As consumers demand more better-for-you products, experts note that the juice and juice drinks category has been challenged in a unique way and struggled to maintain its share of the beverage market. “The juice/juice drinks sector has struggled during the past year,” says Susan Viamari, vice president of Thought Leadership at Chicago-based Information Resources Inc. (IRI). “Volume declined 1.8 percent, while dollar sales inched up just 0.8 percent. Juice drink concentrates saw the largest slide (volume down 49.8 percent; dollars down 24.1 percent), while performance was strongest in bottled juices (volume down 0.5 percent; dollars up 2.2 percent).”

These numbers reflect growing consumer trends of better-for-you, fresh products, among many other factors. Chicago-based Euromonitor International also points to the decline in its March 2016 report titled “Juice in the US,” and explains that it’s largely a result of consumer aversion to sugar and artificial ingredients. “The high sugar content of many juices has turned health-conscious consumers away from these beverages. This trend is having a particularly damaging effect on juices which are not 100 percent juice, as these are more likely to have added sugar in their ingredient lists, pushing away consumers who may have once perceived these products as favorable compared with carbonates.”

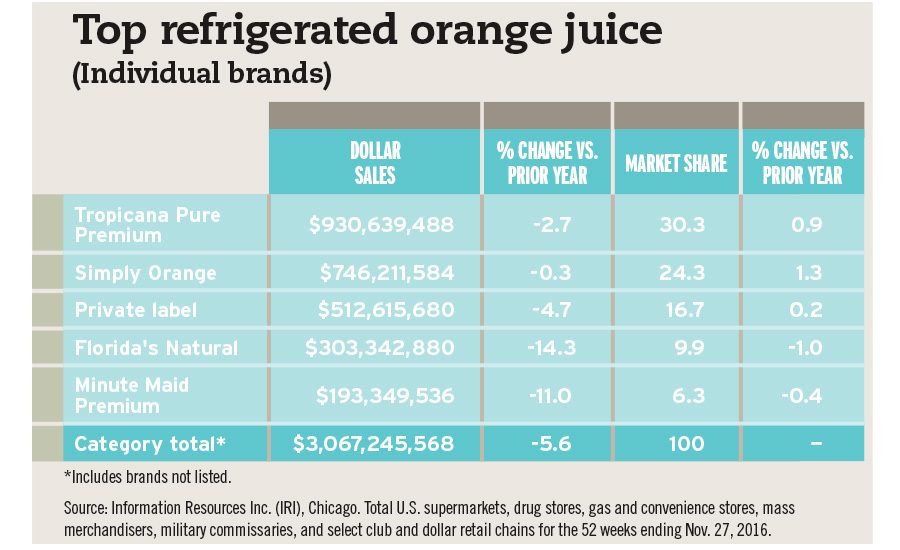

Orange juice represented roughly 37 percent of off-trade volume sales in 2015, making it the most popular option in the United States, according to a the Euromonitor report. But, due to reduced yields of Florida’s oranges as a result of citrus greening, unit prices have increased, which has caused consumers to shift to non-citrus juices as a substitute for carbonated soft drinks, it states.

However, the reduction in orange juice sales has at least partially benefited other segments within the category. “The rising price of citrus fruit juices has encouraged increasingly health-conscious consumers to further explore alternatives to the soda production industry, … shifting their preferences to exotic non-citrus drinks as a substitute for soft drinks,” the report states.

Additionally, consumers have begun to favor premiumized products, which call for higher unit prices. Euromonitor notes that smoothies, coconut waters and exotic fruit juices have gained traction as a result of a more premiumized positioning.

In fact, super-premium juice wholesale dollar sales grew by 11 percent to $2.2 billion, up from $582.2 million in 2000, according to New York-based Beverage Marketing Corporation’s (BMC) November 2016 report titled “U.S. Single-Serve Fruit Beverages through 2020.” The market research firm predicts wholesale dollars in the super-premium segment to grow to $3.2 billion by 2020.

“Although it had stagnated due in large part to the economic woes of the late 2000s, the super-premium juice market has rebounded in the last few years and has had strong performance since 2000,” the report states. “It enjoyed strong growth in 2015.”

According to Chicago-based Mintel, growing competition from energy drinks and other functional beverages also has challenged the category. “One of the largest non-alcoholic beverage markets, the category has stalled at the $20 billion mark,” the market research firm states in its October 2016 “Juice and Juice Drinks” report. “Like other non-alcoholic beverage leaders (CSDs and dairy milk), the category is losing share to other beverage types that offer flavor and function innovation, some with lower sugar/calorie levels.”

Additionally, the Mintel report indicates that the category struggles due to limited drinking occasions. Although 100 percent juice leads with 66 percent consumption, occasions for consuming 100 percent juice drop off after the morning drinking occasion, it notes. However, juice drinks and smoothies are able to maintain an audience throughout the day.

Despite these challenges, the category remains a competitive market for large and emerging brands alike. According to IBISWorld, PepsiCo dominates the juice and juice drinks market, maintaining 40.9 percent share; The Coca-Cola Co. holds the No. 2 spot, with 12.1 percent share; Campbell Soup Co. is in third with 8.5 percent share; and Dr Pepper Snapple Group rounds out the Top 4 with 5.3 percent market share.

Looking ahead, the market research firm forecasts category revenue to grow at an annual rate of 1.3 percent during the five years to 2021 as the category further innovates.

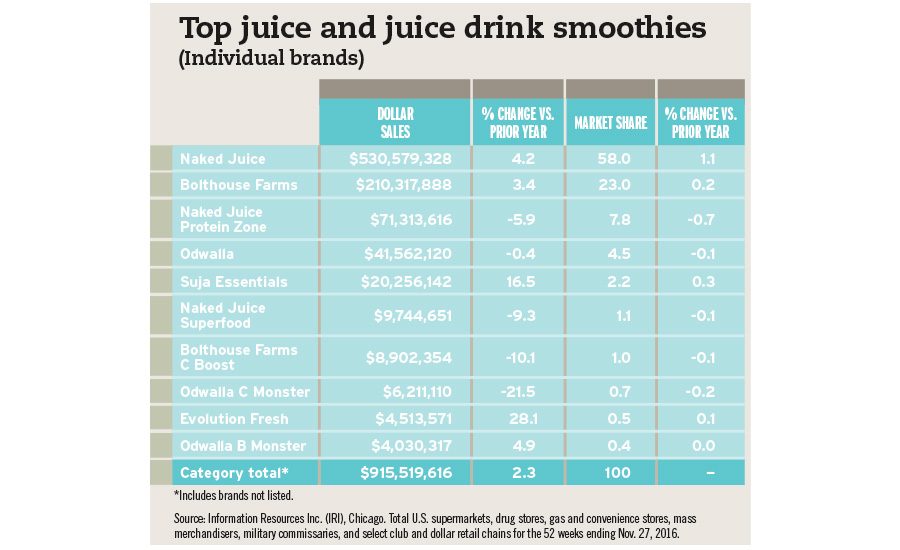

“Producers that are able to take advantage of the smoothie and juice bar trends are expected to have fared [the] best in the past five years. PepsiCo’s Naked Juice brand is an example of this,” the IBISWorld report states. “As this new trend continues, it opens a path for new entrants to fill. The variety of industry product offerings has encouraged new entrants to offer their own exotic mixtures and somewhat shields potential drops in revenue as losses from one product are offset with gains from another.”

Keep it simple

Consumers are just as concerned about what is not in the products that they consume as they are about what is in them. Sixty-eight percent of North American consumers surveyed in Nielsen’s 2016 Global Ingredients Study said that they would pay more for products that are free of undesirable ingredients, says Andrew Mandzy, director of strategic insights at New York-based Nielsen. Furthermore, 61 percent say that the shorter the ingredient list, the healthier the product.

“This trend shows up fairly clearly in the data, as sales of natural and organic juices are up 7 percent and 23 percent, respectively. In addition, GMO-free sales in shelf-stable juices are up over 30 percent compared to a year ago,” he explains. “… Consumers are focusing on simplicity and transparency, and juice buyers are no different.”

In line with this, more than a quarter of juice/juice drink consumers purchase organic products, according to Mintel’s report.

Mandzy says that consumers have been very clear that they’re looking for simpler products, with less processing and ingredients that they understand. “Manufacturers have reacted by simplifying the ingredients in the products they make, removing artificial ingredients and preservatives, while also being conscious of ingredients like sugar, sodium and fat.”

Many juice manufacturers have begun launching juice and smoothie products that are organic and feature clean, easy-to-read labels. For example, Bolthouse Farm’s 1915 brand recently introduced a line of cold-pressed smoothies that are made with organic pureed fruits and vegetables. The line boasts an ingredient panel featuring no more than six ingredients and nutrient-rich fruits and vegetables.

Additionally, PepsiCo’s Naked Juice brand introduced Naked Cold-Pressed juices in June 2016, which contain no added sugars or preservatives, the company says. The line is made with ready-to-eat, high-quality fruits and vegetables and is Non-GMO Project Verified, it adds.

More and more consumers are reverting to a back-to-basics mentality toward their food and beverage consumption, Mandzy says. This has resulted in an increased demand for products with simple ingredients and less processing, he adds.

As processing has become a concern, BMC’s report notes an influx of juice manufacturers utilizing high-pressure processing (HPP) for their products. “HPP reportedly gives raw foods a longer shelf life and preserves more of their vitamin, mineral and enzyme content,” the report states. “… Among the HPP segment’s attractive features, besides high shelf price, are users’ penchant to ingest drinks as regimen, garnering major repeat business, and ability to support significant mail order/Internet business,” the report states.

According to the report, Oceanside, Calif.-based Suja Juice Co. dominates the HPP juice segment. The company offers several lines of organic, HPP juices and juice drinks, including fruit-infused waters, drinking vinegars and juice blends.

Although the juice and juice drinks category has offered an alternative to consumers looking to avoid carbonated soft drinks, it has experienced some attrition for its own sugar content. “The trend toward healthy alternatives to carbonated soft drinks (CSDs) has led consumers to substitute those products with this industry’s offerings,” the IBISWorld report states. “… However, such health awareness has also detracted from fruit juice sales, a traditional industry staple. The growing consumer focus on fruit juice’s high sugar content has wounded its previously healthy reputation.”

Although not all segments have been equally impacted by this concern, market research experts note that the U.S. Food and Drug Administration’s new Nutrition Facts label, which updates the serving sizes to reflect the amount that consumers typically will consume and adds an Added Sugar section under the Total Sugars section, also could have an impact on the category, mostly notably due to the Added Sugars section, analysts note.

“Proposed changes to nutrition labels could impact the juice category, more so than other soft drink categories,” the Euromonitor report states. “The new labels propose separating added sugar from total sugars. Although most juices are high in sugar, if consumers are more easily able to differentiate between products with naturally occurring sugar and those with added sugar, some juice categories may be able to shed some of the perceptions of offering unhealthy beverages. By contrast, juice drinks and nectars with high levels of added sugar might suffer from such labeling challenges.”

Nielsen’s Mandzy notes that 22 percent of North American consumers are conscious about their sugar intake and actively control the amount they consume. “The additional metrics of added sugars will create yet another data point for consumers to consider as they make decisions about their health and wellness,” he says. “As of today, only 12 percent of sales in the category have a claim that says ‘No Added Sugars.’”

Make it functional

At the same time that consumers are looking for simple, clean labels, they’re also demanding products that provide functional and/or nutritional benefits. “Consumers want more — more healthful ingredients, an extra serving of vitamins/minerals/fruits/veggies, and they are looking for beverages that help them advance their nutritional goals in these areas,” IRI’s Viamari says.

As consumer trends shift, innovation within the juice and juice drinks segment will help maintain and further drive consumer interest, market research experts say.

“As health and wellness becomes even more important, foods and beverages will face more scrutiny from consumers as they seek simpler ingredients, functional ingredients and more healthy attributes overall,” Nielsen’s Mandzy says. “When it comes to juices, consumers are clear about what matters. When asked which attributes influence purchasing decisions in juices, 36 percent of consumers stated that natural ingredients impact their buying behavior, 37.9 percent stated low sugar has an impact, and 33.6 percent stated that health benefits are important. In addition to that, consumers want to trust the brands they engage with in juices, as over 44 percent stated that trusting the brand has an influence on purchasing decisions.”

Transparency is an overarching demand that consumers are expecting from all their consumer packaged goods (CPGs), Mandzy adds. “Transparency about what is in the products we consume will drive consumer decision making, and juices are no exception,” he says. “Consumers will expect simpler ingredients, less processing and more healthy attributes in their juices and beverages overall.”

In its report, BMC notes that juices still are viewed as a healthier option compared with other beverage categories.

“Juices are viewed as more nutritious than fruit drinks, and super-premium juices promote themselves as even more healthful, while sparkling juice is viewed as a healthier option than carbonated soft drinks,” the report states. “The addition of nutraceutical enhancements such as vitamins, minerals (like calcium) or herbs is seen as restoring nutrients lost in processing and, in some cases, adding benefits not normally found in fruit.”

In response, juice and juice drink manufacturers have begun to offer fortified juice options. For example, PepsiCo’s Tropicana brand launched Tropicana Essentials Probiotics this month. The line contains 100 percent juice with 1 billion live, active cultures in each serving. The line boasts no added sugars and more than the daily recommended value of vitamin C.

“Fortification has become an important influencer of trends,” IRI’s Viamari says. “Consumers are looking for beverages that provide benefits beyond simple thirst quenching and innovators are delivering against sought-after benefits, such as nutritional enhancement, workout recovery and energy enhancement through fortification/integration of new/unexpected/better-for-you ingredients.”

Sales of refrigerated juices with fortified claims have increased 7.5 percent year-over-year, while sales of shelf-stable fortified juices increased 17.7 percent year-over-year, according to Nielsen's Mandzy. “Consumers are seeking out functional benefits from the foods and beverages they consume,” he says. “Either to be proactively healthy, or to manage an existing ailment, we see a clear shift toward foods and beverages playing a significant role in consumer and shopper health management.”

As a result of these trends, the vegetable juice segment has experienced increases during the past five years, with green juices leading the charge, according to the IBISWorld report.

“Younger consumers — primarily the millennial generation — want more than just traditional juice,” the report states. “They want an innovative blend of flavors that is both nutritious and delicious. Nevertheless, the industry has been fighting back, offering its own variety of new products. Tropical flavors like mango and pineapple have been on the rise as consumers look for exotic and creative healthy alternatives.”

Complex juice blends and unique, exotic juice flavors have recently garnered consumer attention as well, according to Euromonitor. “Mixed juices or smoothies are perceived to offer the benefits of several fruits and/or vegetables, which outweigh the downsides associated with naturally occurring sugars,” the report states. “Exotic juices, such as coconut water, pomegranate juice and prune juice, are valued not only for their unique and exciting flavors, but also for the naturally occurring electrolytes and antioxidants they purportedly contain. Of the 11 juice brands identified as having off-trade value sales growth [of] over 5 percent, eight are deemed mixed or exotic juices.”

Noting the desire for unique flavors combined with health benefits, Austin, Texas-based Daily Greens introduced Green Ade, a new line of cold-pressed green juices. The line features innovative lemonade flavors like Watermelon-Hibiscus Ade. Each flavor highlights nutrient-dense, algae-based superfoods, such as chlorella and Blue Majik spirulina, which each contains 65 individual nutrients, the company says.

Moving forward, juice and juice drink manufacturers will face some challenges, but new product innovation likely will be the key to success. “The battle for share of the stomach is fierce — crossing over between CPG and [quick-service restaurants] (QSR), and even beyond,” Viamari says. “Juices/juice drinks marketers are facing this same competitive pressure. To compete, marketers need to stay in lockstep with the evolving needs, wants and behaviors of their consumers. This means ensuring the product is where the consumer is shopping, when the shopper is looking for it, [and] in a convenient and needs-based package. For instance, is this stock up or immediate consumption?

“The category will continue to grow and evolve, finding momentum in healthier for you and functionality,” she continues. “Juices provide a quick and inexpensive opportunity to satisfy a taste craving, fuel up without slowing down, round out nutritional intake, etc. Marketers must play on all of these benefits in a highly targeted way.” BI