With the Summer Olympics in Rio de Janeiro, Brazil, on the horizon, athletes like American gymnast Simone Biles and Jamaican sprinter Usain Bolt are on a quest for Olympic Gold on the world’s biggest stage. Although the average person might not aspire to be an Olympic-caliber athlete, more consumers are quenching their thirst and powering up with sports and protein drinks, according to industry experts.

A mixture of carbohydrates that supply energy and electrolytes that maintain fluid balance, sports beverages, like Purchase, N.Y.-based PepsiCo’s Gatorade and Atlanta-based The Coca-Cola Co.’s Powerade, are the fifth largest New Age category by dollar sales and third by volume, according to New York-based Beverage Marketing Corporation’s (BMC) October 2015 report titled “U.S. Sports Beverages through 2019.” Among the brands, Gatorade and Powerade comprise 90 percent of the volume in the sports drink industry, it adds.

Although the term isotonic can be loosely used to describe many sports drinks, the report notes that not all fluid replacement drinks technically are isotonic beverages. “To be truly isotonic, the product must replace lost body fluids, electrolytes and glucose in similar concentrations to existing body fluid without causing either swelling or shrinkage of cells,” the report explains.

Authored by BMC Senior Editor Roger Dilworth, the report also notes that sports drinks are just one segment — albeit one of the largest segments in the competitive New Age beverage market — in the spectrum of functional beverages, defined as such because they provide some degree of medicinal or health benefits.

“The global wholesale sales of sports beverages was $11.2 billion in 2014, which is 5.1 percent more than 2013’s $10.7 billion and up from $4.7 billion in 2002. Global sports beverage wholesale dollars are expected to advance at a five-year compound annual growth rate (CAGR) of 3.5 percent from 2014 (the latest year in which figures are available) to $13.3 billion in 2019,” the report states.

Flavor fusions

In order to exploit an edge over flavored waters, sports beverage purveyors have increased the range of flavors they offer, BMC’s report notes. For example, Gatorade introduced sub-lines to its Thirst Quencher line, which are designed to attract consumers that are beyond its traditional 18- to 24-year-old male demographic, it says.

Powerade also has explored new flavor additions. Earlier this year, The Coca-Cola Co. released Powerade Twisted Blackberry and Powerade Ion4 Watermelon Strawberry Wave.

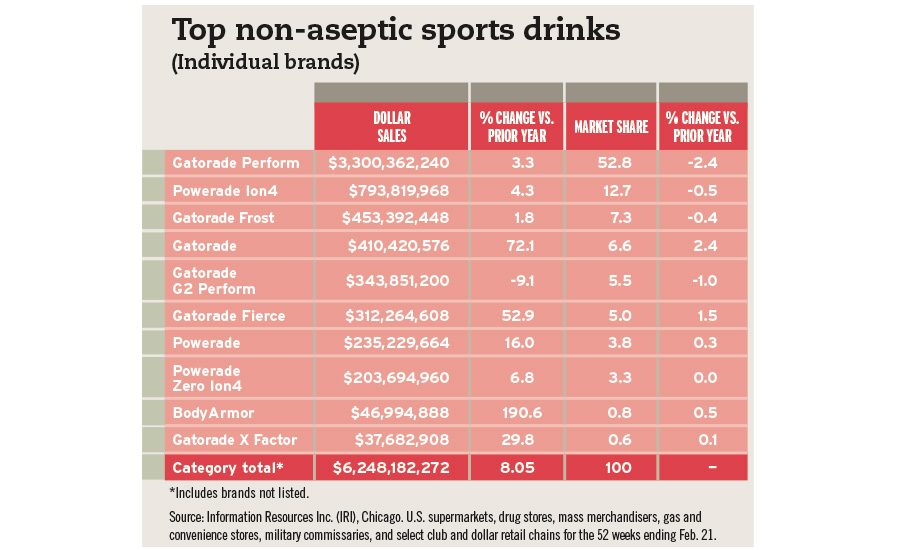

According to Chicago-based Information Resources Inc. (IRI), non-aseptic sports drinks were up 8 percent in dollar sales, totaling $6.2 billion for the 52 weeks ending Feb. 21, in U.S. supermarkets, drug stores, mass merchandisers, gas and convenience stores, military commissaries, and select club and dollar retail chains.

With nearly 53 percent of the market share, the No. 1 brand, according to IRI data, Gatorade Perform, generated $3.3 billion in sales, a 3.3 percent increase year-over-year, and was followed by Powerade Ion4, which amassed nearly $794 million, a 4.3 percent increase year-over-year in U.S. multi-outlets, IRI data notes. At nearly 191 percent, BodyArmor experienced the largest percentage increase, followed by Gatorade and Gatorade Fierce at 72 percent and nearly 53 percent, respectively, based on IRI data.

BodyArmor’s triple-digit growth could be a result of support from Dr Pepper Snapple Group Inc. (DPS), Plano, Texas. The company has invested $26 million in Beverly Hills, Calif.-based BA Sports Nutritional LLC, which owns the BodyArmor line of premium sports drinks. An additional $6 million investment in

April raised the company’s ownership position from 11.7 percent to 15.5 percent, the company says.

“BodyArmor has been a winning addition to our allied brand lineup, enabling us to build our presence in the growing sports drink category with a great-tasting and differentiated product,” said Rodger Collins, DPS president of packaged beverages, in a statement at the time of the added investment.

In its March 2016 report titled “Sports Drinks in the US,” Chicago-based Euromonitor International notes that the term “sports drinks” is a misnomer, because both athletes and non-athletes are consuming sports drinks. Yet, increased pressure from substitute products, such as ready-to-drink (RTD) protein drinks and coconut water, have mitigated some of the low single-digit growth in 2015, the report notes.

“The high sugar and sodium content of these beverages, positioned as necessary for replenishment, amount to approximately half that of the leading cola carbonates and make their flavor appealing to consumers of all types,” the report states. “The somewhat healthy, yet somewhat unhealthy, nature of these beverages means that the category has been less sensitive to shifts in consumer lifestyle trends than others, allowing for relatively consistent year-on-year growth, with an off-trade volume CAGR of 3 percent for the review period 2010-2015.”

Powering up with protein

In 2015, the RTD protein drinks segment grew to nearly $572 million, with wholesale dollars increasing by 5 percent; this is nearly identical to the category's growth in 2014, but a deceleration from the 7.9 percent growth in 2013, according to BMC. Only one brand, Muscle Milk, is demonstrating signs of breakout success to date, it adds.

New York-based Kantar Worldpanel USA’s Client Analyst Kevin Weissheir notes that protein drinks steadily are increasing in usage occasions. “Consumers … are using protein-rich beverages to both nourish their bodies after activity and as a meal or snack replacement,” he says. “From an athletic standpoint, protein beverages can serve as a refueling of the body after any kind of physical activity. For an everyday consumer, they are a great option as a meal supplement or as an on-the-go meal.”

Downers Grove, Ill.-based Bio-Engineered Supplements and Nutrition Inc. (BSN), a division of Glanbia plc, expresses similar sentiments. “Everyone needs protein on a daily basis, and for those who don’t have the time to get an adequate amount through foods, ready-to-drink protein from dairy sources is a good alternative,” BSN Communications Coordinator Tim Weigard says.

In addition to its line of protein powders, BSN offers Syntha-6 RTD protein shakes, which are available in Chocolate and Vanilla varieties and contain 40 grams of protein and 2 grams of fat in each 14.5-ounce aluminum bottle.

Manufacturers of other non-beverage protein products also are recognizing the growing consumer base for protein drinks. Berkeley, Calif.-based PowerBar Inc., a division of Post Holdings Inc., launched PowerBar Protein Shakes in Chocolate and Vanilla varieties. The beverages can be used to help rebuild muscle, replace a meal or as a healthy snack, the company says. Made with 30 grams of protein, PowerBar Protein Shakes contain only 2-3 grams of sugar in each 14-ounce bottle.

Kantar Worldpanel’s Weissheier adds that protein beverages no longer are solely seen as nutritional supplements. “Consumers can now find protein-enriched smoothies, juices and alternative dairy,” he says. “A major variation that is beginning to take hold is high-pressure pasteurization (HPP) juices and smoothies with added protein. Consumers are attracted to the naturally filtered juice with the added nutritional benefits of protein.”

During March’s Natural Products Expo West, San Bernardino, Calif.-based Evolution Fresh, a subsidiary of Starbucks Coffee Co., Seattle, announced the expansion of its lineup of cold-pressed, HPP juices to include 93 percent juice protein smoothies in two flavors: Protein Power Berry and Protein Power Greens. Available nationwide at Starbucks locations, the Protein Power Berry flavor is rich, fruity and contains 14 grams of protein in each 15.2-ounce bottle, while the Protein Power Greens flavor is packed with 26 grams of protein, the company says.

RTD protein drinks as meal replacements also are gaining ground. Chicago, Ill.-based SPINSscan Natural reports that the category is up 6.8 percent year-over-year and generated $2.3 billion in sales for the 52 weeks ending Feb. 21 in natural, specialty gourmet and multi-outlets, excluding Whole Foods Market. Additionally, it reports that sports beverages and isotonics grew to $3.37 billion, an increase of 7.1 percent, for the same timeframe.

Athletes fuel up

In their quest to be the best, athletes are turning to sports and protein drinks to fuel their bodies. For example, in January, three-time World Champion and U.S. gymnast Biles teamed up with Chicago-based fairlife LLC, which manufactures Core Power high-protein drinks, as a member of Core Power’s Everyday Awesome team of athletes, along with Dallas quarterback Tony Romo and New York Rangers captain Ryan McDonagh.

Available in Vanilla, Chocolate and Banana varieties, Core Power CORE contains 26 grams of protein and 240 calories, while Core Power Light contains 20 grams of protein and 150 calories and is available in Chocolate and Strawberry Banana flavors.

Dairy-alternative beverages also are appealing to sports and protein drink consumers by taking advantage of Olympic marketing opportunities. Sacramento, Calif.-based Blue Diamond, which manufactures Almond Breeze non-dairy beverages, partnered with the USA swim team to fuel athletes before and after they’re in the pool, the company says.

Yet, sports and protein drinks are not just for the hard-core athlete, notes Chicago-based Mintel in its January 2015 report titled “Nutritional and Performance Drinks,” adding that the category’s growth and wide appeal of these products, beyond athletes, has resulted in significant sales increases.

“Some 61 percent of U.S. adults use sports drinks … [and] 34 percent of sports drinks users drink them even when they are not working out,” Mintel Food and Drink Analyst Beth Bloom says. “This [raises] to nearly half of respondents age 18-24. Such usage indicates the value of product positioning that moves beyond a sports focus and highlights attributes such as hydration and flavor.”

Experts note that the sports and protein drinks category is expected to remain a solid performer because of continued interest in health, convenience and function, but the weight-loss drink segment will continue to struggle through 2019.

When it comes to wholesale dollars, BMC predicts that sales of sports beverages in the United States will rise to $5.8 billion by 2019, with a steady CAGR of 3.5 percent from $5 billion in 2015. It adds that the U.S. protein drinks market also will experience steady growth — from an estimated $571.9 million in 2015 to $671.4 million in 2019, a four-year CAGR of 4.2 percent.

“Opportunity exists to grow sales in the category by increasing usage occasions and establishing relevance in the lives of consumers,” Mintel’s Bloom says. “Promoting products for their proven efficacy in meeting a range of specific consumer needs, e.g. hydration, weight management, skin health, sustained energy, will [help] encourage consumption.”

Brands capitalize on the vigor of the vegan and vegetarian market

While experts note that health-and and-wellness trends are having a major impact on the success of the sports drink market, the category also is experiencing fragmentation based on functionality, notes Portland, Ore.-based Steviva Ingredients’ President Thom King.

“We attribute this to a driving goal of clean label sugar reduction and new innovations in minerals, herbal derivatives and supplements that are added to these drinks,” he says. “Consumers are moving toward reduced sugars and increased functionality. We are seeing a rapid increase in our business in the sports drink category, [which] we are attributing to the new FDA nutritional panel requirement claiming added sugars.”

Tina Rzeha, marketing associate for beverage ingredients at Hoffman Estates, Ill.-based Sensient Flavors, agrees. “From sports drinks containing almond milk, coconut milk and even coconut water containing whey protein, the options seem to be limitless,” she says. “Clean labels and natural ingredients are on the rise in this category.”

Fermented sports drinks, like kefirs and kombuchas and brain brain-function enhancers, also are on the rise, King adds, while Sensient Flavors’ Rzeha predicts that botanical flavors will cater to consumers’ need for more natural beverages.

Steviva Ingredients’ King predicts that as more brands try to capitalize on the vigor of the vegan and vegetarian market, the protein drinks market will continue to dramatically increase. “This category is increasing particularly in the reduced sugar, dairy-free and pea protein categories. We see great growth with pea protein [and] are seeing steady growth in cricket proteins,” he says.