,” invites consumers to “power up with potent brain and body-rocking fuel” in a variety of flavors such as Black Cherry Vanilla, Cotton Candy, Peach Mango and Rainbow Unicorn.

(Individual brands)

| DOLLAR SALES | % CHANGE VS. PRIOR YEAR | MARKET SHARE | % CHANGE VS. PRIOR YEAR | |

| 5 Hour Energy | $867,674,353 | -9.3 | 88.7 | -1.4 |

| Tweaker | $20,733,560 | -0.3 | 2.1 | 0.2 |

| Stacker 2 Extra | $14,331,080 | -8.7 | 1.5 | 0.0 |

| Stacker 2 | $10,818,855 | 10.1 | 1.1 | 0.2 |

| VPX Bang | $10,748,995 | 438.6 | 1.1 | 0.9 |

| Category total* | $977,831,293 | -7.9 | 100 | --- |

*Includes brands not listed.

Source: Information Resources Inc. (IRI), Chicago. Total U.S. supermarkets, drug stores, gas and convenience stores, mass merchandisers, military commissaries, and select club and dollar retail chains for the 52 weeks ending May 17.

The energy drink brand Bang experienced meteoric growth, outperforming all-natural energy drinks and becoming one of the top brands in the entire market,” stated Mintel’s May 2019 “Energy Drinks – US” report in Beverage Industry’s August 2019 issue. “Bang features fun, unique flavors and caffeine levels outside the norm of most energy drinks. Bang’s rapid growth is due to the brand’s appeal among high-frequency energy drink consumers. High-frequency drinkers enjoy flavor variety and are most interested in highly caffeinated energy drinks.”

In the same issue, BMC’s Dilworth pointed out that while the energy shots’ category suffers from a dearth of competition, the energy drinks’ market boasts several key players and “cutthroat competition” is forcing companies “to come up with new innovations instead of resting on their laurels,” he said.

Total energy drink and energy shot sales generated an estimated $13.5 billion in 2018, representing a growth of 29.8 percent from 2013,” Mintel’s report stated. “Growth stems entirely from energy drink sales, which represent 91.5 percent of the entire market; energy shot sales have largely stagnated.”

Chicago-based Euromonitor International also detailed similar success for the energy drinks’ category. In 2013, energy drinks captured $9.6 billion in sales. For the five-year time period of 2013-2018, the category generated $12.3 billion in sales, a 28.3 percent year-over-year growth rate and a compound annual growth rate (CAGR) of 5.1 percent, the market research firm said in the August 2019 Beverage Industry.

Contributing to steady growth, energy drinks are beginning to evolve in terms of ingredients, flavor and function, with several brands releasing lower-sugar, healthier options in slim cans, experts noted.

(Individual brands)

| DOLLAR SALES | % CHANGE VS. PRIOR YEAR | MARKET SHARE | % CHANGE VS. PRIOR YEAR | |

| Red Bull | $2,891,049,948 | -2.3 | 24.6 | -2.4 |

| Monster Energy | $1,763,585,023 | -2.6 | 15 | -1.5 |

| VPX Bang | $780,813,606 | 80.2 | 6.6 | 3.6 |

| Red Bull Sugar Free | $687,763,019 | -0.3 | 5.9 | -0.5 |

| Monster Energy Zero Ultra | $687,273,572 | -3.4 | 5.8 | -0.6 |

| Category total* | $12,712,904,112 | 8.3 | 100 | --- |

*Includes brands not listed.

Source: Information Resources Inc. (IRI), Chicago. Total U.S. supermarkets, drug stores, gas and convenience stores, mass merchandisers, military commissaries, and select club and dollar retail chains for the 52 weeks ending May 17.

For the first time in its history, The Coca-Cola Co., Atlanta, released Coca-Cola Energy, aimed at providing consumers with a new and approachable option to the energy drink category, whether it’s for a night out with friend or a mid-afternoon pick-me-up, it says. The energy drinks are available nationwide in four flavors: Coca-Cola Energy, Coca-Cola Energy Zero Sugar, Coca-Cola Energy Cherry and Coca-Cola Energy Cherry Zero. Each 12-ounce slim can contains 114 mg of caffeine, guarana extracts, niacin and B-vitamins.

Also in January, Gatorade, a brand of PepsiCo, announced the launch of its first caffeinated beverage designed to deliver energy and hydration: BOLT24 ENERGIZE. The beverage contains 50-75mg of caffeine and delivers electrolytes from watermelon and sea salt, as well as 100 percent of the recommended daily value of antioxidant vitamins A and C, and vitamins B3, B5 and B6, the company says. The performance beverage also contains no artificial sweeteners or flavors and is available nationwide in 16-9 ounce bottles in Strawberry-Lemon, Orange-Passion Fruit and Cherry-Lime.

Demonstrating fierce competition with their sugar-free energy drinks are Santa Monica, Calif.-based Red Bull North America Inc.’s Red Bull Sugar Free variety and Corona, Calif.-based Monster Beverage Corp.’s Monster Energy Zero, which took the No. 4 and No. 5 spots, respectively, based on IRI data for the 52 weeks ending May 17. The Red Bull Sugar Free variety saw sales of $781 million, while Monster Energy Zero notched $669 million in sales versus a year ago.