The U.S. coffee market remains steady, but a few trends are having an impact on it. A 2015 Gallup study found that Americans are drinking just as much coffee now as they were in 1999, about 2.7 cups a day. “Sixty-four percent of U.S. adults report drinking at least one cup of coffee on an average day, unchanged from 2012 and remarkably similar to the figure in 1999,” Lydia Saad explained in her July 2015 report titled “Americans’ Coffee Consumption is Steady, Few Want to Cut Back.” “Additionally, coffee drinkers currently report consuming just under three cups of coffee per day, also unchanged.”

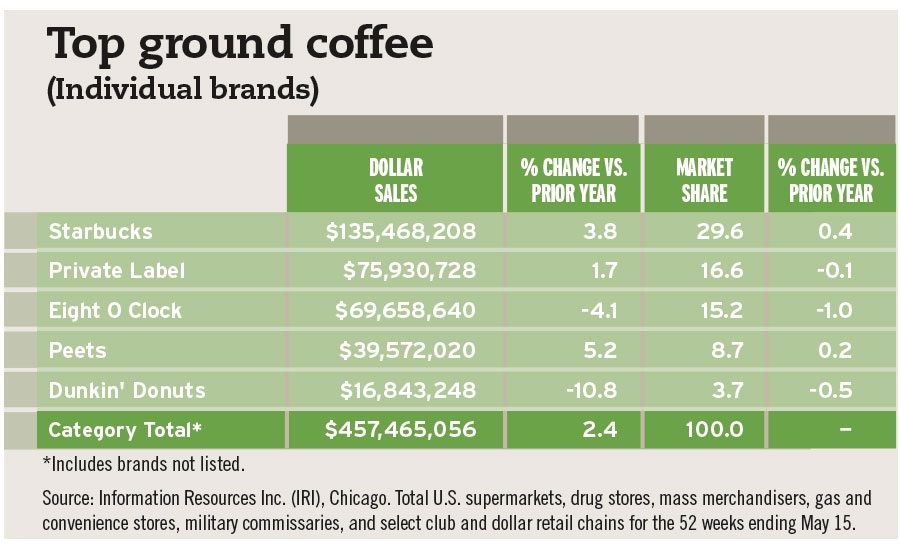

Although American’s aren’t drinking more coffee, the market continues to grow. According to data from Information Resources Inc. (IRI), Chicago, dollar sales for the overall coffee category reached $9.5 billion for the 52 weeks ending May 15 in U.S. supermarkets, drug stores, mass merchandisers, gas and convenience stores, military commissaries, and select club and dollar retail chains, a sales increase of 4.5 percent year-to-date.

The category also is driving new formats and varieties. “There have been some major brand and format launches in the U.S. in the last year, including the launch of McCafé in K-Cups and bagged coffee. This leds to a lot of promotions in the category, particularly for the K-Cup format,” Lauren Masotti, client manager for U.S. beverages at New York-based Kantar Worldpanel US, said in Beverage Industry’s September 2015 issue.

Eric Penicka, research analyst for Chicago-based Euromonitor International also explained in the September 2015 issue that some of coffee’s market growth is due to increased prices, largely a result of the growth of coffee pods and an interest in premium coffees. “Overall, the retail unit price of coffee rose by 4 percent, driven by coffee pods and fresh coffee beans,” he said. “Coffee pods are capturing an increasing share of the coffee market and have [a] considerably higher unit price than any other coffee type. Meanwhile, consumer migration to premium coffee beans is driving prices higher as well.”

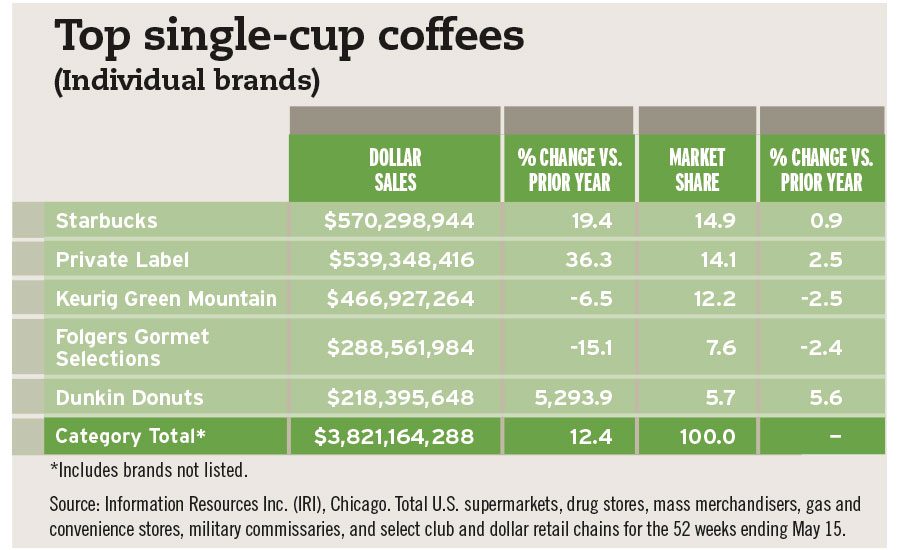

IRI data shows that single-cup coffee experienced a sales increase of 12.4 percent, for $3.8 billion dollars for the 52 weeks ending May 15.

“The convenience and simplicity [single-serve pods] offer has led to their continued growth, and they are the primary reason for growth in coffee in terms of value sales,” Penicka said. “Coffee pods have been the driver of coffee growth in value terms.”

Another trend grabbing attention is cold-brew coffee. However, experts noted that the trend has not yet grown large enough to significantly impact sales or further penetration.

“Cold brew, despite receiving a lot of attention in the press, remains very niche,” Penicka explained. “On-trade (foodservice) has been the backbone of this, and, until recently, was reserved to independent, specialty coffee shops.”

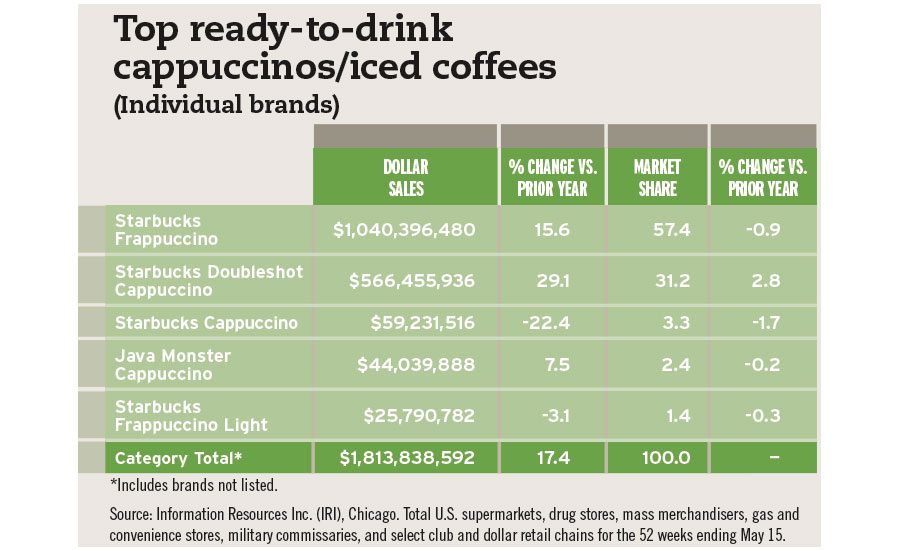

RTD coffees also continue to grow in popularity and variety. According to IRI data, the iced coffee/cappuccino segment experienced sales increases of

17 percent year-to-date for $1.8 billion in the 52 weeks ending May 15. Although Starbucks’ coffee-based RTD beverages are leading the pack, competition can be seen from the energy drink category as Java Monster took the No. 4 spot for sales in this coffee segment, IRI data shows.

Experts say this is because frequency of purchases has grown in the segment. “Ready-to-drink coffees (iced, packaged in containers) boomed into the market in the past year or two, but still are a sub-segment of a niche category in the market,” Kantar’s Masotti explained in the September 2015 issue. “Penetration has stabilized, but frequency has grown — the category attracted users and they really like drinking it.”

Euromonitor’s Penicka noted that category growth will come slowly. “Coffee growth in volume terms is expected to inch up at a [compound annual growth rate] (CAGR) of 1 percent between 2014 and 2019,” he said. “Retail value is expected to slow to a CAGR of 2 percent, largely a result of market saturation of coffee pods in the next couple of years. RTD coffee is expected to have a healthy CAGR of 4 percent in both value and volume terms.” BI