Private Label Goes Public

By JENNIFER ZEGLER

Private label beverages are more innovative and attracting more consumers

Archer Farms Sarsaparilla soda, Vixen energy drink and Braidenwood Estates merlot — from soft drinks to energy drinks to wines, private label beverages are making inroads through innovation. Imitation generics or staid store brands no longer, new private label beverages are, in some cases, out-foxing competitors. Due to improvement in quality and the rising popularity of retailers such as Trader Joe’s, which dedicates stores solely to its own branded merchandise, private label beverages are going public.

“Private Label from a Consumer

Perspective,” a study by the Hartman Group, Bellevue, Wash., revealed

that consumers increasingly are buying private label products, especially

at Wal-Mart and Kroger. In fact, the study’s Top 10 included five

Wal-Mart and Sam’s Club private label brands: Great Value, Equate,

Sam’s Choice, Wal-Mart and Member’s Mark. Also making the list

were brands by Target, Albertsons and Safeway.

Carbonation nation

Private label carbonated beverages are escaping the

soft drink category’s imitation reputation. Some stores, especially

Target, have formulated unique flavors and brands. Target’s Archer

Farms line offers new flavor blends, including Sarsaparilla soda or Blood

Orange Italian soda. The national on-the-go chain 7-Eleven, Dallas, Texas,

launched its own Big Gulp sodas, leveraging the famous fountain drink name.

In addition to regular and diet colas, other flavors are Mint Lime Twist

and Ginger Apple Snap, all in wide mouth 20-ounce plastic bottles.

Cornering the burgeoning energy drink market, another

convenience store chain, Circle K, launched Talon and Vixen energy drinks.

The menacing-looking Talon is available in regular and sugar free

varieties, both with a citrus taste. On the other hand, Vixen is targeted

toward women – with an edge. Unlike other female-targeted energy

drinks, Vixen sports a black can and a logo with attitude. Available in

sugar-free Citrus Passion and Foxberry, the drink is formulated with the

familiar blend of energy enhancing ingredients in addition to folic acid.

“Others have had some success going after

females with pretty pink cans, but we felt that there was another, edgier

female consumer segment not being reached,” said Mark Wright,

category manager for Circle K, a division of Canada’s Alimentation

Couche-Tard in a statement. “Our in store testing confirmed that this

was true and we have high expectations for the Vixen brand.”

Full steam ahead

As Americans become more attracted to designer coffee

and more educated about the benefits of tea, private label brands are

perking up to fill the store demand for coffee and tea.

“The average coffee offering has been turned

into a dessert menu,” said Mike Ebert, president of Coffee Masters

Inc., Spring Grove, Ill., in a recent issue of Beverage

Industry’s sister publication PL Buyer. “Today’s

coffee customer is looking for products that create the much sought-after

gourmet environment.”

When stacked against Starbucks, private label coffees

are not making much of a dent on the giant’s ‘grande’

hold on the market, but that’s just grounds for improvement. The

increase in popularity of single-brew or coffee pods has created a new

market in addition to the constant appeal of bulk sizes.

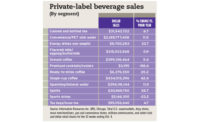

| Private Label Beverage Performance | |||||

| CATEGORY | DOLLAR SALES (IN MILLIONS) | % change vs. YEAR AGO | UNIT SALES (IN MILLIONS) | % change vs. YEAR AGO | |

| REFRIGERATED TEAS/COFFEES | $22.1 | 11.7% | 16.9 | 13.0% | |

| READY TO DRINK TEA/COFFEE | $30.2 | 8.5% | 17.1 | 0.7% | |

| COFFEE | $260.5 | 9.5% | 72.7 | -6.0% | |

| SHELF-STABLE BOTTLED JUICE | $587.4 | -3.2% | 331.4 | -9.8% | |

| BOTTLED WATER | $890.2 | 11.2% | 653.7 | -2.0% | |

| Source: Information Resources Inc. total supermarket, drug and mass merchandise sales (excluding Wal-Mart) for the 52 weeks ending Sept. 10, 2006 | |||||

| Private Label Beer Performance | ||||

| CATEGORY | DOLLAR SALES | % change vs. YEAR AGO | CASE SALES | % change vs. YEAR AGO |

| BEER | $12,630,010 | -19.0% | 719,027 | -24.1% |

| Source: Information Resources Inc. total supermarket, drug and mass merchandise sales (excluding Wal-Mart) for the 52 weeks ending Sept. 10, 2006 | ||||

| Private Label Spirit Performance | |||||

| CATEGORY | DOLLAR SALES | % change vs. YEAR AGO | VOLUME SALES | % change vs. YEAR AGO | |

| VODKA | $63,757,230 | -2.7% | 1,073,805 | -5.5% | |

| TEQUILA | $6,496,573 | 0.5% | 59,335 | 11.5% | |

| RUM | $21,351,630 | -5.9% | 309,312 | -5.5% | |

| GIN | $7,590,815 | -15.2% | 126.636 | -16.9% | |

| SCOTCH | $3,270,932 | -2.3% | 37,963 | -5.4% | |

| NORTH AMERICAN WHISKEY | $10,269,130 | -11.0% | 143,615 | -12.6% | |

| CORDIALS | $8,076,084 | -10.1% | 111,746 | -13.9% | |

| PREPARED COCKTAILS | $530,729 | 214.4% | 8,630 | 225.1% | |

| NON-ALCOHOLIC MIXERS | $29,433,920 | 2.8% | 1,432,149 | -2.7% | |

| COGNAC/BRANDY | $3,747,513 | -1.3% | 48,164 | -7.7% | |

| CATEGORY TOTAL | $154,524,500 | -3.5% | 3,351,357 | -5.1% | |

| Source: Information Resources Inc. total data from food and drug outlet sales for the 52 weeks ending Aug. 13, 2006. | |||||

“For private label, the biggest thing right now

is single-brew products,” Ebert said. “Much importance also has

been placed on the types of products that accompany coffee – this can

be anything from pastries to coffee filters. As long as it’s gourmet,

customers want it and retailers want to put their name on it.”

As a population forever in search of better-for-you

products, the U.S. tea market has grown as more benefits are uncovered.

From antioxidants to sleep benefits, Americans are lining up to steep their

teas – and private label is ready to fill the cup.

“There is a demand for natural and organic teas

right now, particularly green tea and Rooibos teas,” Lalith Guy

Paranavitana, owner of Empire Tea Services, Columbus, Ind., told PL Buyer. “These types of

tea are much sought after primarily for their health benefits.”

Paranavitana predicted the next trend in private label

teas will be nylon, pyramid shaped tea bags, which were recently

mainstreamed by Lipton. The pyramid-shaped tea bags allow room for the tea

leaves to unfurl without escaping into the brew. Tea also is primed to

escape an old stereotype.

“Specialty tea is reaching out to all

demographics,” Paranavitana says. “Gone are the days when tea

was appreciated by the ‘older folk.’ Knowledge is key. More

information is available in easy access thanks to the Internet. Therefore,

private label has a great opportunity to appeal to different demographics,

particularly college students, in an effort to fuel the category’s

growth.”

Universal appeal

Consumers thirsting for better-for-you beverages would

most likely begin searching in the bottled water and juice aisles. Both

categories have seen great growth from consumers searching for healthier

drinks for themselves and their families.

“The juice and water categories cross all

demographics and lifestyles,” said Shawn O’Connell, marketing

manager for Clement Pappas, Seabrook, N.J., in PL

Buyer. “The subcategories offer something

for each individual or family. Children are the largest opportunity;

however the baby boomers probably offer the largest growth

opportunity.”

In this category, private label is expanding due to

the desire and education of consumers.

“People are drinking less soda and are looking

for healthier alternatives such as juice and water,” O’Connell

said. “Staying ahead of the trends with new and exciting flavors, and

allocating the proper resources to grow items is one way to increase sales.

Store brands are the perfect way to help retail drive the health and

wellness trend.”

Flavored water and antioxidant-rich juice blends

provide new frontiers for private label bottled water and juices. Light

juices also are an opportunity as parents search for lower calorie, lower

sugar options for their children. In this segment, product packaging,

quantity and placement within the store will increase the private label

appeal for families as well as grab-and-go consumers.

Great grapes

Research also has led to an increase in wine

consumption thanks to studies that reveal the health benefits of the

fermented fruit. Wine’s popularity has had an effect on beers and

spirits, as sales of private label products has remained steady, neither

increasing nor decreasing. Yet with an average price point of $4.70 per bottle, private label wines are creating a new

generation of afficianados.

Quite possibly the most famous private label wine is

Trader Joe’s Charles Shaw. Affectionately known as “Two-Buck

Chuck,” the Monrovia, Calif.-based chain’s private label line

is available in Cabernet Sauvignon, Chardonnay, Merlot, Sauvignon Blanc and

Shiraz varieties. The Shaw line has inspired a cult-like following who have

created a ‘Charles Shaw for President’ campaign.

Grocery store chain Food Lion, Salisbury, N.C.,

uncorked its Braidenwood Estates Wines in 2005. In order to make the line

accessible, the store launched the Cabernet, Chardonnay and Merlot in

11.25-ounce bottles, which are the equivalent of two to three glasses

of wine. Braidenwood Estates is made for Food Lion by New York’s

Canandaigua Wine Co.

Spirits are not about to be left out of the private

label trend. The customizability trend has increased the appeal of spirits,

which has caught the attention of retail giant, Wal-Mart, Bentonville, Ark.

Wal-Mart’s Web site reported it plans to triple the shelf space for

spirits in some stores to appeal to the home mixologist.

Whether it’s pick-me-up energy drinks or

better-for-you beverages, the appeal of private label is going public.

Formerly ‘blah’ store brands are innovating to create an

enhanced appeal on the shelves for their own beverage brands, and consumers

are responding.