![]()

Private Label Beverages:

The gateway to retailer loyalty

by Joana Cosgrove

Often overlooked in favor

of more widely recognized national brands, private label (PL) beverages,

occupy an understated space on the shelf.

While it’s true PL beverages lack the marketing

dollars that buoy national brands, and are inherently more susceptible to

market fluctuations, they quietly play the

important role of “gateway product” when it comes to drawing

consumers into a retailer’s realm of PL products.

This characterization is especially true when it comes

to PL carbonated soft drinks, the single largest supermarket grocery

category, chalking up 5 to 6 percent of typical grocery sales. “Soft

drink penetration is well over 90 percent to 95 percent with a high

frequency and velocity,” says Edmund O’Keefe, vice president of

investor relations and corporate development, Cott Corp., Toronto, Ontario.

“We’ve found that if a customer

likes the retailer brand proposition associated with the soft drink then

they’re more likely to try, for example, the salsa, cookies or

detergent – a phenomenon that we call the “halo effect”.

If you get it right, you’re not only helping improve your position,

point of difference and profitability in CSDs, you’re also building

the halo effect for your retailer brand program all across the

store.”

The halo effect initiated by PL soft drinks is crucial

considering the ongoing trend of retail consolidation in which large

retailers continue to get larger. “As they consolidate, the market

and become more powerful, they will turn to PL as a key driver for

differentiation because each retailer wants to position themselves somewhat

differently,” comments O’Keefe, who adds that the biggest

market opportunity for PL is the U.S. market. “On a volume basis in

carbonated soft drinks, PL has 27 percent of the market in England, it has

20 percent of the take-home market in Canada, but it’s only 11

percent in the United States. Clearly the United States is a significant

market for retailer brand soft drinks. The best-in-class large retailers in

the United States have PL shares of between 20 percent and 35 percent of

their soft drink volume, whereas the average is only 11 percent. As the big

retailers get bigger and concentrate the market, they’re driving

those shares up.”

During the past five years, sales of carbonated soft

drinks – both PL and national brands – have fallen sharply, due

in large part, to increased water consumption, which is the byproduct of an

increasingly health-focused and obesity-wary consumer population. Instead

of reaching for a cola, more consumers are guzzling calorie-, caffeine- and

carb-free sparkling flavored waters. “The water category is a $700

million category, and PL accounts for about 22 percent of it. It has grown

about 10 percent this year, and in units it has grown about 25 percent to

30 percent,” says Tom Aquilina, Aquilina & Associates, a

Chicago-based consultant who teaches Private Label Sales and Marketing

Strategies course curriculum at St. Joseph’s University.

“If you look at a supermarket today, space

allocation for water at retail is probably 30 percent to 40 percent greater

than it was five years ago. What used to be a beverage aisle is now largely

dedicated to waters of all types – distilled, spring – and the

consumption is huge because the water industry has done a tremendous job

marketing water.”

The sparkling flavored water category is a shining

example of how PL is capable of creating its own distinct and successful

niche. It also illustrates PL’s ability to be both a follower and, in

this case, a leader in flavor creation. “Speed to market with new

flavors is an area of strength for PL,” Cott’s O’Keefe

says. “A lot of new flavors like pineapple and strawberry are favored

by the Hispanic market and the average consumer alike, and PL can respond

quickly with innovative flavors.”

PL juices

Much like PL carbonated soft drinks, PL chilled juices have hit hard times thanks to what industry

insiders call “The Cola Wars: Part 2.” Pepsi-owned Tropicana

against Coca-Cola-owned Minute Maid have commoditized the juice business by

enacting the same battle plan the two companies used to grow their soft

drink business, to the detriment of PL brands.

“Twenty years ago, Pepsi and Coke took prices

down to a point where PL didn’t make any sense. If you could buy a

2-liter bottle of Coke or Pepsi for 89 cents, why would you buy a bottle of

PL cola for 79 cents? That’s what happened with juice,” says

Rich McCelland, director of marketing, Pasco Beverage Co., Dade City, Fla.

“You can find two (64 ounce) cartons of Tropicana or Minute Maid on

sale for $4 almost every day, so you have a situation where the average

consumer wouldn’t buy a PL juice at $1.99 because they can get a

national brand for only pennies more. Unless they are familiar with or

already enjoy the taste of a PL brand, the consumer will almost always opt

for the national brand.

“Minute Maid and Tropicana aren’t making

money selling juice at two for $4,” he continues, “but the

companies behind them are so big, they can afford not to –

that’s not the case for most PL suppliers who can’t afford to

lose money.”

Putting PL juices back on track is a slow and

educational process. McClelland says he tries to help category managers

understand that this kind of national brand pricing is erosive and

self-defeating. “Tropicana and Minute Maid are available

everywhere,” he says. “When retailers sell Tropicana at two for

$4, it reduces margins, supplies temporary consumer gratification and maybe

even refrigerator load. But apply that same scenario to PL and the juice

becomes a destination product because you can’t buy Sam’s

Choice orange juice any place other than a Wal-Mart.

“When a consumer gets hooked on the fact that

Giant’s PL has the quality of a national brand with a price-value

relationship that’s significant, than Giant becomes a destination for

the consumer,” McClelland explains. A major PL hindrance is that most

consumers don’t realize retailers have rigid control standards and

criteria for selecting private label vendors that’s equal to or

better than the national brands in quality, he adds.

Sales of some single-fruit PL juices like orange are

definitely suffering, but sales of allied juices are growing. Pasco is

currently producing a line of mango, guava and strawberry-banana nectars

for PL accounts like HEB that are a hit with consumers of all ethnicities.

Juice blends like apple-cherry and cranberry-grape are also popular. In

single-flavor juices, grape juice is getting a lift from studies linking

grape and grape juice consumption to a variety of health benefits.

McClelland believes the surging popularity of juice

blends is attributable to the same trend that’s impacting beverages

across all categories: the quest to provide flavorful and healthful alternatives to soft drinks.

Courting the PL consumer

The groundwork for increasing PL beverage shares has

been laid, but in the meantime there’s a lot of work to do, according

to Aquilina. He says first retailers must find a way to win customers using

flavor. “A Coke consumer probably does not drink Pepsi, and

vice-versa. They’re loyal and they’ve acquired the certain

taste that each brand delivers,” he says. “PL has not provided

that point of differentiation in taste to create that sort of

following.”

His second assertion for increasing the share of PL beverages

boils down to on-shelf merchandising. “There’s a tremendous opportunity

to market carbonated beverages in supermarkets, but retailers have to realign

their current merchandising strategy compared to where it is today, it can’t

be an afterthought. DSD is very territorial with their shelf space and they

manage it extremely well.”

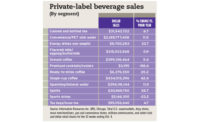

| Private label product sales | ||||

| Dollar Sales | % Change vs. Year Ago |

Unit Sales | % Change vs. Year Ago |

|

| SPIRITS | $130,117,256 | -5.3% | 14,931,141 | -7.5% |

| CONVENIENCE/PET STILL WATER | $269,861,984 | 27.0% | 130,810,344 | 12.9% |

| JUG/BULK STILL WATER | $324,489,312 | -3.4% | 361,754,816 | -6.4% |

| SPARKLING/MINERAL WATER | $86,170,408 | 21.1% | 123,367,040 | 22.8% |

| COFFEE ADDITIVE/FLAVORING | $466,260 | -18.0% | 156,797 | -23.3% |

| GROUND COFFEE | $112,899,816 | -3.1% | 43,988,524 | -3.5% |

| GROUND DECAFFEINATED COFFEE | $33,000,692 | 0.9% | 11,743,059 | -0.8% |

| INSTANT COFFEE | $29,767,058 | -3.4% | 10,380,507 | -1.5% |

| INSTANT DECAFFEINATED COFFEE | $10,036,108 | 3.9% | 2,886,060 | 4.6% |

| WHOLE COFFEE BEANS | $26,553,128 | 0.4% | 5,842,718 | 1.3% |

| REFRIGERATED TEAS | $16,240,978 | 1.9% | 11,626,932 | -3.0% |

| CANNED AND BOTTLED TEA | $21,869,780 | 28.1% | 13,524,116 | 21.4% |

| BEER | $11,053,980 | -7.5% | 685,092 | -9.4 |

| Source: Information Resources Inc., Total U.S. Food, Drug and Mass Merchandise (excluding Wal-Mart) for the 52 weeks ending Aug. 8, 2004. | ||||