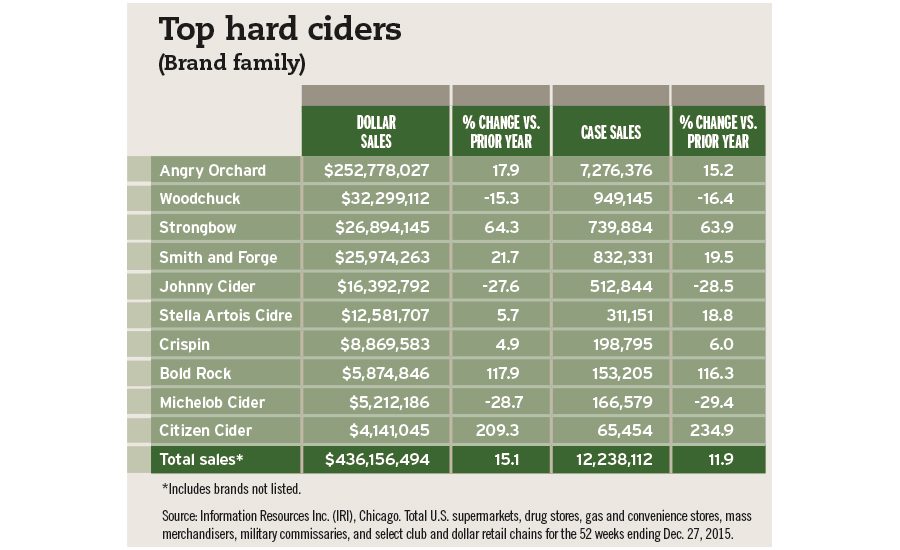

Although hard cider stems from a smaller market share of the beer category, the hard cider segment continues to outpace the beer category as a whole. According to Chicago-based Information Resources Inc. (IRI), hard cider was up approximately 15 percent for more than $436 million in dollar sales in the 52 weeks ending Dec. 27, 2015, in U.S. supermarkets, drug stores, mass merchandisers, gas and convenience stores, military commissaries, and select club and dollar retail chains. Case sales growth was just under 12 percent in that timeframe.

Angry Orchard, a brand of Boston-based The Boston Beer Co., is the segment leader accounting for nearly 58 percent of dollar sales share. The craft brewer continues to make gains with Angry Orchard within the hard cider segment and is capitalizing on its hard cider dominance with line extensions.

In February, the brand announced its new line: Orchard’s Edge. The project will feature hard ciders inspired by unexpected ingredients and aging processes, the company says. The first two varieties — Knotty Pear and The Old Fashioned — are available year-round. Both also are aged on American oak and feature non-apple, fruit-like pears and oranges along with exotic spices like cardamom, it adds.

Analysts recognize that the success of hard cider is resonating with producers outside of the craft family. “[Hard cider] is faring very well, but off of a small base,” says Eric Penicka, research analyst for Chicago-based Euromonitor International. “No doubt, beer manufacturers (AB InBev, MillerCoors, Heineken) would love to, and are, actively trying to tap into this growth.”

One of the top performers for the segment, Strongbow Hard Apple Cider had a sales increase of 64.3 percent for the 52 weeks ending Dec. 27, 2015, in IRI-measured channels. A brand of White Plains, N.Y.-based Heineken USA, Strongbow utilized the seasonality associated with hard cider to reach consumers this past fall.

To increase awareness of Strongbow Season, the brand continued its Bestest Over Ice campaign, the company says.

Smith and Forge, a brand of Chicago-based MillerCoors, also posted strong numbers for 2015.

The brand saw a sales increase of nearly 22 percent in IRI-measured channels for the 52 weeks ending Dec. 27, 2015.

However, not all brands fared well. Although it still maintains its No. 2 position in the hard cider segment, Woodchuck Hard Cider, a brand of Middlebury, Vt.-based Vermont Hard Cider Co., saw sales decrease 15.3 percent. However, a new agreement with Los Angeles-based Pabst Brewing Co. (PBC) could change that.

A subsidiary of C&C Group plc, Vermont Hard Cider Co. entered into an exclusive long-term partnership agreement with PBC for the sale and distribution of the company’s hard cider brands in the United States. The agreement took effect March 1.

Under the terms of the partnership, PBC has the exclusive license to distribute, market and sell all of Vermont Hard Cider Co.’s U.S. Cider Brands portfolio including Woodchuck, Gumption, Wyder’s and Hornsby’s, in addition to the company’s portfolio of International Cider Brands from Ireland and England, including Magners and Blackthorn.

Vermont Hard Cider Co. will retain full ownership of its U.S. Cider Brands and related assets, including its cidery in Middlebury, Vt., as well as distribution rights for the U.S. Cider Brands in all global markets. Under the terms of the agreement, PBC has an option to acquire Vermont Hard Cider Co.’s U.S. Cider Brands and related assets, subject to customary regulatory approval. Consideration will be determined at the time of any exercise of the option; however, it will at least be consistent with the carrying value of the assets.

Challenges ahead

Although hard cider saw case sale gains for the year, a micro analysis of the sales data could suggest a challenging road ahead for the beer segment.

“[C]ider began to experience tough trends in the latter half of the year, down 3.5 percent for the second half of 2015, and even steeper declines through the holidays — down 10 percent in December 2015,” says Danelle Kosmal, vice president of beverage alcohol practice for New York-based Nielsen. “This is particularly challenging considering the seasonality of cider in the U.S., and the volume it typically gains during the fall and early winter months.”