CNBC’s “Mad Money with Jim Cramer” rarely is short on advice when it comes to the next hot stock. For the beer market, the release and sales of numerous hard sodas and seltzers helped contribute to the “hot” performance of the flavored malt beverage (FMB)/progressive adult beverage (PAB) segment in 2016. In Nielsen-measured channels, FMBs were up 5.9 percent in volume and 7.4 percent in dollar sales for the 52 weeks ending Dec. 31, 2016.

“The segment continues to be a growth opportunity for brewers and can easily leverage new and different flavor offerings to keep drinkers satisfied, particularly younger [legal-drinking-age] (LDA) [consumers] seeking to explore through flavors,” says Danelle Kosmal, vice president of beverage alcohol practice for New York-based Nielsen.

Although they account for a smaller portion of the FMB market share, Kosmal says that hard sodas and seltzers were a bright spot for the segment in 2016.

“Growth from the introduction of new soda brands and line extensions is making up for some volume loss from some of the early brands and flavors launched in previous years,” she says. “Seltzers represent only 1.5 percent of the FMB segment, but [they] are also growing at a fast pace.”

Chicago-based Mark Anthony Brands Inc., makers of Mike’s Hard Lemonade, expanded into the emerging sub-segment earlier this year with the release of White Claw Hard Seltzers. Available in in three flavors — Natural Lime, Black Cherry and Ruby Grapefruit — the lineup blends seltzer water with a spike of alcohol and a hint of natural flavor, the company says.

Smirnoff, a brand of Norwalk, Conn.-based Diageo North America, also entered the sub-segment with the release of Spiked Sparkling Seltzers, which are available in Orange Mango, Cranberry Lime and Watermelon varieties.

Kosmal also notes the contributions of hard sodas to the FMB segment. “In part, hard sodas are helping to grow the beer/malternatives category, as the largest hard soda brands are sourcing a majority of their volume from wines and spirits,” she says. “However, hard sodas are also competing with other segments within the category, primarily craft beer and other FMBs.”

Chicago-based MillerCoors, a division of Molson Coors Brewing Co., has expanded upon its Henry’s Hard Soda line since its launch last spring. This past summer, it released a Cherry Cola variety and, most recently, it launched a Grape flavor.

In its June 2016 report titled “Cider/Perry in the US,” Chicago-based Euromonitor International explains that the growth of hard sodas might have contributed to the recent demise of hard cider. “Once an explosive category, it began to appear that hard sodas were destined to replace cider/perry as the sweet, single-percent alcohol-by-volume (ABV) alcohol of choice,” the report states. “Where ciders had been able to draw contrast to bitter craft beers, hard soda has done the same, competing for the same consumers.”

Brian Sudano, managing partner with New York-based Beverage Marketing Corporation (BMC), says that FMBs and PABs make up the alternative beverage alcohol segment, which has been subject to a rotation of flavor profiles throughout the years. “These are characterized by easy-to-drink, more pre-adult flavor profiles,” he says. “In the past five years, the space has moved from cider to Margarita variants, to hard soda to hard seltzer variants to now spirit-based [ready-to-drink] RTDs.”

Although he recognizes hard sodas’ short-term growth, Sudano notes this could be tied to its initial novelty. “As with hard soda, it is just another flavor iteration but with less initial consumer appeal. As a result, its impact has less to do with the format but more to do with what is new,” he says. “However, the overall appeal in a category driven by flavorful products to a product by name [that] is less flavorful will have less appeal to alternative beverage alcohol consumers.”

In BMC’s November 2016 report titled “U.S. Beer through 2020,” the market research firm projects that the FMB segment’s volume will continue to grow at a compound annual growth rate of 4.6 percent from 2015 to 2020. This is a slowdown compared with the 14.2 percent FMBs experienced during the 2010-2015 time period, based on BMC’s May 2016 report titled “2016 U.S. Alcohol Beverage Trend Analysis.” BI

Top hard ciders

(Brand family)

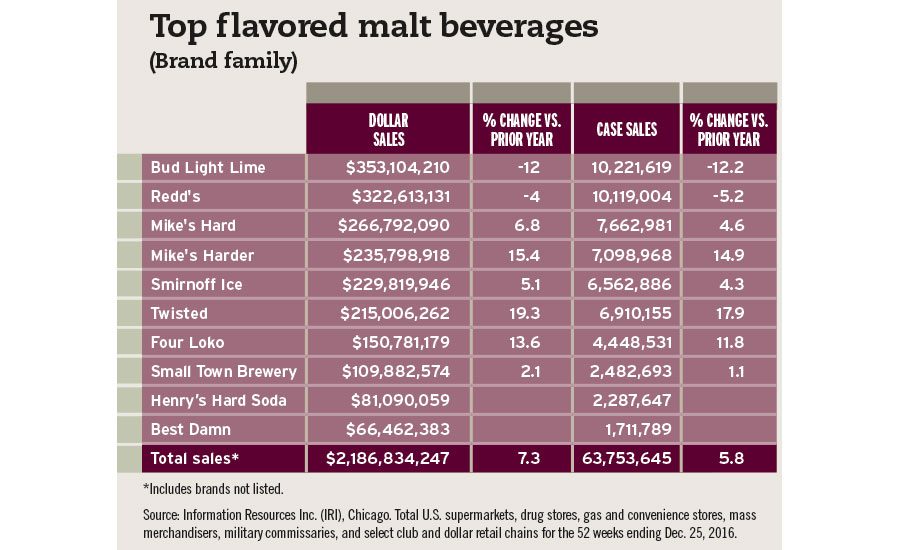

| Bud Light Lime | $353,104,210 | -12 | 10,221,619 | -12.2 |

| Redd's | $322,613,131 | -4 | 10,119,004 | -5.2 |

| Mike's Hard | $266,792,090 | 6.8 | 7,662,981 | 4.6 |

| Mike's Harder | $235,798,918 | 15.4 | 7,098,968 | 14.9 |

| Smirnoff Ice | $229,819,946 | 5.1 | 6,562,886 | 4.3 |

| Twisted | $215,006,262 | 19.3 | 6,910,155 | 17.9 |

| Four Loko | $150,781,179 | 13.6 | 4,448,531 | 11.8 |

| Small Town Brewery | $109,882,574 | 2.1 | 2,482,693 | 1.1 |

| Henry’s Hard Soda | $81,090,059 | 2,287,647 | ||

| Best Damn | $66,462,383 | 1,711,789 | ||

| Total sales* | $406,071,964 | -8.3 | 10,984,585 | -11.3 |

*Includes brands not listed.

Source: Information Resources Inc. (IRI), Chicago. Total U.S. supermarkets, drug stores, gas and convenience stores, mass merchandisers, military commissaries, and select club and dollar retail chains for the 52 weeks ending Dec. 25, 2016.