In the Two of a Kind song “All Over This World,” the singers open with, “All over this world, all over this world; People are alike, but not the same; All over this world.” As more consumers embrace a more globalized world, the United States is seeing an increasing influence from other cultures. These multi-cultural consumers are impacting not only how consumer packaged goods (CPG) companies bring new products to market, but how they market, manage and merchandise existing brands.

“Multi-cultural consumers are transforming the U.S. mainstream,” says Eva Gonzalez, executive director of diverse consumer insights for New York-based Nielsen. “Propelled by the twin engines of population growth and expanding buying power, they are at the leading edge of converging demographic and social trends that are reshaping how marketers and advertisers use culture to connect with increasingly diverse customers.”

Classifying a multi-cultural consumer with more than one culture or ethnic heritage or background (Asian Americans, African Americans, Hispanics, etc.), Gonzalez explains that these shoppers have taken on an ambicultural identity, which allows them to competently function in both cultures by maintaining their heritage but seeing themselves as Americans.

“Multi-cultural consumers are expressive and inclusive, which very often allows multi-cultural consumers to simultaneously maintain their cultural heritage and see themselves as part of the new mainstream, allowing them to mix and match endless choices and products to suit their effortless duality in lifestyles and tastes,” she says.

Strength in numbers

Their increasing share of the population has contributed to the influence that multi-cultural consumers have had as they enter the consumer marketplace. Citing Nielsen’s study “The Multicultural Edge: Rising Super Consumers,” Gonzalez says that multi-cultural consumers rapidly are becoming the core of the U.S. population.

“Today, African American, Asian American and Hispanic consumers account for more than 120 million people combined (38 percent of the total population),” she says. “These groups are projected to increase by 2.3 million each year before becoming a numeric majority of the population by 2044, according to the U.S. Census. With expansive buying power and unique consumption habits, multi-cultural consumers are an emerging consumer force in the country.”

Chicago-based Information Resources Inc. (IRI) also notes the contribution that multi-cultural consumers will have on population growth, particularly Hispanic consumers.

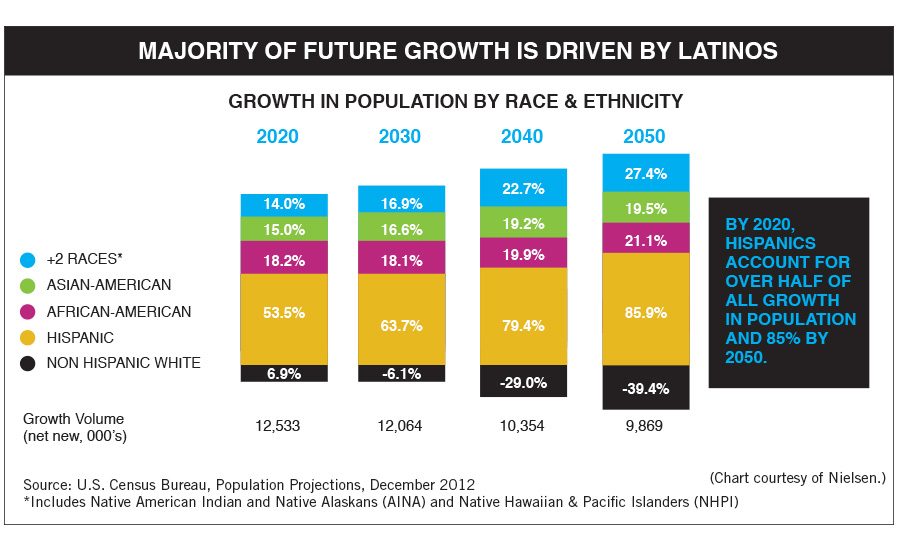

In its July 9, 2015, presentation “Connecting to the Hispanic Consumer,” IRI notes that Hispanics will outpace other ethnic groups in their contribution to population growth percentages. During the next five years, Hispanic consumers are forecasted to account for 53 percent of that growth. African American ranked second at 16 percent and Asian was 15 percent.

Sourcing the U.S. Census Bureau’s Population Projections from December 2012, Nielsen predicts similar numbers for 2020 — with African American slightly higher at 18.2 percent — and anticipates even more growth in the coming decades.

In an Aug. 7, 2015, post by Sarah Boumphrey, head of strategic, economic and consumer insight for Chicago-based Euromonitor International, the analyst notes that in the 10-year span from 2004 to 2014, the ethnic minority population in the United States increased from 30.6 percent to 37.9 percent. The market research firm estimates those numbers will increase to 44.5 percent in 2030.

Points of differentiation

What helps set multi-cultural consumers apart from non-multi-cultural consumers is their embracement of technology, research indicates.

“Connected and mobile savvy, multi-cultural consumers use their smartphones and other devices at much higher rates and more intensely than their non-multi-cultural counterparts,” Nielsen’s Gonzalez says.

In IRI’s presentation, it reports that 50 percent of Hispanics have said they purchased grocery items online at least once in a calendar year. This outperforms the general population where 40 percent indicated as much.

Smartphone usage for shopping also showed a higher incidence for millennials who are bilingual or Spanish-language-preferred versus English-language-preferred or non-Hispanics. IRI reports that of the millennials that spend three or more hours on the Internet using their smartphone, bilinguals were the highest at 64 percent. Spanish-language-preferred came in No. 2 at 59 percent compared with 53 percent of English-language-preferred and 31 percent of non-Hispanics.

Channeling multi-culturals

Taking into account ambicultural consumers’ tendency to over-index various products and services, these consumers are having a growing influence on the CPG market across various retail channels.

Nielsen’s Gonzalez explains that Nielsen has defined multi-cultural “super consumers” as those who comprise the Top 10 percent of households that drive at least 30 percent of sales, 40 percent of growth and 50 percent of profits of a CPG category.

“Multi-cultural consumers comprise a disproportionate share of many categories, such as dairy, baby food and diapers, laundry supplies and detergents, school supplies, and other family goods,” she notes. “Of 126 grocery store categories reviewed,

45 categories (36 percent) over-index in total rate of spending for all multi-cultural consumers compared to non-multi-cultural consumers. These attitudes and behaviors demonstrate cultural and behavioral traits unique to the various ethnicities.”

When it comes to Hispanic consumers, this group will spend at least $10 more on each visit in comparison to the total market across the board of consumable and non-consumable CPG products, Gonzalez highlights.

For example, when it comes to adult beverages (beer, wine and spirits), Hispanics spend on average $51 during a shopping trip vs. $39 for the total market. And across the Top 15 CPG categories — which include carbonated soft drinks, beer and malt-based beverages, wine, and coffee — these consumers led the growth for all, according to Gonzalez. “Depending on the category, Hispanic volume helped to grow or at least stem some of the declines,” she adds.

Additionally, Hispanics are more engaged with the beer category. In Nielsen’s “What’s Your Drink? | Alcoholic Beverages’ Multicultural Motor,” the market research firm identified that 44 percent of Hispanic adults stated they have consumed a beer within the past 30 days, slightly higher than the U.S. average. Among the beer segments they consumed were domestic light beer and imported beer, it reported.

The demographic wasn’t exclusive to beer, though, as wine and liquor experienced growth worth tens of millions of dollars from the Hispanics as well, according to Nielsen.

“Hispanics contributed with 13.3 percent (dollar sales Hispanic Share) to alcoholic beverages in February 2016 and 12.8 [percent] to non-alcoholic beverages, according to Nielsen Target Track,” Gonzalez added.

Hispanics are not the only multi-cultural segment having a positive effect on the beverage alcohol market. For instance, African American consumers are 14 percent more likely than the total market to have consumed vodka in the past month, while more than 40 percent of Asian American shoppers consumed or bought a bottle of wine, liquor or beer in that same timeframe.

Yet, identifying what product factors resonate with multi-cultural consumers also should be considered when forecasting the path to purchase. In Chicago-based Mintel’s December 2015 report titled “Hispanics and Brand Loyalty – US,” the market research firm reports that Hispanics value functional aspects in brands.

“Hispanics are loyal to one brand over another because they see quality in it,” the report states. “Affordability, dependability and trust also reinforce the brand’s appeal. In this context, Hispanics define quality as a product or service that meets expectations at a reasonable price.”

Mintel also noted the importance of quality and brand loyalty for African American consumers. In “Black Consumers and Brand Loyalty,” which also was published in December 2015, the market research firm highlights that with more than 44 million consumers across 16 million households, African American consumers offer great opportunity for CPG brands.

To help tap into the more than $1 trillion in buying power that this demographic maintains, Mintel segmented African American consumers into three categories: Ambassadors, the most loyal to brands of the three; Savvy Brand Seekers, a loyal group that looks for high quality but will trade brands for bargains; and Devoted Penny Pinchers, which are driven by low cost and aren’t conscious of brand name.

Ambassadors account for 38 percent of the African American community (12.1 million people) followed by Devoted Penny Pinchers at 35 percent (11 million).

Savvy Brand Seekers represent the remaining 27 percent (8.3 million people).

“Black consumers are very brand name conscious and brand loyal — the majority know which brands they’re planning to buy before they actually go shopping,” the report states. “Many are buying some of the same brands they grew up on, which speaks to the level of influence their parents have on shaping their shopping behaviors, even as adults. Quality, dependability, trust and longevity play an important role in driving loyalty, but those are the table stakes to enter the game.”

Citing data from a July 2014 report titled “Black Consumers’ Attitudes toward Advertising – US,” Mintel notes that 46 percent of African Americans represent the Cultural Activist segment, a sub-demographic that could be identified as being more Afro-centric and has a strong cultural connection to the African American community. A large portion of the three loyalty groups, particularly Ambassadors and Savvy Brand Seekers, make up the Cultural Activist segment, it adds.

“To gain their loyalty, Blacks want brands to go out of their way to get to know and communicate with them in a way that they can relate to on a personal and cultural level,” Mintel’s report states.

Nielsen’s Gonzalez echoes similar sentiments about multi-culturals. “Multi-cultural consumers gravitate to brands, products and activities that reinforce their cultural roots,” she says. “And these behaviors are affecting the purchase behavior of non-multi-cultural consumers, too.”

Given multi-cultural consumers’ estimated growth in the years to come, Gonzalez says marketers and advertisers’ ability to understand the cultural essence that drives these consumers will give them a glimpse into future market trends as well as an opportunity to build long-lasting consumer-brand relationships.

“Multi-cultural shoppers may be the key to the future, not just because of their numbers, youth and economic clout, but because their unprecedented influence on the attitudes and consumption habits of non-multi-cultural consumers is upending outdated assumptions and enlarging and expanding the multi-cultural market opportunity,” she says.