The well-known philosopher Aristotle once said “The energy of the mind is the essence of life.” In today’s everyday life, the energy drinks market might be the new essence of the life as the category — in connection with an uptick in energy shots’ sales — now is the No. 2 performer, second only to bottled water, in convenience stores, according to market research analysts.

“Dollar sales are up more than 7 percent and units are up more than 6 percent, and across the full CPG [consumer packaged goods] market, it grew 4 percent in dollars and 0.2 percent in units,” says Susan Viamari, vice president of thought leadership at Chicago-based Information Resources Inc. (IRI).

“The market is being driven by a number of factors, including the popularity of energy shots, which have a higher price per unit,” she adds. “Another contributing factor is an increase in promo dollars.”

New York-based Beverage Marketing Corporation’s (BMC) report titled “U.S. Energy Drinks through 2019” highlights the growth of this category across all channels.

“In 2014, the energy drink market grew volume by 6.4 percent and wholesale dollars increased by 5.9 percent,” it adds. “Wholesale sales of energy drinks were $6.6 billion in 2014, an increase of $367.2 million versus the $6.3 billion posted in 2013. Retail dollar sales increased by 5.4 percent to $12 billion. Volume increased by 11.5 million 384-ounce cases to 192.7 million cases.”

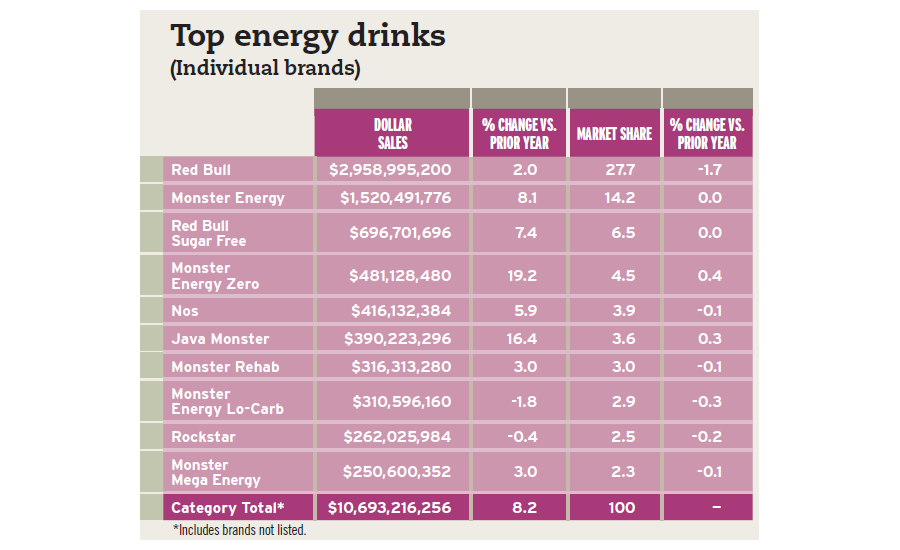

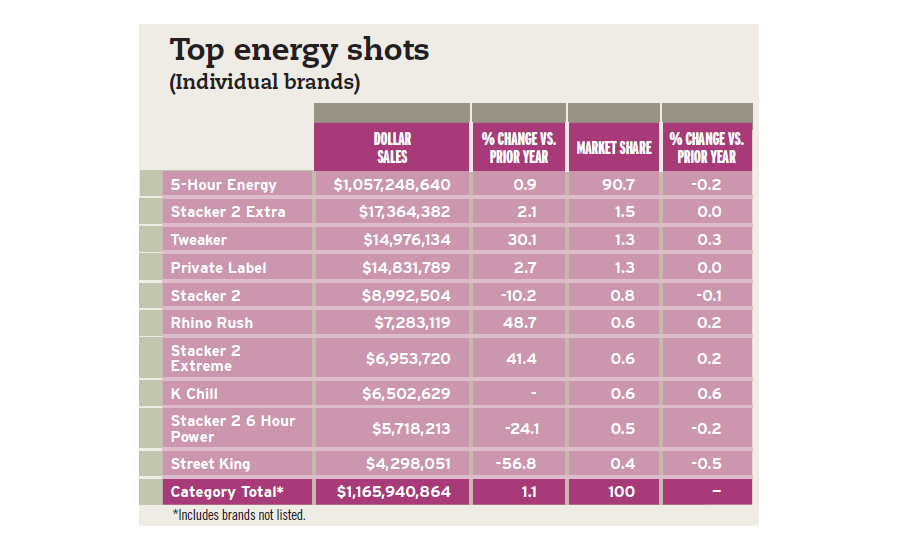

According to IRI data, the non-aseptic energy drinks category saw a sales increase of 8 percent to nearly $10.7 billion for the 52 weeks ending June 12 in U.S. supermarkets, drug stores, mass merchandisers, gas and convenience stores, military commissaries, and select club and dollar retail chains. Additionally, the energy shots category notched nearly $1.2 billion for the same timeframe; however, it only captured a slight 1 percent increase, the data notes.

With $2.9 billion in sales, Red Bull, a brand of Santa Monica, Calif.-based Red Bull North America Inc., is the highest-selling energy drink, and Monster Energy, a brand of Corona, Calif.-based Monster Beverage Corp., is No. 2 with $1.5 million in sales, according to IRI data.

At 43 percent off-trade value share, Red Bull North America maintained the lead position in energy drinks in 2015, notes Chicago-based Euromonitor International in its March “Energy Drinks in the US” report. “Red Bull’s higher value share reflects the product’s relatively high unit price, influenced by the product’s traditionally small metal beverage can in a category otherwise dominated by larger pack sales,” the report states.

However, with 30 percent off-trade volume share, Red Bull was second to Monster Beverage, which saw its off-trade volume and value sales increase in 2015 following a brand swap with Atlanta-based The Coca-Cola Co. The strategic partnership fostered the transfer of The Coca-Cola’s energy drinks brands to Monster Beverage Corp. in exchange for Monster’s non-energy drinks brands (Hansen’ Natural Sodas and Peace Tea).

“In response, Monster’s off-trade volume share propelled from 42 percent in 2014 to 53 percent in 2015, alongside a 6 percentage point off-trade value share gain to reach 42 percent, or $4.4 billion,” it says.

Ingredients & flavors differentiation

In response to consumer demand, beverage formulators are using more natural ingredients, like guaraná, guayusa, honey and green tea, in energy drinks.

For example, this month Brooklyn, N.Y.-based Runa LLC will be rolling out newly rebranded Clean Energy drinks, available in 12- and 8.4-ounce cans in Berry, Unsweetened Lime and Unsweetened Blood Orange flavors.

Energy drinks’ ingredients like taurine, glucuronolactone, caffeine, various B vitamins and inositol help differentiate the category from other nutrient-enhanced beverages, according to BMC’s report.

“Taurine is probably the most distinctive, and perhaps important, ingredient in energy drinks although not all energy drinks contain it. The fact that not all energy drinks contain the same ingredients allows marketers to differentiate their products from competitors’,” it states. “Japanese research showing the cardiovascular benefits of the amino acid was one of the reasons why Red Bull was established in the first place.”

Experts note that fresh fruit flavors such as kiwi, tropical fruit, kiwi and cherry are hitting the mark with consumers. In its report, BMC highlights how initially the Red Bull Edition lineup of the Red Cranberry Edition, the Silver Lime Edition and the Blue Blueberry Edition were limited releases. Last year, the company announced that these flavors would be permanent editions to the lineup along with several new fruit flavors, including Green Kiwi, Yellow Tropical and Orange Tangerine, it adds.

IRI’s Viamari notes that the Red Bull Yellow Edition, released in the first half of 2015, currently is an IRI New Product Pacesetter. “It was too new to the market to be considered for Pacesetter status because it finished its first full year in the market in 2016,”she explains. “It is likely to be an IRI New Product Pacesetter in 2017 (or analysis of 2016 performance).”

“Red Bull Summer Edition and Monster Energy Ultra are top performers in the market, showing triple-digit growth,” Viamari continues. “Monster Energy Ultra Sunrise was a 2016 IRI NPP because it was among the 100 highest-earning beverage launches of 2015. Red Bull Editions was a 2015 NPP. These brands continue to extend, bringing new flavors/varieties into the market to satisfy consumers’ changing palates.”

In addition to functional, natural trends, sugar reduction also is having an impact on the energy drink market. In June, Culver City, Calif.-based Zevia announced the addition of an energy line to its portfolio. Zevia Energy features 120 mg of natural caffeine in each 12-ounce single-serve can. The new line will be available in three flavors: Mango Ginger, Raspberry Lime and Grapefruit.

“We created a line with zero calories, 120 mg of caffeine from coffee extract, sweetened with stevia and no additional supplementation,” said Zevia Chief Executive Officer Paddy Spence in a statement at the time of release “It's a better-for-you option in a category that has not been known for healthy ingredients.”

Young male dominance

Demographically, energy drinks are favored by males; about one in eight men in the U.S., or 15.5 million, drink energy drinks, while only about one in 12 women, or 15.5 million, imbibe energy drinks, according to BMC’s report.

Twenty-one percent, or 6.6 million, of consumers between the ages of 18- to 24-years-of-age are nearly twice as likely to drink energy drinks compared with the national average, it notes. The second highest index was found in the 25- to 34-year-old age range, which comprises roughly 30 to 35 percent of energy drink consumers.

Geographically, consumption of energy drinks is highest in the West, with nearly 27 percent of adults consuming pick-me-up beverages compared with Southerners and Midwesterners at 3 percent and 1 percent, respectively. Hispanics are the most likely ethnic group to imbibe energy drinks followed by Black, Asian and White consumers, it adds.

Fueled by new product innovation and a desire to portray energy drinks as more natural, Euromonitor’s report notes that “today’s products have tried to leverage the consumer fascination with buzzwords such as natural and organic, creating 9 percent off-trade volume growth in 2015,” it says.

Yet, the report notes that most consumers perceive energy drinks to be inherently unnatural when compared with other naturally caffeinated products, such as coffee or tea. And concerns about safety with the energy drinks and shots markets prompted a call for heightened regulation, but currently energy drinks are regulated the same way as other beverages or supplements, it adds.

Chicago-based Mintel, in its report titled “Energy Drinks US,” notes that the energy shot segment has struggled since its 2011 growth. “Energy shots experienced an estimated 4 percent sales decline in 2015, hitting $1.18 billion,” it states. “Future growth is expected to remain stagnant … decreasing an additional 1.8 percent in the period from 2015-2020.”

Although consumers’ awareness of the energy drink and shot category is increasing, the report notes that overall consumption still is limited, with millennials likely to consume energy drinks/shots before exercise. “This fits with today’s greater focus on health and physical activity,” it says. “There are additional opportunities to reach mothers through on-the-go consumption or usage while performing household responsibilities, as mother over index for these drinking occasions.”

With a 90 percent share of the market, 5-Hour Energy, a brand of Farmington, Hills, Mich.-based Living Essentials, is dominating the energy shot category, BMC’s report notes.

The past few years, the brand has leveraged this segment leadership by various causes. This summer, 5-Hour Energy continued to support U.S. military causes with the launch of its limited-edition Extra Strength Cherry red-white-and-blue bottle. This was the first time the Extra Strength Cherry flavor was featured on the patriotic bottle, as previous years featured the regular-strength Cherry flavor, the company says.

For every limited-edition bottle that sold through July 31, the company donated $0.05 to the Special Operations Warrior Foundation (SOWF). “Through the generosity of Living Essentials, the financial support received through the sale of Extra Strength Cherry 5-Hour Energy shots will help us provide college educations to the families of fallen special operations heroes,” said Joseph Maguire, retired vice admiral and SOWF president and chief executive officer, in a statement.

Yet, the energy shot market itself will post minimal growth, from a projected $618.7 million in wholesale dollars and a 1 percent increase in 2016 with low single-digit 1.5 percent growth year-to-year for an estimated $647.2 million by 2019, according to the report.

However, the energy drinks market will continue to post solid gains to 2019. “Wholesale dollar sales are anticipated to advance to a compound annual growth rate (CAGR) to finish 2019 at $9.5 billion,” it adds. “… Retail sales won’t grow as fast, [but] 2019’s anticipated sales of $16.1 billion would be nothing to sneeze at.”