Health and wellness properties continue to drive flavor choices for many beverage formulators as health-conscious consumers are realizing that in addition to various health benefits, beverages also can be refreshing and flavorful.

“The overarching health and wellness trend is the driver behind a multitude of the smaller micro trends that fall under the health and wellness umbrella,” says Victoria Vaynberger, marketing and consumer insights manager at David Michael & Co., Philadelphia. “Natural and ‘authentic’ are being sought after by consumers in hopes of a greater transparency between the packaging of a beverage and what’s actually inside of it. … Consumers are also hungering for functionality from their beverages, which lends itself to flavors from sources known to deliver functional benefits.”

Consumers are looking for more natural products and natural-tasting flavors, affirms Jessica Jones-Dille, associate director of marketing for Wild Flavors Inc., Erlanger, Ky. “They want ‘real’ true-to-fruit flavors and are more cognizant of seasonality and origin of fruits, so they look for products that fulfill that preference,” she says.

Expanding consumer palates is another important driver. “Consumers are looking for interesting, new flavor experiences and finding them in blends, varietals and global flavors that they may not have had before,” says David Wasnak, marketing communications manager at Robertet Flavors, Piscataway Township, N.J.

This includes a trend toward non-traditional flavor profiles, according to Kim Carson, marketing manager for beverages at Givaudan Flavors, Cincinnati. “An emerging trend that has slowly, but finally started to gain consumer acceptance is the use of heat, spice or herb flavors in beverages,” she says. “A great example would be basil, a flavor profile that has been around for a very long time, but when added at a very low level to a beverage with other flavors can provide complexity and uniqueness to create a great-tasting beverage. Currently this trend exists mainly within the alcohol beverage segment, but expect in the coming years to see this trend shift into non-alcohol beverages.”

Yet, familiarity is still a trend that continues to be a driver as consumers seek out mainstream, traditional and comforting flavors, Carson adds.

“Mainstream flavors provide relief from the hectic schedules of everyday life and security in what are still challenging economic times,” she says. “Well-known flavors like lemonade, apple and berry have and will continue to dominate new product launches in 2012 and beyond because they resonate with consumers’ needs.”

Appealing flavors

In a broad sense, flavor trends can be fairly consistent across multiple beverage categories because oftentimes flavor trends are driven by macro trends, such as health and wellness, for example. In addition, certain flavors are more conducive to helping meet these larger consumer demands, such as sugar reduction and natural ingredients, says David Michael’s Vaynberger. For example, it is very common to see the use of citrus and tropical flavors used across all categories, Givaudan’s Carson says.

“Certain categories do offer a more emerging flavor experience versus the mainstream,” she explains. “In almost every beverage category, on a monthly basis some type of orange-flavored beverage is launched; however, almost always there is at least more than one beverage launched with a unique flavor pairing using orange. For example, emerging flavor pairings might be orange and cinnamon or blood orange and yuzu.”

However, not all flavors translate favorably in different formats, and that’s where the road splits. For instance, ginger flavor works well in teas and carbonated beverages, but it doesn’t partner as well with a milk format, Vaynberger says.

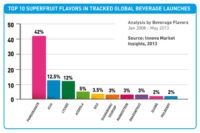

As such, each segment of the beverage industry has its own flavor trends. Alcohol and spirits beverages have trends reflecting exotic fruits, trendy cocktail bar drink choices and indulgent desserts, says Anton Angelich, group vice president of marketing at Virginia Dare, Brooklyn, N.Y. Functional beverages have flavors that reflect healthful associations such as superfruits, he adds.

“There seems to be a diminishing of interest in exotic and tropical superfruit flavors, and a growth in interest in domestic, well-known and comfort food-associated superfruits such as blueberry, tart cherry, blackberry, raspberry, etc.,” he says.

California Custom Fruits and Flavors (CCFF), Irwindale, Calif., is seeing requests for floral flavors such as hibiscus and lavender in calming beverages.

“Consumers are turning to ‘spa-like’ relaxing flavors,” says the company’s Philip Barone, director of flavor development. “At CCFF, we have developed cucumber-mint, pomegranate-hibiscus and Asian pear-lavender to address these needs.”

Although floral flavors are common in calming beverages, floral notes also are growing in popularity in vitamin-fortified waters and teas, he adds.

David Michael also agrees that one of the biggest emerging flavor trends in beverages right now are florals, including chrysanthemum, lavender, jasmine and orange blossom. When it comes to the world of fruit flavors, varietals are big, Vaynberger says.

“An example would be a consumer preference toward the specificity of a flavor like Bartlett pear or Asian pear rather than simply pear,” she says. Pear also is an emerging flavor right now in beverages and other food products, she adds.

The beverage category continues to be an excellent medium to deliver emerging and complex flavors, experts say.

“We’re experiencing continued interest in exotic fruits, like snake fruit, monstera deliciosa, finger lime and cloudberry as well as non-traditional blends exemplified by plumcot — a plum and apricot hybrid,” Vaynberger says. “In terms of flavor popularity, we have recently seen a surge in requests for alcohol flavors in both alcohol and non-alcohol beverages. Specifically, the classics like mojito, Margarita, mint julep and a multitude of flavors for vodka, bourbon and rum.”

In juices, beverage-makers have the opportunity to be innovative and take a little more risk into more obscure fruits, says Jim Hamernik, research and development (R&D) director at Flavorchem Corp., Downers Grove, Ill. “You can’t always put highly acidic fruit into other beverages, such as meal replacements,” he explains.

“I would add that the old standbys are always the most common requests, but some of these tropical fruits that years ago were not standards are now standards, like mango, passion fruit and coconut,” Hamernik continues.

In addition, beverage-makers are looking for more than a single flavor to help differentiate their products.

“They want a combination of different fruits and blends that are unique or unexpected,” Hamernik says. “People are trying to be creative and be a little different than their competitors.”

Allen Flavors Inc., Edison, N.J., has seen a re-emergence of multi-functional drinks with multiple flavor combinations.

“Beverage-makers want flavors that are a complex fruit or fruit plus botanical mixtures that give uniqueness to that brand,” says Cathianne Leonardi, Allen Flavors’ senior flavorist. “In the category, there is a lot of opportunity to create some really unique flavor profiles that then consumers will really associate with that brand.”

Some of the flavor trends that Wild Flavors sees include fruit varietals, exotic blends, mint combinations and floral and vegetable combinations.

“Fresh fruit nuances are popular in all categories,” Jones-Dille says. “However, spice and indulgent blends are more trendy in smoothies and coffee drinks, such as blueberry cinnamon and mint mocha.”

Wild Flavors continues to receive requests for tropical and exotic fruit blends, blends of familiar flavors with more exotic varieties, and punch-type flavors that blend new exotic flavors with traditional fruits.

Energy drink, tea and coconut water categories tend to have more unique flavor options for beverage consumers, Givaudan’s Carson says. Another category in which she notes emerging trends is the alcohol beverage category. “In this category, there are definitely more unique options for consumers with the use of exotic fruit flavors, dessert flavors or spices and herbs,” she says.

All types and manors of tea and flavored tea beverages have been an area of growth for Synergy Flavors, Chicago. The category’s growth is trending on good-for-you benefits from polyphenols and functionality, says Tom Schufreider, the company’s vice president of marketing and business development.

Robertet continues to pay close attention to ready-to-drink (RTD) tea as the category grows as well.

“In addition to the demand for bold, new half-and-half blends, we are also noticing significant interest at the opposite end of the spectrum [such as] unsweetened or lightly sweetened teas that focus less on exciting flavor combinations and more on real ‘brewed’ tea flavor,” Robertet’s Wasnak says.

With an expanding consumer market for RTD tea, Virginia Dare continues to develop new and innovative tea concentrates and ingredients.

“Virginia Dare has launched at the IFT 2012 in Las Vegas a new tea concentrate that has solubilized solids that permit the creation of a clear tea beverage without visible sediment, yet has all the mouthfeel and astringency of a solids-containing RTD tea,” Angelich says. “In a recent consumer survey of RTD tea consumers, 76 percent of in-franchise consumers indicated that they would prefer to not have tea solids/sediment in a product.”

In juices, lemonade is the new lemon, Robertet’s Wasnak says. “Offering a bold flavor that blends well with a number of fruits, lemonade’s ‘homemade’ image appeals to label-conscious consumers looking for naturally refreshing beverages,” he says. “We wouldn’t be surprised if other types of ‘ades’ begin to follow in lemonade’s footsteps in terms of flavored line extensions.”

Dairy-based beverages seem to be a perfect platform for indulgence or comfort flavors such as cookies-n-cream and strawberry cheesecake, CCFF’s Barone says. The popularity of nostalgic flavors ties in with flavors from confections and baked goods of yesteryear finding their way into dairy-based beverages, cocktails, coffee beverages, creamers and many other products, Robertet’s Wasnak says.

“The rulebooks have been thrown away,” he adds. “We are now seeing flavors that were previously thought of as applicable to specific categories or only able to be combined with certain flavors being used in every way imaginable.”

Flavor Dynamics, South Plainfield, N.J., has found superfruit blend varieties to be more popular in both RTD and brewed tea. Traditional fruits for bottled waters and carbonated beverages are more popular, says Colleen Roberts, director of sales at the company. Vanilla, chocolate, strawberry and mango still remain the most popular flavors requested from Flavor Dynamics. Recent requests for new beverages also have included mango varieties and blends including blueberry, goji berry and acai, she says.

Except for the high-proof alcohol category, which continues to look for truly unique aroma and taste profiles, Excellentia International, Edison, N.J., sees the beverage consumer as being somewhat traditional in its flavor demands. “Although there are many new fanciful descriptions, the flavor profiles have not departed greatly from what we as human beings have evolved to desire,” says Tom Buco, president of the company.

Excellentia International commonly receives requests from beverage-makers for fruit and spice combinations; blends of fruit flavors, especially with tropical flavors; berry and lemon combinations; and fruits of provenance.

Flavored malt beverages also have become big drivers in the alcohol beverage category and tend to trend toward flavors preferred by and familiar to younger legal-age alcohol consumers, such as strawberry kiwi, Synergy’s Schufreider says.

“The other trend that we see in the alcohol beverage industry, especially in vodkas, has been to really steal great ideas from other platforms, such as dessert platforms, and incorporate those flavor profiles,” he says. “You’ll see a red velvet-flavored vodka or a cotton candy-flavored vodka. That’s one of the areas that the spirits industry has done a terrific job of creating some excitement.”

With increasing Hispanic population growth in the United States, beverage-makers also are requesting Hispanic flavors as they recognize this market segment is on the rise. Tamarind, watermelon-citrus and cucumber lime are some of the recent requests received by CCFF.

Flavorchem developed a line of flavors based on the growing demand for traditional Hispanic flavors and innovative tastes for dairy and other beverages, including Baja Cacao Cake, Cappuccino, Chocolate-Cinnamon, Flan, Guava, Horchata, Mamey, Mango, Piña Colada and Tamarind. Flavorchem routinely sends representatives to Latin America to scout recent trends in flavors for foods and visit street vendors as a common source of inspiration, Ed McIntosh, the company’s marketing manager explains. Road-side vendors offering beverages such as horchata or those flavored with ingredients such as tamarind and lime have resulted in development of new flavors at Flavorchem.

“Some of these flavors like piña colada have been around forever, but when you go to Mexico and actually see how they are made, you learn about how to recreate more of that authentic Hispanic flavor rather than what has traditionally been a piña colada flavor or a mango flavor,” Hamernik says. “We’re making a more authentic flavor, like the Hispanic population would be accustomed to.”

Naturally popular

As consumers are shying away from long ingredient statements with chemical-sounding names and artificial ingredients, beverage-makers are leaning toward clean labels, which include using natural flavors.

“As natural continues to become less of a trend and more of an industry standard, not only are we seeing product developers coming to us with new projects, but they’re also reformulating established brands as consumer expectations change,” Robertet’s Wasnak says.

Givaudan has seen its requests for natural flavors tending to be more prevalent in certain beverage categories, such as refrigerated and shelf-stable juices, RTD teas and functional beverages. Carson cautions that sometimes cost and taste challenges occur when beverage formulators decide to move to natural options.

Virginia Dare also is seeing more requests for natural flavors and for flavors that can contribute to simple and consumer understandable label statements. The majority of the flavor requests that the company receives are natural, with other natural flavors (WONF) or organic compliant.

“The company’s flavorists are focusing their efforts on creating more natural flavor options and truer-to-fruit flavors,” Virginia Dare’s Angelich says.

Flavor Dynamics' creative team also continually is developing natural flavors, in particular superfruit varieties for beverage applications, Roberts says.

In addition to receiving requests from beverage-makers for more natural options, David Michael also is receiving many allergen-free, gluten-free and Whole Foods-compliant requests, Vaynberger says.

Due to the advances in the quality and economics of natural flavors, they now represent nearly all of Excellentia International’s requests and resultant flavor development efforts. Analytical chemical techniques for the trace component identification of the volatile and non-volatile components of natural materials also are helping to improve the availability of natural colors, the company’s Buco says.

Flavorchem’s Hamernik also agrees that better access to natural ingredients and new sources for natural ingredients are helping to aid their expansion.

“More people are getting further educated and preferring that if you can give them a product that looks and tastes good naturally as opposed to synthetically, they’ll choose the natural,” he says. “With some of the advances that we’ve gotten over the years, we can make better natural products.”

Allen Flavors’ Leonardi also believes that the trend is to differentiate and get as close to natural as possible and still have a shelf-stable product.

“Companies have done a great job of creating CO2 extracts, and it’s basically using carbon dioxide as the solvent,” she says. “You are really removing any unnatural solvents in the process. You are allowing for a wider range of botanicals to be available for use in organic-compliant items and adding complexity to flavors.” BI